The GEP Global Supply Chain Volatility Index, a leading economic indicator based on a monthly survey of 27,000 businesses, slipped to -0.39 in August, from -0.35 in July, signaling rising spare capacity as global supply chain activity cooled.

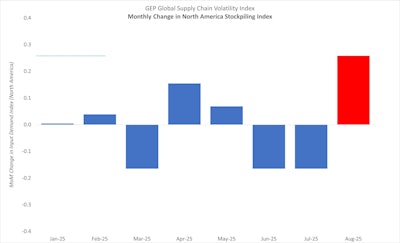

The global figure concealed stark regional contrasts. North America was the outlier, with supply chains running close to full capacity as companies in the continent stockpiled raw materials and components to protect against tariff-driven shortages and delivery delays. This was particularly true for the U.S. consumer goods sector, which includes industries such as food and beverages and household products.

By contrast, Asia’s index fell to a three-month low as purchasing activity weakened in China’s consumer non-cyclicals sector, although the region’s weakness was predominantly across Japan and Taiwan. Europe also deteriorated, with Germany’s basic materials sector faltering and UK manufacturing plunging deeper into contraction. The index here (-0.90) signaled one of the steepest declines since 2024.

“So far tariffs have neither spurred growth nor triggered collapse,” says Michael DuVall, GEP’s global head of supply chain strategy. “Tariff uncertainty is no longer a temporary, it’s a structural reality in the supply chain. Companies need to manage it by reinvesting in resilience, diversifying suppliers, and building critical capabilities like demand sensing to make faster, smarter decisions.”

GEP

GEP

Key takeaways:

· Asia: Index fell to a three-month low to indicate rising spare capacity across Asia’s supply chains as purchasing volumes in China was flat. In contrast, South Korea, Indonesia and particularly India saw greater factory procurement activity.

· North America: Supply chains were practically running at full capacity as recent orders were delivered and companies added to stock.

· Europe: Index falls again as factories purchased fewer intermediate goods and destocked. The data continue to highlight the fragile nature of Europe’s industrial recovery.

· UK: Index falls sharply, as U.K. manufacturers cut back on procurement and inventories.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=100&q=70&w=100)

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)