In 2019, APQC conducted research on the implementation of analytics in supply chain and compared results to those gathered in 2016. A lot has changed for the better in three years: APQC found that many organizations have made great strides in their supply chain analytics efforts. For example, 78% of respondents to APQC’s 2019 survey agree or strongly agree that analytics is ingrained in how their organizations conduct business and manage performance—an increase from just under 60% in 2016. Faced with vast and ever-growing amounts of data, the number of supply chain leaders that actively turn to analytics for decision making support is growing.

Analytics structures

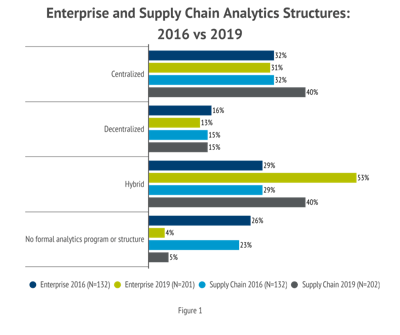

The research in both 2016 and 2019 examined how organizations structure their analytics programs at the supply chain level. Additionally, APQC conducted a similar investigation into analytics at the enterprise level (i.e., across the entire organization or corporation). In its research, APQC defined analytics program structures as follows:

- Centralized: managed through a central corporate department or center of excellence

- Decentralized: analytics staff or programs are located within business units

- Hybrid: combines a centralized oversight structure with staff embedded in the businesses

Broadly speaking, the structure of an analytics program can reflect an organization’s analytics needs as well as the maturity of its analytics efforts. For example, organizations with specific analytics needs (such as understanding customer demand) will generally opt for function-specific analytics teams and a decentralized governance structure. Organizations with enterprise-wide data initiatives, top-down mandates from executive management, or a desire to leverage pre-existing analytics capabilities generally choose a hybrid model, which leverages a centralized governance team with decentralized implementation teams in each business unit or location.

Figure 1 compares the structure of analytics programs at the enterprise and supply chain levels in 2016 and 2019. The data shows a clear decrease in organizations with no formal analytics program or structure at both the enterprise and supply chain levels, consistent with the growing popularity of analytics across organizations. Although the percentage of organizations with a decentralized structure has remained relatively static over the last three years, there has been a marked increase in organizations using a hybrid structure at both the enterprise and supply chain levels.

While there is no one-size-fits all approach for an analytics program structure, APQC has found several reasons why organizations increasingly find the hybrid model attractive. Centralized governance provides better strategic alignment, accountability, consistent communication, and implementation planning. Decentralized implementation teams, meanwhile, create accountability within each location or business unit for the adoption of new technologies, responsibilities, and behaviors. These decentralized teams also help ensure that analytics projects meet each location’s or unit’s unique needs and integrate subject matter expertise as needed. In this way, hybrid structures help organizations combine a holistic perspective and centralized guidance with the flexibility and insights into business needs provided by decentralized implementation.

At the supply chain level in 2019, the same percentage of organizations opted either for a hybrid structure or centralized structure. These results indicate that in the supply chain, organizations see value in both centralized guidance and the hybrid approach.

One trend that has remained constant is that a majority of supply chain professionals in both 2016 and 2019 indicated that their organizations had increased investments in analytics over the prior three years. With increased investment and a greater adoption of more advanced types of analytics, organizations’ analytics programs have become more successful and more mature over the last three years. In 2016, only 33 percent of organizations considered their analytics programs to be very effective or effective in solving strategic challenges. By 2019, more than 66 percent of respondents rated their organization as effective or very effective.

While it is impossible to say what the next three years will bring, one thing APQC knows for sure is the importance of data and analytics for supply chains moving forward. No longer a competitive differentiator, a strong data and analytics program is increasingly a necessity for supply chains in a volatile, chaotic, uncertain, and ambiguous world. Given the current ubiquity of big data and analytics, supply chains that lack effective analytics capabilities within the next three years will likely find themselves scrambling to catch up.