According to the latest Collaborative Robot Market – 2025 report from Interact Analysis, the global collaborative robot (cobot) industry is poised for a new growth cycle, after hitting a cyclical rock bottom in 2024. However, market divergence and structural transformation will continue to intensify over the coming years.

By 2029, shipments will be ~125,000 units (with a forecast 2025-2029 CAGR of 20%), yet revenue will lag at ~$2.5 billion, constrained by persistent average revenue per unit (ARPU) erosion (-3 to -5% per year post-2025).

“In 2025-2026, we forecast the market will enter into a period of acceleration. Shipment growth for 2025 is projected to rebound to 20.6%, propelled by demand from the semiconductor and logistics sectors, along with the recovery of the electronics segment in the second half of the year. By 2026, the market will peak, as pent-up demand for industrial upgrades meets with the emergence of new application scenarios, such as high-payload logistics, agriculture, and healthcare,” according to Interact Analysis.

Key takeaways:

· In 2024, as manufacturing demand continued to wane, the collaborative robot market bottomed out again and shipment growth dipped to 13.8%, following on from a fall of 14.3% in 2023. However, the automotive sector demonstrated remarkable resilience in 2024 and the semiconductor/electronics segments showed signs of recovery. This convergence of factors, combined with supply chain problems and stubborn inflation, saw 2024 mark the lowest trough in the market cycle.

· In the long term, the market is anticipated to maintain a 20% CAGR from 2025-2029. Yet, this overall growth masks significant regional disparities. China is on track for a volume-driven expansion, with shipments expected to reach 70,000 units by 2029. In contrast, Western markets will focus on revenue growth through application-specific adoption.

· China is expected to account for 70% of global incremental growth through to 2029. This surge is primarily fueled by demand from the electronics sector, which consumes 34% of domestic shipments, as well as from the education and new energy sectors.

· On the other hand, growth in the EMEA and Americas regions are expected to lag behind China. This is mainly due to the sluggish investment in automation exacerbated by Europe’s weak economy and concerns over tariffs in the United States.

· After 2025, annual price erosion is projected to narrow to -3 to -5%, down from the previous rate of over 5%. This is attributed to the premiums commanded by high-payload models and value-added features such as AI and machine vision, which partially offset price declines.

· The pricing paradox can be explained by the “scale effect” of low-cost Chinese models (with payloads of less than 5kg). This effect suppresses the price-increasing impact of heavier models.

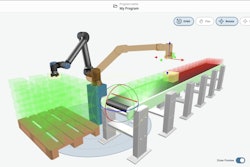

· In 2024, material handling and assembly, as the two largest applications for cobots, together accounted for over 50% of global revenues.

“Labor shortages, the shift towards flexible manufacturing, the expansion of e-commerce logistics, and the penetration of automation in services continue to be robust drivers of growth. However, new challenges are emerging. Large orders exceeding 100 units test the capacity of manufacturers and their supply chain management capabilities. Additionally, price wars have already reduced global ARPU (average revenue per unit). The 2024 global revenue forecast has been revised downward by 5%,” according to Interact Analysis. “In summary, the collaborative robotics market is undergoing a decisive transformation from broad-based expansion to structural growth. Winning strategies will focus on regional specialization, such as China’s dominance in electronics and the Western automotive ecosystems. Companies will also expand into high-growth applications like welding and inspection or explore blue ocean markets such as agriculture and services. Furthermore, integrating AI and vision technologies into high-payload models will be crucial to sustaining value amid pricing pressures.”