Stock outs and the bullwhip effect are arguably the two most chronic, persistent, deadly issues in supply chain management.

Out-of-stocks have been a nagging problem that has plagued the retail/consumer packaged goods (CPG) industry for decades. The 1996 study conducted by the Coca-Cola Retailing Research Council and Andersen Consulting concluded that, on average, 8.2% of the time a product is out-of-stock. What’s incredible is that this type of study has been conducted repeatedly since then and, guess what? Out-of-stocks have remained between 8.1-8.3%.

The bullwhip effect – where a small change in sales at retail amplifies and magnifies itself through the rest of the supply chain – has also plagued the retail/CPG industry. It seems like we’ve either got way too much stock, or not enough. And sadly, like stock outs, there’s been little to no progress on taming the bullwhip effect.

What’s going on? Decades of industry initiatives and academic research, many millions spent on new technologies, and we’ve hardly made any progress.

A profound truth

Almost 50 years ago, at the 1975 APICS conference, Dr. Joseph Orlicky, the pioneer of material requirements planning, said, “never forecast what you can calculate.”

Leveraging this profound truth is the key to finally making a material dent in both stock outs and the bullwhip effect.

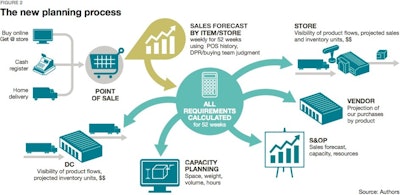

The retail/CPG supply chain should be driven only by a forecast of consumer demand – time-phased by item/selling-location (e.g., store, webstore, etc.). The consumer demand forecast should then be used to calculate a series of integrated, time-phased inventory flow plans (for a 52-plus week planning horizon) from the store to the supplier factory – often referred to as flowcasting – as depicted below:

Demand Clarity

Demand Clarity

The entire retail supply chain is re-synchronized daily, based on yesterday’s sales and inventory changes. As inventory at store level increases or decreases above or below a set level, flowcasting automatically recommends the adjustment of the flow and level of inventory across distribution centers (DCs) and factories that service the store. The result is a balanced trading network, the elimination of shortages, increased sales, reductions in supply chain operating costs and increased inventory velocity.

A new kind of visibility

This business process provides the retail/CPG supply chain with a new kind of visibility – a forward-looking, time-phased projection of demand, supply, and inventories by item/location for all partners, from factories to final points of sale. As a result, sales forecasting and all other forecasting activities are eliminated at every node of the retail supply chain except the only place where it matters: the final point of sale.

The result is the creation of a model of the business and a totally synchronized retail supply chain aligned daily to consumer sales. This process, upon reaching critical mass, enables manufacturers and their trading partners to transition from a make and ship-to-stock environment to a make and ship-to-order environment.

The implications for retail/CPG supply chains are significant. Flowcasting not only eliminates the need for suppliers to forecast their retail trading partners’ needs, but it ensures that the entire retail supply chain will be refreshed and automatically resynchronized daily. Daily re-planning and resynchronizing the entire supply chain is the key to being in stock.

Supplier scheduling

The concept of supplier scheduling has been standard practice in manufacturing for decades – that is, sharing a projection of future required product needs to help a manufacturer’s suppliers plan and deliver. Flowcasting allows retailers and their manufacturing partners to leverage the same concept.

The planned shipments are the demand plan for the supplier for this retail customer – indicating how many units of each product will need to be shipped, when and where. Given the long-term horizon of the projections of planned shipments (i.e., supplier schedule), this eliminates the need for the supplier to forecast demand for this customer. The schedule also allows retailer to supplier order lead-times to collapse, since suppliers always have a current view of future demand – with which they can use to plan production.

From a supplier perspective, their major retail customers can provide them with calculated demand, rather than having to forecast it themselves. Most CPG manufacturers would only require a handful of supplier schedules from their large retail customers to provide 70-plus% of their total demand. They can forecast the balance.

The projected requirements have all retail, supply chain and inventory flow constraints/rules incorporated, specific to each retail customer. As an example, if Retailer 1 was experiencing increased sales or had decided to change the shelf inventory requirements at a future date, the supplier schedule would reflect this in the planned shipment quantities.

The flowcasting model is based on a fundamental principle – a valid simulation of reality. If the retailer and trading partners know the future will be different than the past, then these insights are factored into the forecast and resulting inventory flow plans, culminating in the supplier schedule. As a result, no guessing is needed by the supplier and the bullwhip effect is tamed.

A single set of numbers

The new planning process develops up-to-date consumer-driven, integrated plans that are valid across the entire value chain, including plans that span multiple organizations. Retailers and their trading partners now have, for the first time, a complete model of their business—that is, a future-dated digital twin of the supply chain—containing all projected product flows from factory to front door for an extended planning horizon of 52 or more weeks. The result is that they have improved control over their business.

The integrated supply chain can be managed to a single set of numbers – whereby all teams, including suppliers, are driven only by a forecast of consumer demand and each team’s plans are the translated version of this forecast into actionable information with which to plan, deliver and improve service, cost and productivity, as depicted below:

Demand Clarity

Demand Clarity

Flexible, yet stable

Integrating the retail/CPG supply chain from consumption to supply and replanning the entire supply chain daily has significant advantages compared to today’s fragmented and siloed approaches. Since the process recalibrates daily based on what did and didn’t sell, inventory can be quickly diverted to where it’s required to stay in stock. At the same time, supply remains stable – since it’s an aggregated projection of requirements, shared with merchandise suppliers.

The result is the best of both worlds. Stocks outs are decimated, and by sharing supplier schedules, the bullwhip effect is eliminated.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=100&q=70&w=100)

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)