During the current recession, the strategic game plan of most companies is to cut costs, streamline operations and work more efficiently. Nowhere are these strategies more important than in the procure-to-pay arena. Achieving visibility and control over purchasing goods and services, as well as paying for them, is critical to effectively managing your organization's finances, especially in the current economic climate.

Together, Procurement and Accounts Payable provide an important profile of an organization's spend, cash flow and economic health. In Procurement, spending plans are developed and financial commitments are made, while the Accounts Payable department contains actual information on how an organization's spending plan has been implemented and how, where and with whom its money has been spent. Achieving visibility in these areas helps organizations understand their spending patterns, and this visibility is the first step to achieving control of expenses and making smarter purchasing decisions.

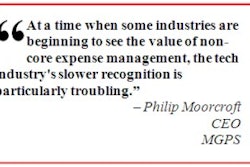

While procure-to-pay may not have been a key area for technology investment in the past, in this economic climate it is becoming more essential as organizations realize that they need to find efficient and effective ways to monitor and control their expenses. As many organizations have seen, merely implementing corporate purchasing policies is not enough to control spend. The combination of policies backed by automation enables them to effectively enforce the rules they have established. Additionally, companies are using automated systems to gain key insights that help them manage their spend, cash flow and working capital. They can see, for example, where they are spending money, which vendors they are using, and where opportunities lie for volume discounts and other savings.

Following are best practices for achieving cost savings and efficiencies in procure-to-pay. These practices, based on the experiences of world-class organizations, are particularly beneficial now as organizations look for ways to positively impact the bottom line and cut expenses.

1. Win over the maverick buyers. Maverick buyers circumnavigate established processes by conducting indirect purchases outside of the system. Maverick buyers pose a financial problem because you don't have visibility into, or control over, how they are spending your organization's money. While this is an issue in all economic climates, it is even more important at a time when organizations can't afford to waste money or lose savings opportunities.

To tackle this problem, organizations need a purchasing system that is so effortless and easy to use that it encourages widespread adoption. Many automated systems offer "punch out" catalogs connecting users to catalogs using standard Web interfaces, as well as "in house" catalogs. This makes it easy for employees to order supplies and allows approvals and receipts to be tracked and managed through electronic catalog management.

The city of Helsinki, for example, uses an e-procurement system that enables more than 7,000 users and 50 professional buyers from 30 different divisions to handle hundreds of thousands of purchase-related transactions annually. The system makes it easy for users to select contract-based products from electronic catalogs, or type in the items for which they are looking. Using this technology, the city has achieved a very high degree of automation and a matching rate of more than 80 percent. Also the system automates complex bookkeeping standards and general ledger rules, as well as organizational business rules and policies that simplify purchasing, and it offers drill-down menus that make it easy to view and track financial data.

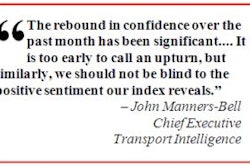

2. Run reports to analyze where you can save money. Finding ways to cut costs has become even more critical in a recession, when companies need to tighten their belts without undermining their ability to compete. Savvy companies are relying on spend analytics to achieve significant savings by realizing volume and early-pay discounts, ensuring they are benefiting from the terms of their contracts, and eliminating duplicate payments and costly late payment fees.

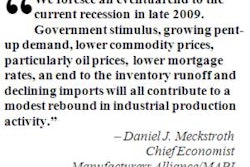

3. Take a hard look at strategic purchases. For commodity or non-strategic purchases, companies typically select suppliers based on cost. However, this approach won't work for strategic purchases. Companies can't afford to jeopardize critical areas that can make or break their businesses, particularly in an economic climate that doesn't leave room for error. In strategic areas, consider the overall value that suppliers provide, including quality, reliability and service. In some key areas, such as research and development, you may want to invest even more during a recession to position your company well for the inevitable economic rebound.

4. Gain efficiencies and improve processes. A large European brewer, for example, has achieved "no-touch" straight-through processing for more than 90 percent of its purchase order-based invoices. Look for ways to streamline operations and gain process improvements as a painless way to cut costs during tough economic times. Many forward-thinking companies are using key performance indicators (KPIs) to gain process improvement through ongoing measurement and monitoring. They are measuring current performance against goals and benchmarks to identify their strengths as well as opportunities for improving processes and saving money.

5. Take a holistic approach to procure-to-pay. In times like these, companies can't afford to have half a view of their financial operations, waste time through inefficiencies or work at cross-purposes. For example, relationships with valued suppliers could be damaged if Accounts Payable consistently delays processing their invoices. By implementing a holistic procure-to-pay system that automates the entire process from identification of a need, through planning and budgeting, to procurement and payment, companies will gain efficiency, visibility and value throughout the financial supply chain. They will be able to know where their money is going and how to find opportunities for cost savings, and they can ultimately make informed decisions about how and where to most strategically spend.

6. Find a solution that provides immediate cost savings and benefits. Today more than ever, companies need to find ways to achieve savings and efficiency in a very short timeframe. Investing in long-term re-engineering projects that promise future savings is no longer an option. Many are implementing technology that provides ROI within a matter of months.

When times are tight, knowing where you are spending your money and identifying effective ways to cut costs are very important. At the same time, savvy companies are looking at longer-term opportunities. They are using automated procure-to-pay systems to strategically focus on key purchasing areas, benefit from process improvements and more effectively manage their cash flow and working capital throughout the supply chain. By using technology for short-term as well as strategic, long-term gains, they are achieving key competitive advantages that will position them well when the good times return.