London — August 13, 2008 — The practice of global sourcing in the retail and consumer sector is thriving, but many companies are not particularly clear on their cost savings or confident of product safety and other key risks, according to a survey launched today by PricewaterhouseCoopers.

Cost is the primary driver of global sourcing decisions, yet 21 percent of respondents do not know what savings to expect. Worryingly, the survey of nearly 60 retail and consumer goods' companies found that one-quarter of respondents did not know what their actual savings were.

Companies from Australia, Canada, China, France, Germany, India, the United Kingdom and the United States took part in the survey, with 44 percent of the companies sourcing more than $500 million of product globally each year and 27 percent sourcing more than $1 billion globally. Despite recent and ongoing robust growth in global sourcing, companies are clearly still challenged with some basic elements, the survey finds.

Harder Costs to Quantify

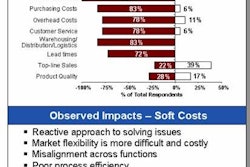

Among survey respondents, the more common costs measured were the ones that are easier to track: transportation and logistics, customs and warehousing. The harder ones to quantify, and the ones less likely to be measured, include compliance costs, quality costs and out-of-stocks. Surprisingly only about half of the respondents measured the cost of out-of-stocks from global sourcing, even though for retailers and suppliers out-of-stocks on the shelf can generate significant costs in the form of lost store sales and lost margin.

For some respondents, overseas sourcing has become so widely embraced that the cost savings generated no longer necessarily provide a competitive advantage. As executives watch competitors reduce costs through overseas sourcing, they have no choice but to follow suit because "everyone else is doing it too."

Carrie Yu, global retail and consumer leader with PricewaterhouseCoopers, said that globalization has laid the groundwork for profound change in the way that companies source and manufacture products, particularly in the retail and consumer sector, where companies are striving for greater efficiency in a crowded and competitive market place.

"Given margin pressures imposed by the softening of the U.S. and European economies, high fuel and commodity prices and the reputation risks presented by product recalls and environmental considerations, it is more vital than ever to accurately measure the cost and effectively manage the risks of global sourcing," Yu said. "The results [of the survey] show that while some companies have a robust process for reviewing and monitoring the benefits and savings arising from their global sourcing efforts, other companies are either not aware of the potential benefits or do not have the systems in place to track them."

China Still Number One

Another key theme emerging from the companies surveyed is that the practice of global sourcing is dynamic and growing. In fact, both historic growth rates and projected growth rates are double-digit figures — almost half of survey respondents have seen a growth rate of more than 10 percent in the past five years, and four in ten project growth rates of more than 10 percent in the next five years.

The survey showed that China is still the number one destination for global sourcing for 83 percent of respondents. India followed with 58 percent, but Mexico, Brazil, Malaysia, Canada, Chile, Italy and Bangladesh were also cited.

The survey also picked up that product quality is the single greatest risk to global sourcing, cited by 68 percent of the survey sample. However, fewer than half said they were very confident of managing the risks associated with product safety, despite the potentially damaging repercussions of a product failure or product recall. A quarter of respondents source over 75 percent of their product globally, and with such a high percentage lacking confidence, more active steps are needed to manage product quality risk, according to PricewaterhouseCoopers.

Sustainability concerns have clearly gained ground in the retail and consumer goods sector, illustrated by the fact that 41 percent of respondents feel climate change is one of the most significant risks to their supply chain. However, almost one-third of respondents were "not very confident" or "not confident at all" about their organizations' ability to properly manage carbon footprint risks. Only a third of respondents were rewarded on issues relating to corporate responsibility.

"Robust Growth" Ahead

Despite these concerns, Lino Casalino, Canada retail and consumer advisory leader at PricewaterhouseCoopers, said that global sourcing in the retail and consumer sector is set to experience "robust growth" in the future.

"What is clear from the survey is that while they are moving in that direction, the majority of survey respondents are not yet taking advantage of all the potential benefits of their global sourcing operations," Casalino said. "Companies must adapt their organization structure and processes to maximize cost savings and minimize associated risks, while identifying new ways to differentiate themselves through global sourcing — through cost, quality, brand or environmental approaches."

Just over half of the 59 survey respondents were from retail, with the bulk of the rest coming from food and beverage, textiles and clothing and others including fast moving consumer goods and durable goods.

The Global Sourcing Survey report is available through PricewaterhouseCoopers at www.pwc.com/r&c.

Cost is the primary driver of global sourcing decisions, yet 21 percent of respondents do not know what savings to expect. Worryingly, the survey of nearly 60 retail and consumer goods' companies found that one-quarter of respondents did not know what their actual savings were.

Companies from Australia, Canada, China, France, Germany, India, the United Kingdom and the United States took part in the survey, with 44 percent of the companies sourcing more than $500 million of product globally each year and 27 percent sourcing more than $1 billion globally. Despite recent and ongoing robust growth in global sourcing, companies are clearly still challenged with some basic elements, the survey finds.

Harder Costs to Quantify

Among survey respondents, the more common costs measured were the ones that are easier to track: transportation and logistics, customs and warehousing. The harder ones to quantify, and the ones less likely to be measured, include compliance costs, quality costs and out-of-stocks. Surprisingly only about half of the respondents measured the cost of out-of-stocks from global sourcing, even though for retailers and suppliers out-of-stocks on the shelf can generate significant costs in the form of lost store sales and lost margin.

For some respondents, overseas sourcing has become so widely embraced that the cost savings generated no longer necessarily provide a competitive advantage. As executives watch competitors reduce costs through overseas sourcing, they have no choice but to follow suit because "everyone else is doing it too."

Carrie Yu, global retail and consumer leader with PricewaterhouseCoopers, said that globalization has laid the groundwork for profound change in the way that companies source and manufacture products, particularly in the retail and consumer sector, where companies are striving for greater efficiency in a crowded and competitive market place.

"Given margin pressures imposed by the softening of the U.S. and European economies, high fuel and commodity prices and the reputation risks presented by product recalls and environmental considerations, it is more vital than ever to accurately measure the cost and effectively manage the risks of global sourcing," Yu said. "The results [of the survey] show that while some companies have a robust process for reviewing and monitoring the benefits and savings arising from their global sourcing efforts, other companies are either not aware of the potential benefits or do not have the systems in place to track them."

China Still Number One

Another key theme emerging from the companies surveyed is that the practice of global sourcing is dynamic and growing. In fact, both historic growth rates and projected growth rates are double-digit figures — almost half of survey respondents have seen a growth rate of more than 10 percent in the past five years, and four in ten project growth rates of more than 10 percent in the next five years.

The survey showed that China is still the number one destination for global sourcing for 83 percent of respondents. India followed with 58 percent, but Mexico, Brazil, Malaysia, Canada, Chile, Italy and Bangladesh were also cited.

The survey also picked up that product quality is the single greatest risk to global sourcing, cited by 68 percent of the survey sample. However, fewer than half said they were very confident of managing the risks associated with product safety, despite the potentially damaging repercussions of a product failure or product recall. A quarter of respondents source over 75 percent of their product globally, and with such a high percentage lacking confidence, more active steps are needed to manage product quality risk, according to PricewaterhouseCoopers.

Sustainability concerns have clearly gained ground in the retail and consumer goods sector, illustrated by the fact that 41 percent of respondents feel climate change is one of the most significant risks to their supply chain. However, almost one-third of respondents were "not very confident" or "not confident at all" about their organizations' ability to properly manage carbon footprint risks. Only a third of respondents were rewarded on issues relating to corporate responsibility.

"Robust Growth" Ahead

Despite these concerns, Lino Casalino, Canada retail and consumer advisory leader at PricewaterhouseCoopers, said that global sourcing in the retail and consumer sector is set to experience "robust growth" in the future.

"What is clear from the survey is that while they are moving in that direction, the majority of survey respondents are not yet taking advantage of all the potential benefits of their global sourcing operations," Casalino said. "Companies must adapt their organization structure and processes to maximize cost savings and minimize associated risks, while identifying new ways to differentiate themselves through global sourcing — through cost, quality, brand or environmental approaches."

Just over half of the 59 survey respondents were from retail, with the bulk of the rest coming from food and beverage, textiles and clothing and others including fast moving consumer goods and durable goods.

The Global Sourcing Survey report is available through PricewaterhouseCoopers at www.pwc.com/r&c.