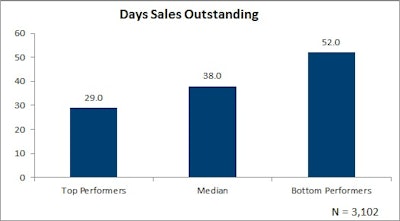

Days sales outstanding (DSO) is calculated as 360 days divided by the ratio of net sales, divided by the average month-end trade accounts receivable balance (excluding all unbilled receivables). It is a quick, high-level measure of the state of an organization’s receivables. A high number of days could indicate problems receiving prompt payment from customers. A low number of days sales outstanding indicates a more efficient business.

As shown in the graph, American Productivity and Quality Center’s (APQC’s) Open Standards Benchmarking in supply chain planning shows that bottom performers have a DSO of 52 days, whereas top performers cut their DOS almost in half to 29 days. Managing DSO can be a good step to maintain the capital needed for growth. In addition, a lower DSO often results in a decrease in uncertainty for the supplier, who can be more confident in its financial standing and ability to fill the necessary orders.

Organizations can improve DSO using a two-pronged approach: Identify first the internal and then the external problems that affect a customer’s ability to pay. Internally, organizations should address invoice errors, which can delay how promptly a customer receives a correct invoice. Externally, organizations should conduct both customer and customer-segment analysis, particularly on high-value customers. By examining the payment histories of major customers and customer industry segments, as well as external developments that may affect customers in the future, organizations gain a clearer picture of which customers are slow to pay and which have the potential to become so in the future.