While offshoring began in the 1960s, a decade or so ago, excited by the shiny gold lure of reduced labor costs, many U.S. manufacturers began a rush across the Pacific to take advantage of opportunities in China and other emerging markets. In what some observers have described as a herd mentality, competitors tried to outdo each other establishing sites in Asia.

But now, many of those manufacturers are finding that the gold has turned to dross. In this special edition of Supply & Demand Chain Executive, we’ll examine the reasons why. Companies like Apple and GE already have announced that they’re bringing some manufacturing home. Other players are following suit, considering reshoring back to the United States, or, perhaps, near-shoring to Mexico. They’re discovering that there are many more issues to consider and, hey, maybe it’s not so cheap over there anymore.

One major consideration is total landed cost. Its key components include raw material and component costs; manufacturing costs (fixed and variable); transportation and logistics; inventory carrying cost; and taxes and duties. Not including them in the formula can lead to disaster.

Just look at transportation and what it can do to lead time. First, the product is made in China, then it’s loaded into containers and put on a cargo ship. Now it spends 4 or 5 weeks on the water (where, basically, you’re paying for a floating warehouse), then comes into a U.S. port where it has to be unloaded and put onto trains or trucks for shipment to a warehouse and finally to the end user. A glitch anywhere along the way, such as a port strike, and delay can be exponential.

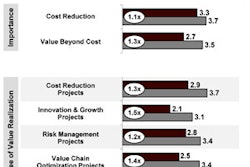

A Hackett Group study “confirmed that the most important decision driver in the development of a manufacturing sourcing strategy is total landed cost. Product quality, protection of intellectual property and supply chain risk trail in importance.”

While stolen IP lagged behind total landed cost in the Hackett Study, it can be devastating. It’s difficult to maintain control of your IP when you’ve turned over your carefully engineered and developed properties to a partner in a country where such rights aren’t as protected as they are here.

Harry Moser, Founder and President of the Illinois-based Reshoring Initiative, says, “IP [theft] is serious. It can happen here, but it’s worse over there. The Chinese government is very aggressive in forcing companies to divulge technology if they want a factory in China.”

A Midwestern firm that outsourced to China was exhibiting at a trade show. Walking the show floor, one company rep found a Chinese company displaying his company’s products, right down to the marketing materials that featured the rep’s own child in a photo! It would be funny, if it wasn’t so serious.

It’s not just the big companies that need to reevaluate their presence in Asia and other low-cost markets. Ariba’s Tim Minahan describes what happened to one of his mid-sized clients.

“Our customer outsourced and saw rising costs and shipment delays,” he says. “They used our network to uncover potential suppliers, thinking Malaysia or the Philippines. After a competitive business process, they settled on a U.S. supplier and cut their supply cost 30 percent and their lead time from 120 days to less than 30.”

See, it can be done. To learn more, please enjoy this special issue.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)