Chief financial officers (CFOs) and finance leaders are changing the way they look at supply chain models, according to a new Protiviti survey. In fact, 45% of finance leaders are turning to revenue assurance models that emphasize flexibility and resilience, and away from efficiency-based supply chain models, such as just-in-time.

"This year’s survey findings confirm that CFOs continue to extend the value they deliver to the organization far beyond the boundaries of traditional finance and accounting activities, as they reimagine their roles and embrace responsibilities tied to supply chain, automation, analytics, ESG, leadership skills and more,” says Christopher Wright, global leader of Protiviti’s Business Performance Improvement practice. “Through recent tumultuous years, CFOs globally have been presented with opportunities to establish and stress-test their expanding strategic roles in real-time, which has helped them contribute to the dialog in the C-suite and boardroom.”

“More CFOs and finance leaders now realize that high-impact disruptions like interest rate volatility, trade wars, and Russia’s war on Ukraine have exposed the fragility of the global supply chain model,” says David Petrucci, a managing director and global leader of Protiviti’s Supply Chain and Operations practice. “CFOs are paying more attention to considerations such as how long suppliers can operate amid a catastrophic event and how long their own organizations can operate amid prolonged supply chain disruptions. It’s essential for them to look beyond traditional cost calculations by evaluating and monitoring supply chain reliability, responsiveness and resiliency.”

From Protiviti:

- 72% of respondents’ finance operations experienced disruptions or delays because of supply chain challenges, pandemic-related impacts, and/or the effects of inflation in the past year. The majority (51%) of those that experienced such delays say they engaged a managed services provider or business process outsourcing firm to address the resulting challenges, according to Protiviti.

- CFOs are also addressing concerns about inflationary trends, the survey showed. For example, 35% of CFOs are assessing the need for new skills and talent inside and outside of their organizations; 33% are balancing the risk of higher staff attrition against potential compensation increases and 32% are refining and/or increasing scenario planning.

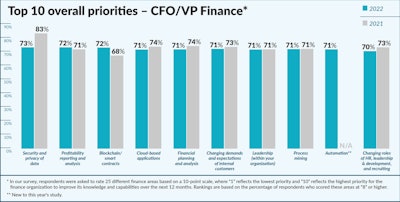

- Blockchain and smart contracts moved up in the Top 10 list this year. Here's the Top 10 priorities:

Protiviti

Protiviti