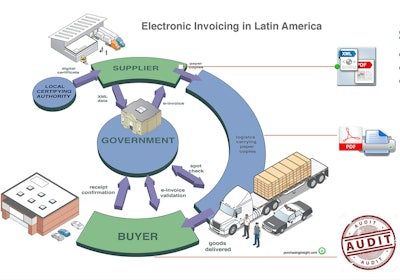

It’s no secret that government regulations can heavily burden corporations that are seeking to minimize their risk of penalties and fines. Complex financial mandates—such as the e-invoicing and fiscal reporting requirements prevalent in Latin America—require sophisticated changes to operational procedures and the integration of several teams, from information technology (IT) to supply chain to finance and accounting. However, as more and more governments worldwide start to implement business regulations like electronic invoicing, companies are realizing that this forced standardization can help reduce operational costs and improve cash flow.

Automation Is Critical for Compliance and Reduces Operational Costs

Effective compliance with complex financial mandates requires automating processes within your enterprise resource planning (ERP) system. Only when companies use a single system of record, automate reports, and automatically match purchase orders, goods receipts and suppliers’ invoices for accuracy can they eliminate the risk of errors and minimize audit risks.

Yet, such automation has benefits that go far beyond compliance by enhancing processes in multiple business operations, such as:

- Inbound receiving. Many countries in Latin America require that a copy of the government-approved e-invoice accompany all shipments, acting as a bill of lading. As tax authorities across the globe emulate the successful mandates in Latin America, this requirement is likely to spread globally, offering companies the opportunity to streamline their inbound receiving processes. With e-invoices on the truck, and often available even before the goods arrive, shipments can be verified immediately upon receipt, turning hours of inventory management and manual data entry into a single scan-and-click process. In fact, companies who implemented these automated receiving processes realized cost savings of up to 40 percent while increasing employee productivity by up to 50 percent.

- Accounts payable. Relying on manual accounts payable processes is risky in countries mandating electronic invoicing. The data necessary in these reports can be cumbersome—for example, Mexico requires a 30+ digit, case-sensitive, alphanumeric unique identifier code, and a single typo in the code can result in fines. With an approximate 7 percent error rate in codes entered, these mistakes can quickly add up. Instead, XML invoices should be automatically imported into your ERP so that it links back to the government-approved document—with all of the correct information already there. Collection, validation and processing of these invoices can all be automated, and journal entries and required reporting should all be linked from the ERP. Since invoices can be marked OK to pay as soon as goods arrive, moving to an automated accounts payable (AP) process frees up the AP team to focus on exceptions, discrepancies and innovations instead of getting bogged down in data entry.

- Accounts receivable. Many countries that require e-invoicing also mandate that the e-invoice be available for buyers to download for a set amount of time via a web portal. Some countries, like Brazil, make this service available as a part of their e-invoicing server. Others, like Peru, require that companies maintain their own web portals for archiving. Either way, this automated e-invoicing archiving process minimizes the burden on accounts receivable teams to reissue invoices, as they are now available on demand.

Required Standardization Paves a Path for Improved Cash Flow

Collectively, the standardization and automation made possible by financial compliance mandates also bring forth opportunities for enhanced cash flow. Using supply chain financing, corporations can lower the cost of payment processing while providing suppliers with greater access to liquidity, as payment approval windows decrease from weeks to hours. Suppliers have the ability to immediately convert invoices into cash, and can speed up the payment process based on their unique cash flow needs, payment terms and billing cycles.

Traditional hurdles to supply chain financing—paper invoices that require too much time to process, in addition to onboarding and implementation barriers—are eliminated with mandated, standardized e-invoicing. Since all buyers and suppliers participate in e-invoicing, no onboarding is needed. Plus, real-time invoice processing shortens approvals.

With streamlined AP processing and the availability of supply chain financing, buyers and suppliers have more control of their cash flow and improved visibility into financial transactions. Buyers can automate payments—as soon as goods arrive if they choose—and suppliers can opt for real-time payments. Not only does this strengthen cash flow within individual companies, but the option to get paid faster can also strengthen buyer-supplier relationships and enhance supplier stability, which is especially critical in the emerging markets where e-invoicing mandates are most common.

As business-to-government financial regulations spread globally—especially in attractive emerging markets and countries that rely on income from value-added taxes (VAT)—companies will be forced to update age-old business processes. While these mandates certainly aren’t without challenges, they also present opportunities for innovations and invite companies to update antiquated, manual models to more efficient automated procedures. Ultimately, companies who see these requirements for the opportunities they provide can enhance processes and cash flow, strengthening their global operations.

Scott Lewin is the CEO of Invoiceware International.