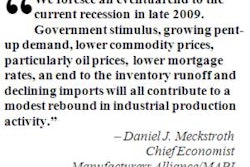

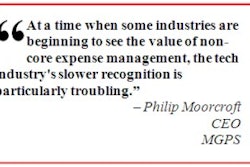

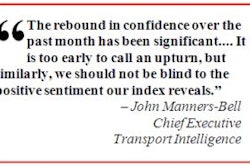

May 28, 2009 — According to recent economic forecasts, the current recession may be deeper and last longer than originally estimated. During difficult economic times like these, procurement and finance are often joined at the hip, leaving no stone unturned in their effort to eliminate waste, control cost and do more with less.

Unfortunately, in many organizations, while these groups share a commitment to efficiency and savings, they often work in silos, each executing to the best of their ability in the hope that it all adds up to the greater good. In times like these, however, more must be done.

By eliminating divisional silos between these two critical backbones, organizations can improve visibility and control over spending and investment. Inter-departmental collaboration streamlines the entire process from sourcing to payment, for everything from raw materials to IT consulting services. This drives immediate benefit by reducing direct and indirect costs.

In today's economy, manufacturers, retailers and others dependent on supply chains face significant challenges. Overcoming these challenges requires a strategy that integrates financial and operational supply chains.

Asking the Important Questions

Operational and financial supply chains are inextricably linked: activity on one side of this delicate balancing act has short- and long-term implications on the other. A purchase order or bill of lading is issued whenever the purchasing department sources materials, or when goods are shipped to the customer; both of these events become triggers for some kind of financial action — a payment or an invoice.

There are four critical questions organizations can ask to determine where they can get more value from integrating financial and operational supply chains. The answers to these questions show the synergies across all areas — positive momentum in one area (finance or supply) has a positive effect on the other.

1. Am I doing everything possible to reduce cost?

When finance and procurement operations work together on this challenge, the biggest area of opportunity is control. Increasing the percentage of spend under management delivers tangible impact on controlling cost, including:

Companies should take advantage of spend management tools — such as automated invoicing, e-sourcing and e-procurement — to optimize the benefits. Additionally, most companies don't maximize commercial card usage and therefore miss significant savings opportunities. Using commercial cards for as much buying as possible (direct, indirect materials and services) will not only reduce processing costs but also can generate rebates back to the organization.

2. How compliant am I?

"Compliance" in this case relates to both regulatory compliance — such as Sarbanes Oxley reporting — and controlling off-contract spending.

In the case of meeting regulatory compliance requirements, it's essential that operational information such as inventory turn data and supplier payment history is timely, complete and comprehensive. When purchasing and finance work together on compliance-driven reporting, violations are less likely, and the costs of reporting drop.

Driving internal compliance with corporate spending policies gives both finance and purchasing a headache. On-contract buying offers a lot of opportunity, but a lack of communication and common understanding means that companies often:

It's not easy, but working together to set goals for increasing on-contract buying and creating incentives that reward cross-departmental cooperation and compliance can limit unpleasant surprises at the end of the year.

3. Are we using spend visibility across the organization?

With spend, what you can't see can, in fact, hurt you. A lack of insight into what's being spent, and by — or with — whom it's being spent, keeps companies from collecting on significant savings. A comprehensive spend management suite delivers easily accessible supplier information in one central repository of data. Here, information is shared and acted upon throughout the organization.

The new frontier lies in using the important data made available thanks to technology. All too often, the information lives only in finance yet has significant potential for driving operational excellence. These insights can drive advanced spend analytics and go well beyond such basics as cost and volume by supplier.

Integration and visibility deliver:

4. Am I doing all I can to improve efficiency?

The opportunities to squeeze out inefficiency using integration and automation are endless. A transparent and closed-loop source-to-settle process provides cross-functional visibility and bridges the gap between finance and supply. The seamless exchange of information throughout this interconnected cycle illustrates the number of opportunities that lie in capitalizing on terms:

Once a company truly embraces the idea that there is more to be gained when boundaries come down, spend and payment solutions can bring all parties together with information and communication. Automation, integration and transparent business processes combine to help finance and operations work together on shared goals — getting more, faster. That's a powerful combination for success in any economic environment.

About the Author: Terry Wellesley is managing director for BMO Spend & Payment Solutions. More information can be found at http://www.bmospendandpayment.com/index.html.

Unfortunately, in many organizations, while these groups share a commitment to efficiency and savings, they often work in silos, each executing to the best of their ability in the hope that it all adds up to the greater good. In times like these, however, more must be done.

By eliminating divisional silos between these two critical backbones, organizations can improve visibility and control over spending and investment. Inter-departmental collaboration streamlines the entire process from sourcing to payment, for everything from raw materials to IT consulting services. This drives immediate benefit by reducing direct and indirect costs.

In today's economy, manufacturers, retailers and others dependent on supply chains face significant challenges. Overcoming these challenges requires a strategy that integrates financial and operational supply chains.

Asking the Important Questions

Operational and financial supply chains are inextricably linked: activity on one side of this delicate balancing act has short- and long-term implications on the other. A purchase order or bill of lading is issued whenever the purchasing department sources materials, or when goods are shipped to the customer; both of these events become triggers for some kind of financial action — a payment or an invoice.

There are four critical questions organizations can ask to determine where they can get more value from integrating financial and operational supply chains. The answers to these questions show the synergies across all areas — positive momentum in one area (finance or supply) has a positive effect on the other.

1. Am I doing everything possible to reduce cost?

When finance and procurement operations work together on this challenge, the biggest area of opportunity is control. Increasing the percentage of spend under management delivers tangible impact on controlling cost, including:

- New opportunities for volume-based discounts;

- Audit trails that define and track expected versus actual savings for better performance;

- Elimination of service charges.

Companies should take advantage of spend management tools — such as automated invoicing, e-sourcing and e-procurement — to optimize the benefits. Additionally, most companies don't maximize commercial card usage and therefore miss significant savings opportunities. Using commercial cards for as much buying as possible (direct, indirect materials and services) will not only reduce processing costs but also can generate rebates back to the organization.

2. How compliant am I?

"Compliance" in this case relates to both regulatory compliance — such as Sarbanes Oxley reporting — and controlling off-contract spending.

In the case of meeting regulatory compliance requirements, it's essential that operational information such as inventory turn data and supplier payment history is timely, complete and comprehensive. When purchasing and finance work together on compliance-driven reporting, violations are less likely, and the costs of reporting drop.

Driving internal compliance with corporate spending policies gives both finance and purchasing a headache. On-contract buying offers a lot of opportunity, but a lack of communication and common understanding means that companies often:

- Lose thousands of dollars in rebates and rewards;

- Find that suppliers are less willing to negotiate because volume buying too often falls short of promises;

- See costs spiral out of control.

It's not easy, but working together to set goals for increasing on-contract buying and creating incentives that reward cross-departmental cooperation and compliance can limit unpleasant surprises at the end of the year.

3. Are we using spend visibility across the organization?

With spend, what you can't see can, in fact, hurt you. A lack of insight into what's being spent, and by — or with — whom it's being spent, keeps companies from collecting on significant savings. A comprehensive spend management suite delivers easily accessible supplier information in one central repository of data. Here, information is shared and acted upon throughout the organization.

The new frontier lies in using the important data made available thanks to technology. All too often, the information lives only in finance yet has significant potential for driving operational excellence. These insights can drive advanced spend analytics and go well beyond such basics as cost and volume by supplier.

Integration and visibility deliver:

- Better decision-making based on the realities of needs, opportunities and nice-to-haves across the organization;

- A solid financial foundation from which to make investments and changes for long-term growth;

- An agile model that allows the company to capitalize on profitable opportunities whenever and wherever they appear.

4. Am I doing all I can to improve efficiency?

The opportunities to squeeze out inefficiency using integration and automation are endless. A transparent and closed-loop source-to-settle process provides cross-functional visibility and bridges the gap between finance and supply. The seamless exchange of information throughout this interconnected cycle illustrates the number of opportunities that lie in capitalizing on terms:

- When payment processes are fully automated, companies gain immediate visibility into what's being spent, as well as who's spending it and where.

This on-the-mark insight means that supplier negotiations and the resulting terms are much more efficient: conversations can focus on getting the best possible price, rather than chasing discounts that are often never redeemed. The outcome: better supplier terms, stronger levers for performance and higher value on every dollar spent. - Another example: when purchasing ships an order, the supplier issues an advanced ship notice (ASN). If the ASN is automatically copied to accounts payable, manual keying is eliminated, the process accelerated and errors reduced. In addition, there's an immediate opportunity to determine the value of capturing an early pay discount. While this seems obvious and simple commonsense, the reality is that it's much more likely to be the exception than the rule in most organizations.

Once a company truly embraces the idea that there is more to be gained when boundaries come down, spend and payment solutions can bring all parties together with information and communication. Automation, integration and transparent business processes combine to help finance and operations work together on shared goals — getting more, faster. That's a powerful combination for success in any economic environment.

About the Author: Terry Wellesley is managing director for BMO Spend & Payment Solutions. More information can be found at http://www.bmospendandpayment.com/index.html.