Feb. 3, 2016—LeaseAccelerator, a provider of equipment lease management software, published a report listing the off-balance sheet lease obligations of the 500 largest U.S. public companies. The report, entitled Who Is Most Impacted by the New Lease Accounting Standards?, aims to provide greater awareness of the potential impact of the new lease accounting standards.

Both the recently announced IFRS 16 and the forthcoming FASB ASC 842 will require companies to transfer their operating leases, previously only disclosed in the footnotes of their financial reports, onto their balance sheets starting in 2019. They will replace IAS 17 and ASC 840 (formerly FAS 13), respectively. According to the International Accounting Standards Board, listed companies around the world have around $3.3 trillion of leasing commitments over 85 percent of which do not appear on their balance sheet.

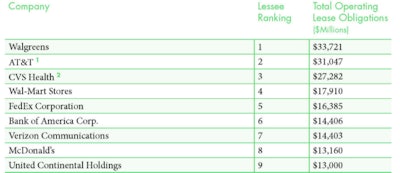

The companies that will be most impacted by the new capital lease accounting standards will be those with the largest operating lease obligations. The off-balance sheet leases for a specific company can range from a few million dollars, on the low end, to tens of billions of dollars, on the high end.

As the new standards were being developed over the past 10 years, there was much debate and analysis of how the changes will impact companies’ decisions to lease vs. buy, and how credit ratings may change. However, there was very little research into the additional administrative burden that will be placed on companies to redesign their lease accounting processes to comply. Specifically, to avoid a significant deficiency or material weakness, at-risk companies will have to adopt new management strategies, policies and software to address the big data problem of equipment lease management—maintaining complete, accurate, and up-to-date data for leases, assets and stakeholders distributed around the world.

“With comparative reporting requirements for the new lease accounting standards starting as early as 2017 for most firms, we believe that many Fortune 500 companies are woefully unprepared for the new lease accounting standards, especially their equipment lease portfolio,” said Michael Keeler, CEO of LeaseAccelerator. “We hope the publication of this report will provide CFOs with a perspective on the relative size and significance of their operating lease obligations compared to their industry peers, and prompt a proactive investigation of solutions given the 2017 income statement comparables deadline.”

LeaseAccelerator compiled a list of the 500 largest U.S. public companies ranked by the size of their off-balance-sheet leasing obligations. To identify the 500 companies, the company used Fortune magazine’s most recent Fortune 500 study. For the operating lease obligations, the company collected data from the most recent SEC 10-K annual filings for each of these public companies. No calculations nor manipulation of the leasing obligation data was performed. LeaseAccelerator organized the data reported by the companies into a list.