COVID-19 has highlighted the importance of suppliers to the success of the entire supply chain. If these relationships are not built on the right foundation, the entire supply chain is weaker as a result. While organizations need to get to market as quickly as possible with the right supplier, organizations also need to do their due diligence to ensure that they find a reliable supplier and structure the relationship appropriately.

This article looks at the strategic sourcing process to see why there is truly no one-size fits all model for selecting a supplier and examines some important considerations and cycle time measures. Based on the nature of the supplier relationship, it’s wise for organizations to take their time to select the right supplier and work carefully to negotiate a contract. However, organizations also have room to improve when it comes to non-value-added tasks like entering selected suppliers into the procurement system. Benchmarking key cycle time measures for these processes can provide a baseline for growth and improvement.

Strategic Sourcing

The strategic sourcing process is like a funnel that begins with a broad view of a category of materials or services and narrows as the organization vets and selects suppliers. Depending on what an organization is buying and the nature of the relationship between buyer and supplier, selecting a supplier can take as little as one day or longer than two months. Organizations are well-served by moving intentionally for the most strategic relationships.

From traditional to next-generation srm

The traditional model of supplier relationship management, which is based mainly on finding the lowest cost and shifting any risk to suppliers, is inadequate in today’s environment given the pace of change and the need for more collaborative, value-creating approaches in buyer-seller relationships. In contrast to this older model, next-generation supplier relationship management recognizes that supplier relationships exist along a continuum, with transactional relationships on one end and highly strategic, mutually beneficial relationships on the other. There are different sourcing business models for each of these relationships (developed by Kate Vitasek and her colleagues at the University of Tennessee), and the time it takes to establish these relationships can vary.

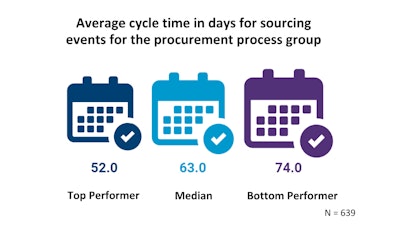

This variation is evident in APQC’s procurement data. APQC found that the average cycle time in days for sourcing events (which begins with an internal stakeholder request for a supplier and ends when the contract is signed) can vary quite a bit. The fastest organizations can complete this cycle in 52 days or less, while the slowest organizations take 74 days or more.

There are plenty of good reasons why the process takes close to two months even for the fastest organizations. To provide an overview of the considerations that organizations may need to think through, it is helpful to examine two very different models of supplier relationship: The Basic Provider Model, which is entirely transactional; and the Vested Business Model, which is much more intensely relational.

The Basic Provider Model

If your organization is looking for an office supplies provider, the relationship will likely be transactional in nature and not require much supplier relationship management. One common approach to quickly select a supplier in these cases are sourcing events like e-auctions, which have become more widespread in procurement as cloud-based tools continue to mature. The advent of these tools has made ‘reverse auctions’ increasingly popular and easier both for buyers and suppliers. In this form of auction, suppliers put in their prices and competitively lower them over a period of time. The horserace between suppliers means the buyer saves money regardless of who wins. So long as the organization collects pre-bidding information to ensure that suppliers are bidding apples-to-apples, this can be an effective way to get bidders engaged and grab the lowest price for commodities quickly in a single, time-bound event (rather than through endless rounds of negotiation with multiple suppliers).

The Vested Business Model

Some supplier relationships are highly strategic and work to the sustained mutual benefit of both parties. Forming these relationships is a longer process that involves, among other things, completing a market analysis to identify potential partners; working with buyer and supplier stakeholders on mutual goals; and comprehensive formal risk assessment by both buyer and supplier.

Signing on the dotted line

Once an organization selects a supplier, both parties still need to negotiate a contract. Much more than just a formal statement of terms and conditions, contracts are a critical element of the procurement process that explicitly define the nature of the relationship and any performance management standards.

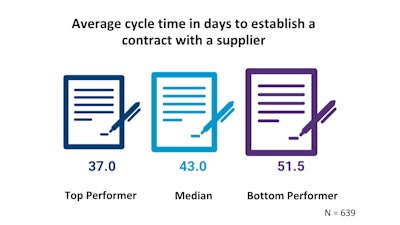

The complexity of the contract and the length of time it takes to finalize it will vary based on the relationship. For example, APQC has found that on average, the fastest organizations take 37 days or less to negotiate a contract, while the slowest organizations can take 51 days or longer. This cycle time is a subset of the average cycle time for sourcing events (shown in Figure 1). In other words, if the slowest organizations take 74 days total, 51 of those days are wrapped up in negotiating and establishing a contract.

While organizations can shrink these cycle times by selecting the right sourcing business model and getting clear on the organization’s needs and requirements upfront, the cycle time generally reflects the unique constraints and considerations that go into building strong and lasting relationships.

Setting up vendors

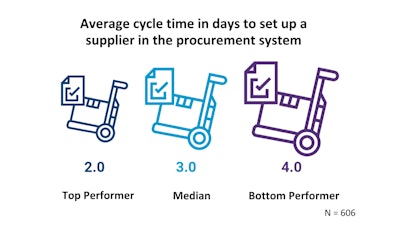

Unlike the steps above, setting up a new vendor in the organization’s procurement system is a completely administrative, non-value-added activity. APQC found that bottom performers take four days or longer to complete this step, while top performers can complete this task in two days or less.

Digitization and automation can help speed up this process, especially if it involves a lot of hand-offs between functions. If you find yourself among the bottom performers on this measure, it’s worth mapping out the process to locate and eliminate any bottlenecks to speed things up. As a purely non-value-added task, there’s nothing to be gained from a slower process—Faster is better, so long as it’s accurate.

Conclusion

Clearly, there are good reasons why organizations can take two months or longer to select a supplier and negotiate a contract. Organizations need to move deliberately and with care to build strong relationships, especially when these relationships are strategic. Other steps, like entering a supplier into the system, should happen as quickly as possible. Benchmarking can help an organization discover where these processes are unnecessarily slow and help identify improvements. Pick the most important measures for your procurement process and track them regularly. Even if you’re not performing well today, benchmarking gives you a baseline from which to improve and can help you build the business case for the resources you need to make those improvements.