Everyone is familiar with the proverb “no news is good news.” It applies accurately to many areas of life. But, supply chains are not among them.

Even if the news is terrible, learning timely information about the status of a supplier, a commodity, an order or shipment or any other key element in an established supply arrangement can be tremendously important. It allows the buyer to become more agile and to respond proactively and more appropriately, potentially minimizing the disruption it would otherwise cause. However, if it turns out that “no news” is actually hiding “bad news,” the buyer will be poorly prepared for potentially disastrous disruptions. And, there is no shortage of possible disruption sources.

Disruptive events can come from anywhere. Natural disasters, trade wars, accidents, labor unrest, regulatory shifts, lawsuits, quality issues and cybersecurity attacks are just a few. And, some of the worst disruptions are essentially Black Swan events – developments so rare, like the 2015 tsunami that took out the Fukushima Daiichi nuclear power plant or the attack on the World Trade Center in 2001, both of which triggered profound disruptions – that detailed planning for them is largely impossible.

But, is the Coronavirus disease (COVID-19) a Black Swan event? Observers disagree as to whether the Coronavirus is such a rarity as to be considered improbable, or whether it simply reflects a lack of preparation for the sort of pandemic that occurs with surprising frequency – think of ebola, H1-N1, Swine Flu, HIV/AIDS and so on. Whether COVID-19 can be classified as an unforeseen event or not, having visibility into the early stages of its spread would have been hugely valuable. Not only did its initial outbreak in a major industrial region impact many suppliers, it also disrupted many of those suppliers’ suppliers.

For example, a Dun & Bradstreet study of Fortune 1000 companies found that 162 of them had one or more Tier 1 suppliers in the Wuhan region of China, where the virus originated. That’s not a trivial number, and even seems fairly contained from an impact perspective. However, when they dug a little deeper, they learned that an astonishing 938 of the 1,000 had one or more Tier 2 suppliers there. The business exposure to a problem which might have otherwise been dismissed as a local issue impacting only a few companies, turned out to be much wider than first thought and one that saw global supply chains seize to a halt on an unprecedented scale.

What this means is that when assessing supplier risk, disruptions and performance, it is essential to consider more than just your Tier 1 suppliers. Without visibility into the full supply chain, it is impossible to conduct effective contingency planning or to be as resilient as conditions demand. Still, that’s easier said than done. Information about suppliers, which forms the core of every procurement activity and decision is frequently scattered across multiple collections of data and stored in separate silos such as spreadsheets, MS Access databases, email, handwritten paper documents and Post-It Notes, many of which may be even further decentralized according to their department, including finance, legal, logistics, supply chain and procurement.

Supplier information that is scattered and of questionable reliability makes it almost impossible to make the right strategic sourcing decisions at the right time. But, it’s not the only source of difficulty. In many companies, the relationship between that company and its suppliers is adversarial. Beating up suppliers over pricing – a legacy of the last century – is still common. It grows from the conviction that theirs is a zero-sum relationship in which one can only prosper at the other’s expense. And, when that becomes the prevailing mindset, it encourages price gouging and other forms of retaliatory or combative behavior.

Instead, a relationship that is more collaborative, more like a partnership than a rivalry, is the direction that many successful companies have taken. But, it’s not about being nice just for the sake of being nice; it’s a posture that sets the stage for forms of cooperation which would otherwise be out of the question. Two strategies often employed that improve supplier collaboration are supplier development and category management. Supplier development processes and strategies help build a mutually beneficial and collaborative relationship where each party works to become a better partner. This can result in better performance, improved quality, and more access to product innovation. And, category management is used to holistically manage key spend categories and ensure the supplier selections fit into a bigger picture that balances supplier strategy, risk, performance and cost.

Yet according to Forrester, only 53% of the procurement organizations it studied said that collaboration with their suppliers occurred regularly. Of that number, 93% were among what the study identified as “advanced” procurement organizations – a classification which constituted a distinct minority of its sample. McKinsey takes this a step further, providing evidence that companies with advanced supplier collaboration capabilities tend to outperform their peers, resulting in an average 4.9% EBIT growth when compared to those without. For those companies that lag these leaders, an untapped opportunity exists to generate significant value.

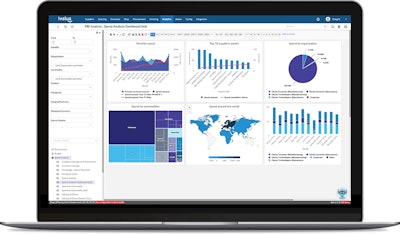

What distinguished many advanced organizations was their commitment to digitizing procurement activities. These activities range from the initial collection of supplier information all the way through to final transactions. The shorthand for this is “source-to-pay” software, or S2P – unified platforms available from multiple vendors, which typically include supplier management, sourcing, contacting, ordering, invoicing and payment for goods and materials. They can also include spend analysis, increased supply chain visibility, greater compliance, improved supplier and stakeholder collaboration and better capacity forecasting. And, it can grow to become a pillar of the company’s risk management strategy for the supply chain and even a help procurement develop into a competitive advantage.

In an era marred by doubt and uncertainty and one where every company is impacted by crisis, procurement has a significant role to play in building the agile and resilient supply chains necessary for companies to survive and thrive. Leading procurement organizations will manage multiple levels of their supply chain and leverage information to mitigate risk & performance issues. They will have committed to supplier development, category management and collaboration. To facilitate, optimize and perhaps even turn some of these activities into a competitive advantage, these leading procurement organizations will likely have turned to technology, such as source-to-pay solutions, to help maximize value from their supply chains.