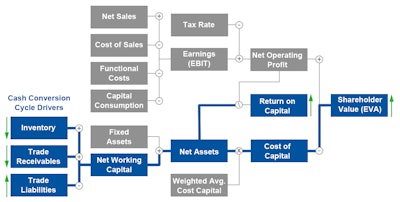

With supply chain executives playing a more prominent role in the boardroom, the ability to articulate how their organization creates shareholder value is becoming an important skill. A good place to start this discussion is with the cash conversion cycle—the least understood but most important supply chain metric because it drives shareholder value and return on capital.

The cash conversion cycle provides a measure of how fast a company can convert funds invested in materials into cash from the sale of finished goods. A decreasing cycle means that management is doing a more effective job using its resources to generate cash, with capital tied up for less time in production and sales processes.

Unlike case fill or perfect orders, which are in the supply chain and measured directly, the cash conversion cycle is a derivative metric measured in days and made up of one part supply chain (inventory) and two parts finance (trade liabilities and receivables). The result is an esoteric metric that can be hard to fully appreciate.

Let’s take a look at the drivers of the cash conversion cycle and how they tie back into shareholder value.

Trade liabilities are what you owe your vendors, i.e., payables. Longer payment terms increase your company’s liabilities and hence working capital. This translates into a lower cost of capital, raising shareholder value and return on capital (see figure 1). Though it creates a short-term cash windfall, increasing payment terms has a downside. Kevin O’Marah from SCM World recently referred to forcing extended payment terms on vendors as “heroin for the supply chain:” it feels good at first but, over time, saps the strength of the entire value chain. He cited practices by General Motors in the ‘80s and ‘90s that nearly destroyed the automotive ecosystem in North America and ruined profitability at the Big Three for a long time.

Trade receivables are what your customers owe you. Faster collection of money owed by customers increases working capital and raises shareholder value. This, too, comes at a cost. Pressuring customers to pay faster puts revenue at risk and can jeopardize longstanding relationships, eroding trust that was built over time.

Inventory reflects the capital invested in stock. In addition to being the most familiar component in the cash conversion cycle, inventory is also the easiest one for supply chain executives to control. It is managed through stocking policies to balance capital invested in inventory with service goals and market volatility. Unfortunately, inventory policies at many companies still rely on rules of thumb that undermine performance.

Rules of thumb are not bad in and of themselves. They provide a helpful means to make a reasonable approximation in the absence of sufficient time and resources to create a precise answer. For example, traditional ABC segmentation practices adopted in the ‘90s provided a way to classify items despite restricted planner headcount, limited computing resources and the long time required to execute complex mathematical equations. There were simply too many items in too many locations for the available resources.

This is no longer true today. While headcount pressure is an even bigger issue than it used to be, computing power was multiplied by more than 1,000 times and the time to crunch complex equations collapsed. ABC segmentation rules of thumb that were helpful in the ‘90s no longer make sense. Instead, automated software algorithms can now sense demand to create accurate forecasts and set mathematically optimized inventory targets for each item at every point in the distribution network.

Companies are able to reduce forecast error by 40 percent and cut days of unproductive stock, freeing millions in cash and making better use of capital. Being automated, inventory policies can now be refreshed weekly instead of once or twice a year to reflect changes in distribution strategy, supply or demand variability, service objectives or lead times. Specific stock levels are published directly to supply planning systems for execution, all without impacting planners. In fact, planners are freed from mundane tasks and can use their time on more productive activities like planning the next promotion.

Demand sensing and multi-echelon inventory optimization systems were adopted at many of the world’s largest companies. If your company is not using these methods, it is a great opportunity to cut unproductive inventory, shorten the cash conversion cycle and drive shareholder value. Published financials of 30 consumer goods, food, and health and beauty companies show that organizations sensing demand carry, on average, 15 days less inventory than those with only traditional planning systems. Likewise, the cash conversion cycle for companies adopting demand sensing was cut by 19 days between 2009 and 2014 compared to just seven days for those without. The spread between the groups quadrupled over the same period, from four to 16 days.

The benefits of leveraging the digital supply chain go beyond accurate inventory projections and a shorter cash conversion cycle. In addition to improving the asset side of the value equation, it also improves net operating profits through lower costs and increased sales. Having the right inventory in the right place reduces costly transshipments and expediting; fewer days of inventory means lower carrying and warehouse costs. Better availability helps grow sales and strengthens customer relationships.

So the next time you get the opportunity to share how your organization creates shareholder value and adds return on capital, consider starting off with the cash conversion cycle and, in the process, help raise the bar for supply chain as a whole.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)