What a time to work in the supply chain industry. From port strikes and rail strikes to environmental, social, governance (ESG) regulations, electrification mandates and natural disasters shutting down major roads and ports, it’s a wonder any food and beverage moves through the cold chain.

But have no fear, it’s not all doom and gloom.

Every disruption or hiccup in the cold food chain proves to be a lesson learned with emerging technologies, additional safety and security measures and more. And, as devastating and cumbersome as some of these disruptions can be, the supply chain always wins in the end.

Regardless of the challenges many of today’s cold food chains face, supply chains always win in the end.momostudio AdobeStock_862238860

Regardless of the challenges many of today’s cold food chains face, supply chains always win in the end.momostudio AdobeStock_862238860

Case in point: Motive’s Holiday Outlook Report shows optimism in the transportation and logistics space, with moderate growth to return in the first quarter and long-term growth trends of 5.7%, year over year, to be restored by the end of 2025.

Transborder freight between the United States, Canada and Mexico experience a slight uptick across all modes, according to a report released by the United States Department of Transportation’s Bureau of Transportation Statistics.

A return to consistent decreases in fuel prices remains the biggest factor in better market conditions for carriers, according to FTR’s Trucking Conditions Index.

And, online grocery in the United States experienced robust growth in Q3, with total sales rising by 13.8% to $27.4 billion compared to $24 billion for the same period in 2023. This increase was largely propelled by significant year-over-year growth in delivery, according to the U.S. eGrocery Market Share Report – 3Q24, powered by Brick Meets Click and Mercatus.

See? Not all doom and gloom.

Here’s a breakdown of Top 6 trends to watch in 2025, along with a deep dive outline of the State of Transportation, State of Software and Technology and State of Sustainability and an overall outlook into 2025 as it relates to the cold food chain.

Trend No. 1 = Economic uncertainty

As of press time, the 47th President of the United States will have been named. And, while both parties provide both opportunities and challenges to the supply chain space, the common denominator is that regardless who fills the presidential seat, economic uncertainty remains.

Cost reduction, for instance, remains the No. 1 priority, “but it’s not affecting every industry equally,” says Jenny Vander Zanden, COO at Breakthrough. “We’re seeing industries like durable goods manufacturers – think building products and automotive suppliers – facing more challenging economic conditions than others because of energy and raw material costs and rising interest rates. This adds an extra layer of complexity to their decision-making and makes transportation cost reduction that much more important for these shippers.” CLICK HERE to read our exclusive interview with Jenny Vander Zanden, COO at Breakthrough.

“On top of that, ongoing political dynamics, particularly with China, have manufacturers rethinking their supply chain strategies and footprints, balancing operations internationally and domestically,” Vander Zanden adds.

Wha’s more, financial and economic worries are weighing heavy on the minds of food and beverage business owners, according to an Expert Market report sponsored by Toast.

“This could indicate that a period of inflation in the United States, initiated by COVID-19, may well have impacted small businesses in this industry. Though inflation peaked at 7% in 2021 and has since decreased to 2.97%, it is yet to reach pre-pandemic levels of around 1.9% in 2018,” the study reveals.

Supply chain experts say 2025 will bring a mixed bag of both opportunities and challenges.freshidea AdobeStock_476362981

Supply chain experts say 2025 will bring a mixed bag of both opportunities and challenges.freshidea AdobeStock_476362981

Despite this, predictions for 2025 suggest that concern about economic uncertainty will drop from 20% to 16%.

“As our research has shown, these have been tough times for business owners in the food and beverage market,” says Expert Market’s editor, Chris Maillard. “Inflation has been particularly difficult to deal with, and in a sector that is particularly reliant on energy-intensive kitchen equipment and the rental of prime sites, the rise in these bills has been tricky too. It’s great to see that optimism is still alive, though, and the smarter operators have dealt with the squeeze by making processes and systems leaner and more efficient, which will help them bounce back more quickly as the economy picks up.”

A report from Sphera shows that more than one-third (36%) of the financial risk notifications warned of worsening revenue and growth outlook. High inflation rates eroded suppliers' purchasing power, with insolvency under self-administration going up 23% and bankruptcies increasing 42%. Additionally, site relocations or closures increased by 26%.

"Sphera's Supply Chain Risk Report shows that a broad range of risks, increasing ESG regulations and compliance failures can stress businesses," says Paul Marushka, Sphera's CEO and president. "Risk exposure is dynamic, and constantly evolving supply chain risks cause ever-increasing market volatility.”

Trend No. 2 = The digital shake-up

From artificial intelligence (AI) and machine learning (ML) to data analytics, transparency, visibility, sustainability and electrification, the digitization of supply chains is real life.

That’s because shippers want more agile and resilient cold chains.

Yet a Tive study found that 47% of companies don’t have access to real-time technologies to monitor their shipments, but 75% of respondents say they’re investing in technologies to support supply chain/shipment visibility.

“In today’s complex global marketplace, real-time visibility is the holy grail for food shippers and their providers. It’s no surprise that 75% of leaders are investing in real-time visibility as a focal point for their broader digital transformation strategy. End-to-end monitoring—especially of temperature, light exposure, and location—is crucial for ensuring product quality, minimizing food waste, reducing excursions, and improving delivery efficiency,” says adds Krenar Komoni, Tive founder and CEO.

Predictive analytics remains essential for demand forecasting, route optimization, inventory management, and automated decision-making.

“[These technologies are] already deeply embedded in procurement operations at large shippers and brokers, especially in perishable freight. In the coming year, these tools will become more feasible and level the playing field for operations of virtually any size, which is important in food distribution, where you have a lot of small carriers,” says Jeff Clementz, CEO and president, DAT Freight & Analytics. “The differentiator in predictive analytics is information. The best analytics services have the most comprehensive data sets in addition to delivering customer service and technical support.”

AI, machine learning, and GenAI are considered to be top digital supply chain investment priorities.Tierney AdobeStock_230441943

AI, machine learning, and GenAI are considered to be top digital supply chain investment priorities.Tierney AdobeStock_230441943

More agile and resilient cold food chains also help reduce carbon footprints, expedite recovery from route disruptions and provide more accurate ETAs, says Margaret Selid, senior product marketing manager at project44.

“As the industry continues to move in this direction, we will see the adoption of technology increase exponentially in the next year,” she adds.

2025 will also bring an increased use of telematics and digital services for carriers and shippers alike, says Alice DeBiasio, VP and general manager, truck trailer Americas and digital solutions, Carrier Global Corp.

“If you haul food, pharmaceuticals and other high-value, high-demand perishable loads, you want to know when there’s a deviation from temperature setpoints or a low battery or fuel level,” DeBiasio says. “Telematics on the TRU can notify you when something is happening inside the vehicle, where the freight is. And it can take a step further by helping you proactively assess and schedule the service you need with a qualified dealer.” CLICK HERE to read our exclusive interview with Alice DeBiasio, VP and general manager, truck trailer Americas and digital solutions, Carrier Global Corp.

And, the next generation of transportation management systems (TMS) “are leveraging AI and machine learning to build systems and platforms that drive higher productivity and efficiency,” says Rishi Mehra, VP of commercial mapping and routing technology at Trimble. “A 2023 survey about what carriers were doing to ‘weather the storm’ showed companies were (and still are) highly focused on automating manual tasks, reducing paperwork and manual documentation, optimizing load scheduling and routing systems, and streamlining other areas of their business.”

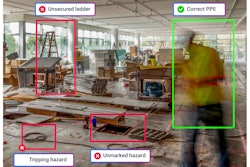

Data is also supporting the emergence of emerging technologies, with AI at the forefront, Mehra says.

“We already see AI dramatically changing the transportation industry, and the next five years will be monumental—especially when it comes to safety, operations optimization, efficiency and productivity. AI-powered video systems are already enhancing safety by detecting hazards on the road, analyzing and predicting risky driver behavior and alerting drivers to take preventive action.” CLICK HERE to read our exclusive interview with Rishi Mehra, VP of commercial mapping and routing technology at Trimble.

Trend No. 3 = ESG compliance and regulations

New emissions standards for heavy-duty trucks are accelerating the switch to more emission-friendly vehicles, Mehra adds, “with forensic carbon accounting and measurement a potential legal necessity for shippers and carriers. Hurdles such as mileage range and charging infrastructure are among the limitations preventing fleets from greater adoption of electric vehicles.”

This all leads to further compliance measures and regulations surrounding ESG.

“The ESG category of risk is important to watch as the U.S. and the EU have concurrently introduced legislation to combat environmental and human rights issues in supply chains and many of the proposed changes, like the EU Deforestation Regulation for example, are expected to impact critical products like palm oil and cocoa,” says Jena Santoro, senior manager of global risk intelligence at Everstream Analytics. “These regulations come with compliance requirements that could increase operating costs for F&B companies and run the risk of reputational disruptions if companies are unable or unwilling to adhere.” CLICK HERE to read our exclusive interview with Jena Santoro, senior manager of global risk intelligence at Everstream Analytics.

Emissions measurement is also becoming increasingly important.

“Since one of the largest contributors to many companies' carbon footprint is their Scope 3 supply chain emissions, companies will have no choice but to implement stronger reporting processes and technology to help manage their carbon footprints,” says Selid. “As emissions reporting becomes mandatory, consumers are also increasing pressure on their favorite brands to deliver on their sustainability promises. More than half of consumers plan to prioritize brands that demonstrate a commitment to sustainability during their holiday shopping this year. In 2025, brands that don’t make progress toward their goals will fall behind competitors who are actively working to reduce emissions.”

Trend No. 4 = Freight fraud

The No. 1 issue facing the freight brokerage industry is cargo fraud, a growing epidemic that’s costing the industry over a billion dollars on an annual basis, according to Chris Burroughs, president and CEO of Transportation Intermediaries Association (TIA).

“The types of fraud take many forms, including cargo theft, identity theft, unlawful brokerage activities, etc. Additionally, the industry is hampered in the motor carrier selection process as 92% of motor carriers are unrated due to an antiquated safety rating process. This lack of clarity from the Federal Motor Carrier Safety Administration (FMCSA) potentially allows unsafe carriers to continue to operate on the nation’s highways and creates confusing in the selection process leading to less safe roads and frivolous lawsuits,” says Burroughs. CLICK HERE to read our exclusive interview with Chris Burroughs, president and CEO of Transportation Intermediaries Association (TIA).

CargoNet, a Verisk business, recorded 771 theft incidents in Q2 of 2024, representing a 33% increase compared to the second quarter of 2023. However, theft activity decreased by 10% from all-time highs established in Q1 of 2024.

The report also shows behavioral shifts in the country's most prolific organized cargo theft groups operating in Southern California. Across the board, these groups evolved to be more discriminating in their shipment targets, stealing high-value freight.

Meanwhile, an Overhaul report recorded a 49% surge in cargo thefts first half of 2024 compared to the same period in 2023, with the average loss per incident skyrocketing to $115,230, an 83% jump from the previous year.

“Inventory replacement costs for shippers and insurance costs for carriers are just two examples of the negative impacts of freight fraud. Across the industry, shippers, brokers and carriers are seeing a wide range of fraud instances,” says Mehra. “In addition, food fraud impacts an estimated 1% of the global food industry at a cost as high as $40 billion a year, according to the Food and Drug Administration. Product safety, supplier safety and transportation safety are of the utmost importance in reducing fraud in the supply chain.”

Trend No. 5 = Nearshoring

Nearshoring has become a go-to strategic approach to supply chain optimization for many U.S. cold food processors and distributors.

For the first time in nearly 20 years, the United States imports more from Mexico than China, with Mexico comprising 16% of total U.S. trade in October 2023 compared to China’s 12.7%.

A study by Flatworld Solutions reveals a significant and sustained increase in interest in manufacturing in Mexico over the past five years as a result of trade policies, labor costs, and supply chain considerations driving the growing interest in manufacturing in Mexico.

The proximity to markets also remains one of the main benefits of nearshoring for the food and beverage industry.

Alan Bebchik, country manager for Nowports, outlines in this expert column that “businesses can readily reach new markets and customers by moving operations to a nearby nation without incurring significant transportation expenditures. Businesses that depend on perishable goods and need to maintain the quality and freshness of their products may find this to be very beneficial.”

“As global disruptions continue to impact shipping lanes, I predict nearshoring and supplier diversification will grow since these strategies can help brands avoid massive disruptions. For brands looking to avoid compounding impacts from multiple disruptions at once, bringing manufacturing closer and diversifying sourcing can help reduce pressure on vulnerable or recovering supply chains,” says Selid.

What’s more, “both severe weather and regulatory changes could disrupt the sourcing continuity of critical food and beverage inputs due to supply shortages, impacting production of end-user products,” says Santoro. “Lastly, when supply shortages complicate or disrupt sourcing efforts, countries have historically engaged in more trade protectionism to safeguard domestic supply for consumption.”

Trend No. 6 = Overlapping disruptions

Like the saying goes, when it rains, it pours.

Such is the case for supply chain disruptions, as overlapping incidents such as labor strikes and natural disasters continue to plague logistics organizations.

For instance, on Aug. 22, Canadian National (CN) and Canadian Pacific Kansas City Southern (CPKC) shut down operations, according to management of the two companies, locking out 9,000 members of the Teamsters union who operate the trains. These two companies account for an estimated 90-95% of all rail shipments in Canada, meaning disruptions can have widespread effects on supply chains across North America.

The Maritime Employers Association announced a three-day strike at two terminals, beginning Sept. 30, affecting close to 350 members.

Close to 45,000 dockworkers at 36 ports along the East Coast went on strike as a result of the International Longshoremen’s Association (ILA) and United States Maritime Alliance (USMX) failing to reach an agreement prior to the Oct. 1 expiration date.

Not to mention disruptions resulting from drought impacts on the Panama Canal, geopolitical crises in the Middle East disrupting trade through the Red Sea, labor strikes at U.S. and Canadian ports and railways, impacts and recovery efforts from Hurricane Helene and more.

“When these risks take place concurrently, as has also been the case this year, global supply chains experience an unprecedented level of chaos,” says Santoro. “Vessels blocked from transiting the Suez Canal, for example, had to absorb the added time and costs of diverting around the southern tip of Africa, while still facing an uncertain arrival at U.S. East and gulf coast ports amid looming full-scale port strikes. The main challenge to ensuring continuity of supply chains is in mitigating the scale of disruptions when alternative options are not necessarily readily available due to competing risks.”

These overlapping disruptions are also forcing shippers and supply chain companies to do more with less.

“Supply chain disruption is really becoming normalized,” says Hamish Woodrow, head of strategic analytics at Motive. “From the huge spike in demand during the pandemic to the various geopolitical and labor elements that have become more and more prevalent in recent years, shippers and carriers alike are starting to see these disruptions as the new normal. The biggest challenge now is being flexible enough to adapt to these changes quickly, while still keeping up with demand. Shippers adapting their supply chain is incredibly challenging, but also more necessary than ever.” CLICK HERE to read our exclusive interview with Hamish Woodrow, head of strategic analytics at Motive.

Here's an outline of the State of Transportation, State of Software and Technology and State of Sustainability as well as an overall outlook into 2025 as it relates to the cold food chain.

State of Transportation

Overall, industry experts say the State of Transportation deems a positive outlook for 2025.

“Rates are rising, inflation seems to be trending toward cooling, and we have likely reached the bottom of the trucking market’s negative growth and are moving in the other direction,” says Woodrow. “Retailers are anticipating consumer demand over the holidays to be strong (even potentially record-setting), and if that’s the case we’ll see transportation (and specifically trucking) get a big boost on its way to positive growth again.”

Possible port strikes, continued economic uncertainty and inflation in all aspects of the supply chain are fluid situations that could impact cold food chains in different ways.NVB Stocker AdobeStock_375988948

Possible port strikes, continued economic uncertainty and inflation in all aspects of the supply chain are fluid situations that could impact cold food chains in different ways.NVB Stocker AdobeStock_375988948

The state of the transportation in 2025 will also be characterized by a complex interplay of labor dynamics, regulatory pressures, technological advancements and economic conditions, Burroughs says.

“Stakeholders across the supply chain will navigate these challenges while striving for efficiency, sustainability and reliability in a marketplace in the face of ongoing changes, hard economic times, and innovation,” he adds.

And, the global container shipping industry continues to witness an increase in freight demand for U.S.-bound shipments.

So, what does this mean for the transportation industry overall in 2025?

“This is due in large part to expectations of a U.S. economic recovery prompting a demand for containerized imports. The better the U.S. economy performs, the more demand will persist into 2025,” Santoro says. “Also, geopolitical crises and labor actions have led to delayed turnaround times for containers and that has encouraged price and demand increases for container shipments. However, there are indicators that container production is on the rise, and oversupply could cause freight rates to drop globally.”

For carriers dealing with the volatility of the freight market, adapting to change is the path to ongoing profitability, Mehra says. This entails everything from investing in innovative solutions to maximizing labor productivity, gaining process efficiencies and improving in other operational areas.

“Transportation companies are increasingly migrating their systems from on-premises to remote storage. This approach is creating efficiency to deliver higher productivity and automation, real-time insight and collaboration among users based on data collection and insights,” Mehra adds. “The early stages of electrification and autonomous trucking are undoubtedly already starting to change and shape our industry’s future. However, state and federal regulations still need to mature to put the needed structure and guardrails around these areas for mass adoption. As the profession evolves technologically, with it may come an overhaul in the hiring and retention processes of drivers, along with better pay and benefits to match updated job duties and expectations.”

“[However,] it is putting severe pressure on finding containers to move ag exports in the Midwest. Containers are so valuable now that they are sending them back to Asia empty rather than filling them with low-margin ag exports in the Midwest,” says Dan Murray, SVP, American Transportation Research Institute (ATRI).

What’s more, the agreement between ILA and USMX is only tentative, with the Master Contract due Jan. 15, 2025, which means, should the two parties not reach an agreement, all 45,000 dockworkers will go back on strike.

“Key issues like port automation remain unresolved,” says Eric Hoplin, president and CEO of the National Association of Wholesaler-Distributors (NAW). "This strike underscores a critical need for reform. No single union should have the power to cripple our economy. Our labor laws, written in a different era, should reflect today’s interconnected supply chain. Manufacturing, transportation, warehousing, and distribution are all essential to our national security, and our policies should recognize their vital role in sustaining the flow of goods and services.”

“This [also] means that shipping continuity through critical U.S. ports is still vulnerable to renewed labor action in the New Year,” adds Santoro. “Escalations in the Middle East also indicate that disruptions to shipping through the Red Sea show no signs of abating, forcing carriers to continue operating with increased costs and prolonged delivery times.”

The rise in online shopping fused with increased consumer demand and changes in tariffs also contribute to the uptick in U.S.-bound shipment trends.

“In 2024, 68% of consumers planned to do their holiday shopping before the traditional holiday season. Because seasonal consumer demand extends beyond traditional peak seasons, companies are forced to move imports earlier in the year, which may be a temporary response to anticipated demand spikes, or they could be permanent changes in trade strategy. By 2025, businesses will likely continue to adjust their logistics strategies, including an increase in nearshoring or diversifying their supplier base to ensure consumers are happy,” says Selid.

State of Software and Technology

Emerging technologies, like AI-powered insights, cloud-based solutions, traceability functionalities and more are critical for improving supply chain agility and resilience. As detailed earlier, the digital shake-up is here and ready to transform the cold food chain.

That’s why, AI, machine learning, and generative AI (GenAI) are considered to be top digital supply chain investment priorities, according to a survey by Gartner, Inc.

“Many brokers utilize digital platforms and software solutions that incorporate real-time tracking, automated load matching, and data analytics to optimize routes and reduce costs. Additionally, artificial intelligence and machine learning are being employed to predict market trends and identify the best shipping options, while cloud-based systems facilitate better communication and collaboration among stakeholders. This technological integration not only enhances operational efficiency but also improves transparency and responsiveness in the freight brokerage process,” says Burroughs.

Machine learning in particular stands as a pivotal technology poised to further transform the supply chain, logistics, and transportation sectors, adds Vander Zanden.

“Shippers must be prepared to adopt and leverage these technologies to maintain a competitive edge. AI is expected to have a profound impact on unlocking a network’s actual total capacity. As enhancements in processing power and the ability to assess and derive insights from vast amounts of disparate data, we can expect to see a fundamental shift in how the industry derives data-driven insights,” Vander Zanden says.

And, to enhance efficiency and improve service, shippers are increasingly leveraging advanced technologies, Burroughs says.

“Many brokers utilize digital platforms and software solutions that incorporate real-time tracking, automated load matching, and data analytics to optimize routes and reduce costs. Additionally, artificial intelligence and machine learning are being employed to predict market trends and identify the best shipping options, while cloud-based systems facilitate better communication and collaboration among stakeholders. This technological integration not only enhances operational efficiency but also improves transparency and responsiveness in the freight brokerage process,” he adds.

State of Sustainability

Sustainability reporting is a big thing to come in 2025. That’s because ESG strategies will no longer be optional for businesses.

For starters, the SEC's adoption of rules requiring enhanced climate-related disclosures mandates public companies to disclose material climate risks and how they impact business strategy, operations, and financial condition.

The government has issued several executive orders aimed at incorporating environmental justice considerations into federal agency decision-making.

Sustainability reporting will be a big thing to come in 2025.Sanchai AdobeStock_955254737

Sustainability reporting will be a big thing to come in 2025.Sanchai AdobeStock_955254737

The Uyghur Forced Labor Prevention Act (UFLPA) has intensified regulatory scrutiny on corporate supply chains, who will need to prepare for increased reporting requirements.

Jurisdictions like the EU, UK, and Asia are leading the charge in developing comprehensive ESG frameworks, such as the ISSB standards, which will impact reporting requirements for companies with international operations, according to Law Business Research.

And, over the past five years, pressure from investors to improve supply chain sustainability has grown by 25%, making it the fastest-growing driver of sustainability efforts, according to a new report from the MIT Center for Transportation & Logistics (MIT CTL) and the Council of Supply Chain Management Professionals (CSCMP).

"Over the past five years, we have seen supply chains face unprecedented global challenges. While companies have made strides, our analysis shows that many are still struggling to align their sustainability ambitions with real progress, particularly when it comes to tackling Scope 3 emissions," says Dr. Josué Velázquez Martínez, MIT CTL research scientist and lead investigator. "Scope 3 emissions, which account for the vast majority of a company’s carbon footprint, remain a major hurdle due to the complexity of tracking emissions from indirect supply chain activities. The margin of error of the most common approach to estimate emissions are drastic, which disincentivizes companies to make more sustainable choices at the expense of investing in green alternatives. "

Despite significant efforts, Scope 3 emissions—which can account for up to 75% of a company’s total emissions—continue to be the most difficult to track and manage, due to the complexity of supplier networks and inconsistent data-sharing practices, according to the MIT report.

“The approach really boils down to three key steps: track, plan, and execute. Tracking emissions at a lane-by-lane level is crucial – there’s no one-size-fits-all solution or silver bullet that will work for a shipper’s entire network. Shippers need a strong lane-level baseline, and from there, they can create action plans to reduce emissions through various stages, like carrier selection, mode conversion, optimization of networks and loads, and incorporation of alternative energy solutions. It’s all about taking a targeted, data-driven approach to carbon reduction,” says Vander Zanden.

Fuel management and electrifying a fleet also remain key pieces to the sustainability puzzle.

A report by Environmental Defense Fund and WSP USA shows that electric vehicle (EV) manufacturing investments over the last nine years has now reached $199 billion, and 63% of that came after passage of the Inflation Reduction Act (IRA).

For its part, Motive’s fleet fuel management reports on utilization, maintenance issues, battery utilization and idling events to improve efficiency and cost and help fleets operate in the most environmentally responsible way possible.

“Leveraging Motive’s real-time GPS updates and geofencing, live traffic and weather overlays, and historical activity tracking, as well as visual data from Motive’s AI-powered cameras, make for a safer, higher-performing fleet on the road. But it all comes back to how this information is taken in and turned into actionable insights. Motive’s engineering team uses machine learning, intelligent automation, and pre-built third-party integrations to deliver this data to get more done with better efficiency, and in less time,” says Woodrow.

project44’s Emissions Monitoring solution provide brands with the GLEC-accredited emissions calculations needed to accurately measure and report on emissions and identify areas of opportunity to reduce their carbon footprints.

“This latest development follows years of sustainability innovation, going back to 2021 when we signed The Climate Pledge and partnered with The University of Tennessee, Knoxville to build the Fleet Sustainability Index. This clean truck index is a practical solution that helps shippers with their Scope 3 emissions strategy,” says Selid.

Other are sharing data on emissions, fuel efficiency, and environmental impact, adopting green logistics practices, and using sustainability metrics to guide customers toward more responsible shipping options.

“This commitment to sustainability not only meets the growing consumer demand for greener practices but also positions freight brokers as strategic partners in helping businesses achieve their environmental goals,” says Burroughs.

Mehra says those most successful in the sector are using real-time insights, automation and innovative technology solutions to advance their capabilities and implement sustainability initiatives.

“But our industry still has a long way to go in developing advanced ESG strategies and reporting processes, but some are certainly leading the way for our sector,” Mehra adds.

Overall outlook of 2025

Supply chain experts say 2025 will bring a mixed bag of both opportunities and challenges.

Possible port strikes, continued economic uncertainty and inflation in all aspects of the supply chain are fluid situations that could impact cold food chains in different ways.

Not to mention disruptions resulting from drought impacts on the Panama Canal, geopolitical crises in the Middle East disrupting trade through the Red Sea, labor strikes at U.S. and Canadian ports and railways, impacts and recovery efforts from natural disasters and more.

“Each of the global events mentioned remain to be resolved and will perpetuate into 2025. The geopolitical events have persisted and even escalated, and severe weather events like hurricanes will continue next season as usual. The Atlantic and Gulf Coasts of the U.S. are prone to major hurricanes as we have already seen this year with Helene and Milton. These storms lead to major infrastructure damage and disrupt supply chains through power outages, road, port, and airport closures, and production halts. Geopolitical events like those mentioned impact U.S. supply chains through shipping disruptions or sourcing/procurement challenges for U.S. companies reliant on inputs or products from suppliers in affected areas. Trade restrictions like sanctions often result from these geopolitical events and make it more difficult for U.S. companies to do business with affected countries or regions, disrupting supply chains,” says Santoro.

For Selid, the outlook for 2025 remains unstable, “with companies needing to continuously adapt to these disruptions on top of natural disasters. However, uncertainty in the supply chain has become the new normal. Companies are far more agile than they have ever been. Expect an increased focus on resilience, diversification and security measures to mitigate these risks.”

Regardless of the challenges many of today’s cold food chains face, supply chains always win in the end.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)