Manassas, Va.—April 1, 2015—INSIGHT, Inc., an international provider of planning solutions that power supply chain design, discusses the recent announcement of the Heinz and Kraft merger. H.J. Heinz Co. and Kraft Foods Group, Inc. announced that they entered into a definitive merger agreement to create The Kraft Heinz Co., forming the third largest food and beverage company in North America.

When global companies merge, they need to rationalize their supply chains, eliminating overlap to create a robust supply network that meets customer service requirements while boosting bottom-line profits. For maximum impact, supply chain planning must comprehensively evaluate the global supply chain to capitalize upon the dynamics of global markets, while excellence in supply chain design delivers superior results for shareholders and customers.

“A significant portion of the value of a merger and acquisition (M&A) deal must be unlocked through reconciliation of product lines and high-level redesign of a consolidated supply chain,” said Jeff Karrenbauer, president and co-founder of INSIGHT. “SAILS from INSIGHT optimizes the most complex, global logistics networks—minimizing costs, streamlining operations, reducing inventory levels, meeting demanding customer service levels and containing supply chain vulnerability risk, while maximizing profits.”

The benefits of a comprehensive global supply chain design that supports the most competitive delivery service levels include: a design that extracts the most from worldwide operations, regional and product flexibility to capitalize upon changing markets, low cost for profitability and pricing leverage, and the advantages of evaluating many what-if scenarios. Continuous improvement, a hallmark of corporate quality, mandates frequent review of the global supply chain network to account for significant change in demand, demographics, economy, product mix, manufacturing capacity, distribution network, assets and so on.

Currently, international mergers and acquisitions are common, with revenue growth and/or cost reduction the clear, targeted benefits. Evaluating the best divestiture option, from a component of merged operations, becomes more important as firms stay true to core capabilities and shed non-essential operations. Strategically, the benefits from merger or acquisition may be clear, but firms can get distracted, consumed by the acquisition or caught up in competitive bidding, failing to execute by charting the course to a single supply chain. Rigorous supply chain design tools do the painstaking work of determining the right assets, manufacturing facilities, warehouse locations, inventory levels and transportation routes.

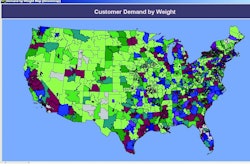

INSIGHT’s flagship supply chain design software solution, SAILS, enables executives to achieve savings by consistently improving the supply chain in accord with the changing dynamics of global trade, merger or acquisition, customer expectations, facilities issues or tough corporate profitability goals. This software tool optimizes the benefits from merger or acquisition, identifying positive and negative assets, and offering alternative scenarios, given management's strategic view. Most recently, INSIGHT introduced INSIGHT SCOREKEEPER, which allows simulation of complete supply chain operations, including procurement, manufacturing and finished goods distribution at a daily level of detail. It has complete, seamless integration into the SAILS system, including database, user interface, and output reports and graphics. It gives the ability to simulate either current supply chain (baseline) or the result of any SAILS optimization exercise with automatic communication of either solution to the simulation.