Handshake, a provider of business-to-business (B2B) commerce technology for manufacturers and distributors, announced key findings from its “2016 Manufacturing & Distribution Sales and Technology Survey Report.” This annual survey explores how manufacturers and distributors around the world are changing the way they sell and deliver products to their customers in the wake of new challenges, disruptive technologies and shifting customer expectations.

“Our most recent survey indicated that manufacturers and distributors are clearly feeling pressure from buyers and competitors to automate manual sales and ordering processes,” said Glen Coates, CEO of Handshake. “Many plan to immediately address these issues, leading them to implement or plan investments in digital commerce technology for their customers and sales teams.”

B2B Companies Develop Mobile and E-Commerce Experiences to Grow Business

Creating an omnichannel, consumer-like customer experience is a key goal for manufacturers and distributors in the next year. When asked what commerce technologies were a priority for their businesses, 63 percent cited web B2B e-commerce software for online customer ordering, 58 percent highlighted mobile order writing software for sales reps in the field and 30 percent said mobile B2B e-commerce that would allow customers to place orders from a mobile device.

As the business-to-consumer (B2C) world continues to raise the bar with conveniences like online ordering and mobile access, similar expectations are seeping into the world of B2B commerce. Among respondents that already invested in B2B e-commerce, 79 percent reported that their customers asked for the ability to order online.

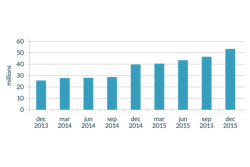

Manufacturers and distributors are recognizing the immediate necessity for investments in B2B e-commerce with 50 percent reporting that they plan to implement solutions within the next 12 months and 20 percent within six months. This is on top of the 44 percent of respondents that already had a B2B e-commerce web portal in place. The expectation of 24/7 online ordering will only become more common among buyers as more companies provide the option.

Suppliers that already responded to their customers’ requests for convenient online ordering are seeing a return on their investment. Among respondents that already implemented B2B e-commerce, 50 percent noticed customers ordering additional products across more categories and 34 percent saw an increase in average order value. By delivering an easier way to do business, manufacturers and distributors are able to drive more sales.

Empowered by Technology, Sales Reps Continue to Play a Critical Role

Despite the investment in self-service, online customer ordering, manufacturers and distributors reported that B2B e-commerce technology is not replacing sales representatives, but helping them provide more strategic value to customers. When asked about the value of sales reps, 75 percent of respondents cited the in-person sales channel as essential to their business. For those companies that deployed B2B e-commerce, 84 percent reported that the size of their sales team stayed the same or grew larger, and 44 percent of these respondents stated that, while customers preferred to order online, they still wanted the option to order through sales reps.

“Relationships are the foundation of B2B selling. Advances in technology are providing manufacturers and distributors with the opportunity to get more value from the relationships sales reps have with customers and help drive the business forward,” said Coates. “Those suppliers that are listening to customers, and implementing mobile and web B2B e-commerce to complement their sales reps are getting a head start on the competition.”

There were 450 respondents from companies self-designated as manufactures and/or wholesale distributors across over a dozen industries, including food and beverage, sporting goods, industrial manufacturing, medical instruments, accessories, apparel, beauty and cosmetics, and gift and homewares. Respondents included leaders within their respective organizations (with C-level leaders at 19 percent, vice president-level leaders at 8 percent and director-level leaders at 14 percent), as well as managers and individual contributors in sales, operations, marketing, finance, customer service and IT.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)