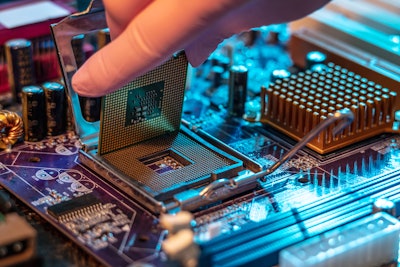

Ask any CIO to cite the most significant impacts of Coronavirus disease (COVID-19) on their IT estate, and invariably listed within their Top 3 issues will be the continued delay in hardware shipments due to the global semiconductor chip shortage. Although chip production has increased slightly in the last few months or so, analysts across the board are predicting that chip shortages will continue to be pervasive across the next few years, with demand still far outstripping supply. Hardware refreshes were delayed due to economic uncertainties caused by the pandemic, further stressing data center management.

Fueling this IT technology demand is the desire to automate everything, with Internet of Things (IoT), phones and cloud computing leading the charge. In the data center, where more advanced chips are needed, servers, networking devices and storage hardware still show high demand levels within an incredibly fragile supply chain. Hybrid data centers are growing again in size as many organizations that rushed to the cloud for remote enablement are now counting the true operational cost of the move and are considering cloud repatriation back into a hybrid infrastructure. For such infrastructure moves, long OEM quoted lead times of up to 9 months have become the short-term norm, as have the surge in global chip prices.

The Semiconductor Industry Association (SIA) notes that although the big semiconductor companies are now investing huge sums to boost capacity - with new plants in the United States and slated for Europe - so sophisticated and complex is the chip manufacturing process, that full recovery and stabilization of chip supply will take a few years at least.

Overcoming the uncontrollable

So, how do CIOs and their procurement teams overcome this extremely limiting outlook for essential hardware refreshes, possibly already postponed from the past 18 months of restrictive lockdowns? On the face of it, little can be done to address today’s shortages, apart from adjusting order books, changing production schedules and swallowing increased prices. Faced with such uncontrollable outcomes, an alternate option for CIOs is to ask reliable third-party manufacturers (TPMs) to step in with short-term support contracts to assist with coverage and procurement.

Already serving tens of thousands of customers and supplying millions of assets, global TPMs can weather supply storms and continue to offer an unsurpassed worldwide stock inventory even in drought chip conditions.

TPMs also have another use in pressing times. They can jump straight in and provide stop-gap coverage while organizations await ordered hardware. The contract flexibility TPMs provide, for example, avoids a “locked-in” situation that can hamper a company’s ability to adjust to uncertain times.

OEMs have fairly rigid support policies and practices, and with good reasons. It fits their business model to be rigid because they need to focus on both support and selling new products. A dedicated TPM does not require this rigidity because support is the core competency in operations. As a result, there is more operational flexibility to fine-tune the service plans to meet different customer needs. This can prove invaluable for IT managers, as a more customized plan can enable organizations to more easily get the help that matters to them in the timely fashion that is necessary.

Leveraging the pre-owned hardware landscape

Buying pre-owned hardware is another strategy to deal with hardware delays. Delays in OEM equipment deliveries of three to nine months are commonplace due to persistent component shortages and supply chain issues. In contrast, a large variety of the most in-demand current and previous-generation equipment is readily available on the secondary market for immediate delivery.

A lot of the latest devices rely on the new chips that are currently short on demand caused by the perfect storm of factory shutdowns from the pandemic; significant disruption at production facilities; some evidence of stockpiling, and most critically, increased commercial and domestic demand throughout COVID-19.

And, while you may venture into a TPM relationship as an assured band-aid for the short-term, likely the removal of managing an inventory of spare parts and the hassle of sourcing new assets will tempt you to stay within the TPM’s umbrella coverage even when the taps for chip supply open fully back up again most likely in late 2022.