Christine AdobeStock_769092028

Since March 26, when the Dali, operated by the Synergy Group and chartered by Maersk, collided with the Francis Scott Key Bridge in Baltimore (part of I-695), causing it to collapse, a series of disruptions at the ports have continued to surface.

Two alternative channels have been opened for vessel traffic, with a third one planned to open this month. These three channels should be able to handle much of the traffic into the Port of Baltimore. The current timeline for reopening of the main channel is by the end of May, according to project44 data.

Key takeaways:

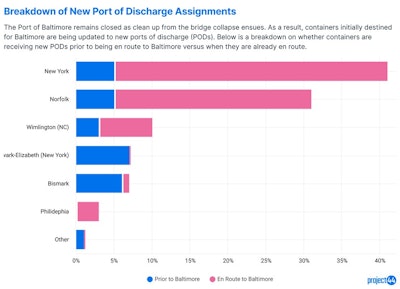

- New ports of discharge have been assigned to many of the containers aboard vessels that were supposed to call on the Port of Baltimore. Unless it is a Maersk container, customers are required to arrange transportation from these places, so there will likely be increased spot rates for both truck and rail in these areas as outbound dray demand increases from these ports.

- These ports are predicted to be equipped to handle the additional volume that’s incoming from Baltimore, but project44 continues to closely monitor import dwell rates at these ports.

project44

project44- Baltimore is running out of freight to pick up due to the lack of inbound shipments, so the containers at port have been sitting for a while. This is not necessarily due to the bridge collapse, but it is likely that Baltimore will either have high dwell or no containers being processed as the port remains closed.

- For instance, rerouted containers in New York are sitting for 66% longer. Containers rerouted to Norfolk show an even larger gap between dwell, with the rerouted containers still around that 5-day mark, but the rest of the containers are right around 2.5 days, meaning rerouted containers are waiting 100% longer to depart the port.

- If the containers have 5 free days, on average a rerouted container is estimated to accrue $200 in demurrage. This number increases if there are fewer free days available. While $200 doesn’t seem like a ton, in 2023, Baltimore handled 1.1 million TEU containers, which averages out to roughly 21,000 per week. This could equate to $4.2 million in demurrage weekly, causing an astounding unexpected increase in transportation costs.

- On top of the higher rates to move the loads, shippers also run the risk of incurring demurrage on these containers if they are not picked up quickly. When a container arrives to a port, there is an allotted amount of days that shippers have to pick up the container. This is generally 3-5 days. If the shipper does not pick up the container prior to this window, they must pay a daily rate of $75-300 until the container is picked up.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)