They aren’t your father’s third-party logistics providers.

Today’s operators are bigger, more sophisticated and offer total supply chain visibility.

The outsourcing strategies that grocery distributors are relying on nowadays call for reducing costs, improving customer service levels, meeting cold storage needs and providing value-added services.

“Consolidation in the industry continues to be a key driver in the evolution of the third- party logistics (3PL) service sector,” says Jim Marcoly, vice president-client solutions, consumer packaged goods, food and beverage at Weber Distribution LLC, Los Angeles. “Mega-companies with mega-national infrastructure are bringing more and more diverse product offerings to the client in an attempt to capture more revenue.”

Stephen Dean, vice president of sales and marketing, Supply Chain Solutions, Ryder System Inc., Miami, says the top-tier 3PL providers are now offering supplier inbound control and transportation management, whereas the previous fulfillment model only operated within the four walls of the distribution center. This visibility includes in-transit tracking of item data and cold chain control via GPS, insuring product delivery and integrity of orders.

WHAT’S PROMPTING THESE CHANGES?

Evan Armstrong, president of Armstrong & Associates, Stoughton, WI, believes that 3PL market growth is driven by companies outsourcing logistics functions to concentrate on core competencies, the need for sophisticated supply chain information technology solutions and the ongoing globalization of trade and logistics.

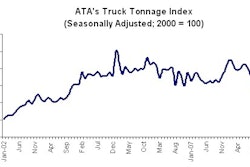

“The underlying structural support of 3PL market growth being three to four times higher than the overall U.S. economic growth as measured by gross domestic product (GDP) continues,” says Armstrong. “Despite an ongoing recession in 2008, third-party logistics service provider revenues grew an estimated 5.5 percent to $128.7 billion. We project that U.S. 3PL revenues will reach $145.3 billion in 2010 after a difficult year (4.5 percent increase) in 2009 and an improving year (8.0 percent increase) in 2010.”

According to Matt Parrott, director of Northern Border Operations, A.N. Deringer Inc., St. Albans, VT, the largest change in the industry involves clients wanting many value added services, such as light manufacturing, client specific labeling, kitting or other such services. Whatever they may be, they are now expected.

“Many of the large retailers and even regular clients are putting more and more expectations on their suppliers prior to purchasing,” says Parrott. “From RFID tags to simply building pallets to certain specifications, customers are demanding shipments be delivered according to strict rules in order to gain efficiencies.”

PROFIT CENTERS WITH CAPABILITIES

Armstrong refers to 3PLs as profit centers that often have the human resources, information technology and engineering capabilities that very few shippers can match. Third-party logistics providers are very good at managing transportation, value-added warehousing and dedicated contract carriage operations; these functions should be considered for outsourcing, he adds.

“Therefore, we recommend outsourcing significant portions of your supply chain while maintaining command and control for strategic supply chain management within your company,” says Armstrong. “Every shipper should be its’ own lead logistics manager and monitor 3PL service levels and ongoing costs.”

Dean of Ryder System says third-party logistics providers offer state-of-the-art WMS and TMS solutions that would be prohibitive if purchased and operated by a single user. “In the transportation arena, a large 3PL usually has existing contracts within lanes used by multiple suppliers, further reducing costs to the outsourced wholesaler.”

By managing all aspects of logistics, Dean continues, the 3PL can control and monitor costs, insuring a competitive edge for its customer. By offering client companies order management with transportation management, the 3PL can manage inbound, including merging orders to reduce overall transportation costs.

“In a multi-client environment, the 3PL can limit issues with existing driver shortages and allowable in-service hours that have been a problem for most wholesalers,” says Dean. “Tighter cold chain controls are also a requirement within the industry, requiring in-transit temp tracking included in most major 3PL transportation management systems.”

Dan Sanker, president and CEO of Case-Stack, a leading multi-vendor consolidator, says, “A lot of CPGs have too many LTLs (less-than-truckload) orders coming in every day to ship out to retailers. They cost a lot of money, it’s inefficient and there’s a lot of waste.”

His company works with many CPG clients who are all shipping to the same places: retailers and distributors. What his company does is work with retailers and distributors to turn, for example, a truck and a quarter into a truckload; a truck and three quarters, into two truckloads.

“And if you can do that, we’ll make sure that we ship full truckloads all the time; and if we can do that, that means the truck goes directly from point A to B,” he says. “It costs less money, it uses less fuel and there is less damage because the item did not have to load and unload three times to get where it’s going.”

Both retailers and manufacturers benefit, according to Sanker. Instead of the retailer having 15-20 LTLs the next morning, he has one truck with the entire order on it and is able to cut down on half the dock labor. The manufacturer, on the other hand, can save 20 to 40 percent on the cost side of shipping and can level the playing field with a Kraft or a Unilever for a company that might be 10 percent of their size.

“The interesting thing about grocery is synchronized balance between their desire to manage the freight, route the freight inbound from the manufacturer and their ability to handle that on a consistent basis,” says Matt Menner, senior vice president, sales and alliances for Transplace, Frisco, TX. “There remains opportunity for the grocer who runs a sizeable fleet to continue to control a lot of their own freight expense by aggressively pursuing backhaul opportunities and also considering utilization of those fleet assets to handle other people’s freight.”

UNTAPPED OPPORTUNITIES

There are still lots of rocks to be overturned when you think about the grocer and their operation and the CPG company that are typically suppliers and 3PLs who are in between, according to Menner. There are still untapped opportunities for CPG manufacturers and suppliers to retail grocery and distribution.

“Areas of improvement exist which makes it exciting and hopefully gives opportunities for providers to tackle those challenges,” he says.

In discussing grocery specifically, Ryder’s Dean uses the instance of a private label manufacturer that has a number of smaller suppliers in the Northeast shipping to the Midwest. Given the 3PL has visibility to these orders and suppliers, the 3PL can manage pick-up and merge smaller orders into full truck loads, reducing costs and insuring on-time delivery, he says.

“Placing warehouses close to your key client’s DCs to provide quick and easy sourcing is the best way to do business with a grocer,” says A.N. Deringer’s Parrott. “Communication and partnering is the roadmap to success working with any 3PL. Work with your providers to develop standard operating procedures so both parties understand each other’s needs.”

With grocery distributors, Sanker of CaseStack says that his organization has to be prepared for things like recalls and reverse logistics. There are typically a lot of SKUs and a lot of codes to be managed in a 3PL’s systems. Given the fact that most CPG and food products are lower-value items, it means you have to run a tight ship, he adds.

“If you look at logistics companies that succeed, there is no tolerance for extra cost in the system,” he says. “If you have a $15 case to run through a system, you can’t spend $10 doing it.”

WHAT’S NEXT?

Marcoly at Weber Distribution thinks that private label opportunity will be the next big thing.

Rising commodity prices and consumer desire to get the best price/value products are driving private labels’ growth.

Backing this up is a recent survey by The Nielsen Co. that found that three-fourths (72 percent) of respondents viewed private label brands as equivalent to name brands, while 62 percent said store brands were just as good as name brands.

“Just as ‘price and value’ will be the main drivers in the private label market, 3PLs are poised to take advantage of the restructuring and opportunities these events will create,” says Marcoly. “This would apply to food, beverages and virtually all commodities within the food logistics supply chain.”

Menner says that the future of 3PL is interlinked with how long this current economic malaise remains. The situation presents a very significant growth opportunity for 3PLs.

“You will see continued competitive forces in the marketplace, as well as some additional consolidation take place,” he predicts. “I’m hopeful that we will see increased growth year over year.”

WHO DO YOU TRUST?

Choosing a third-party logistics provider comes down to trust. Moreover, experts say it’s critical that the provider be more than a vendor; the company must be a partner and an extension of the organization.

In forming the right 3PL relationships, Evan Armstrong, president of Armstrong & Associates advises making sure that the outsourcing process for 3PL evaluation and selection is performed in a competitive and professional manner. He encourages developing a formal request for proposal (RFP). The scope of work being required by the 3PL and current logistics management processes need to be clearly defined.

“Warehouse and transportation cost information as well as shipment data should be included and be as detailed as possible and main key performance indicators (KPIs) should be incorporated into a standard contract for logistics services,” he says. “Common KPIs include percent of on-time shipments, order-picking accuracy (percent by order) and order fill rate measures.”

He also holds that information systems requirements for transportation management and warehouse management have to be developed, whereby a minimum of three and a maximum of six 3PLs should receive the RFP.

“The goal is to use available information to isolate potential 3PLs with the necessary skills and gauge their level interest in working with you on a project before ever sending them a RFP,” he says. “Once they receive the RFP, you want the 3PL to put in a significant amount of effort and really go after your business.” –J.K.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=100&q=70&w=100)

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)