As the 2016 presidential election heats up, and citizens start drawing their political lines and affiliations in the sand, businesses are bracing themselves for what the election’s outcome may mean to them and their global supply chains.

Supply and Demand Chain Executive talked to experts with Deloitte, Tusk Holdings, PricewaterhouseCoopers (PwC), the Reshoring Initiative and Miller & Chevalier to get their take on the election outcome’s potential impacts on top topics, including the Trans-Pacific Partnership (TPP), sanctions, corporate taxes and immigration.

Let’s Talk TPP

After more than five years of intense debates and negotiations, the TPP trade deal was signed on February 4. Hailed as a historic achievement for the Asia-Pacific region, officials claim the agreement will create new jobs by opening up foreign markets for the exporting of goods and by leveling the playing field in foreign markets for the United States. Now the 12 countries involved in this agreement begin their domestic ratification process—and have up to two years to complete this—before the agreement goes into effect.

As the United States begins the process of pushing this agreement through Congress, the TPP is an important issue for 2016 presidential candidates. And because the outcome of this process is critical to businesses and their global supply chains, companies are training a close eye on how this agreement pans out.

“There’s no denying that region represents tremendous population growth; I don’t think any rational person would say you shouldn’t take advantage of a trade agreement with that rapidly growing region,” states Doug Gish, principal and U.S. supply chain leader for Deloitte.

But how such a trade agreement ultimately looks is still subject to debate and, as such, “there is a significant chance that the TPP doesn’t pass,” states Harry Moser, president and founder of the Reshoring Initiative. He goes on to say that he’s against the TPP, explaining that, with almost every trade agreement the United States had “our imports go up and our exports go down, or don’t go up as rapidly as our imports, so our trade deficits almost always get worse with the country we have the trade agreement with.”

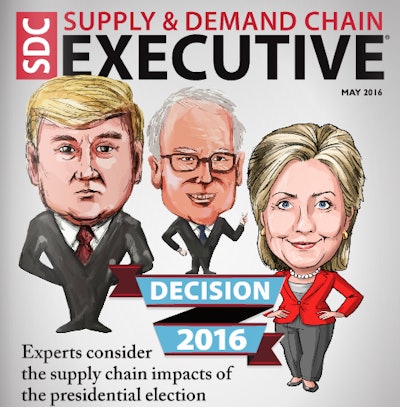

The apparent front-runners in this election are Hilary Clinton and Donald Trump, with Bernie Sanders as a wild card. Trump stated he will not approve the agreement without radical modifications. It looks like, Clinton, however, will approve a watered-down version of it. But there is trouble afoot, says Moser, as “a lot of other countries are having second thoughts on it.”

Gish agrees. “Clinton is most likely to be active in getting a completed agreement. She will be more willing to give up U.S. interests to get the TPP through. Trump is not a fool about global operations and interests. He will want a fair deal that is good for the United States.” Sanders, meanwhile, is very public with his opinions on the TPP. At a rally in Youngstown, Ohio, he stated, “We should kill this unfettered free-trade agreement, which would cost us nearly a half million jobs.”

All that being said, a TPP bill may never land on the president’s desk for approval. Moser explains if Republicans lose both the House and the Senate in the election, then Congress will likely not pass the TPP. “The Democrats are most opposed to the TPP, while the Republicans are generally in favor of globalization, free trade and nominally free trade,” states Moser.

Corporate Tax Reform

Pressure is mounting for 1986-style corporate tax reform. U.S. companies report that the country’s 35 percent corporate tax rate makes it tough for them to compete globally, when their global peers’ corporate tax rates are much lower. And, as Gish points out, reducing the rates will also boost companies’ willingness to invest in things like 3D printing, digital improvements, research and development, and more. “Taxes,” he says, “can be a disincentive to invest and grow.”

Overhauling corporate taxes to give U.S. companies a leg up on the world stage is the subject of much debate among the presidential candidates. It seems both parties agree corporate tax reform must be a top priority, but differ on the approach.

But “taxes matter,” states Scott McCandless, a principal in the Tax Policy Services (TPS) group of PwC’s Washington National Tax Services (WNTS). “It can be an eye-rolling topic, but it’s an important part of the policy picture.”

He states all of the candidates share one major change in common: full expensing. Their plans allow businesses to write off capital assets the first year they put them into service as opposed to the depreciation schedule that exists in the current tax code. “The candidates seem to feel that immediate expensing will have some potentially positive effects to grow the economy,” he says.

There are some differences in the plans being proposed, but McCandless predicts we may see plans move forward in the first 100 days of the new term. The primary focus of those plans appears to be on lowering the corporate rate. “It seems there is agreement between Republicans and Democrats to, at least, make some attempt to lower the corporate rate,” he says. “The crux of it comes down to how low do you lower it and at what cost to other provisions within the tax code?”

In most cases, the way corporate taxes are lowered is through base broadening, which McCandless describes as a “fancy way of saying that, in order to lower the rates, we have to cut existing credits and deductions and other benefits that flow through the tax code in order to balance the economic books.”

Gish predicts if Clinton wins, there will be little movement on a tax plan, while if Trump wins, the reforms may be a bit more radical. Bradley Tusk, founder and CEO of Tusk Holdings, holds a more pessimistic view of what the future holds for corporate taxes. “Odds are nothing will really change,” he says. “If you had a Trump presidency and, therefore, an all Republican Congress and White House, you might see some sort of corporate tax reform. But if Clinton wins, it’s going to be hard, and it will depend on whether there is a Republican or Democratic Congress.”

And if Sanders wins, Moser predicts, “Everyone’s taxes are going up. Your taxes, my taxes, business taxes.”

McCandless states this is where companies need to make sure they have a seat at the table after the election. “Businesses can get a little complacent in their conversations,” he says. “The good ones will talk about the jobs they have and what the tax code means to them, but the great ones will talk about how low a rate they need to really influence their behavior and what it means to their whole supply chain, both upstream and downstream.”

Immigration Reform

Immigration is a top issue in the 2016 presidential race, just as it was in previous election years. The voting public is holding candidates’ feet to the fire and demanding smart policy on immigration. But what does that mean to businesses and their supply chains?

Moser calls the immigration issue “complicated” and says that, if he were President, he’d create a partnership between the United States and Mexico, similar to the one China has with India. But since he’s not president, he suggests the following will happen if candidates just leave things largely alone: “I think the Mexican economy is growing nicely and there is a net migration of Mexicans back to Mexico. I think the problem will solve itself as the Mexican economy continues to improve.”

That being said, he believes Clinton will not take a strong stance on immigration. Moser says, “She won’t be as soft as Trump, but I don’t think she’ll change the trajectory all that much.” And while Trump made all kinds of promises to build a wall and other extreme measures, Moser says “A wall like that would be $100 billion and he’s not going to spend that kind of money, nor are we going to pay for it. But he will make it tougher to stay here and an immigrant that commits the slightest crime will be out of the country in a day.”

Tusk says an H-1B bill may get through the House and Senate, and if Clinton is in office, whether or not she vetoes it will be a tossup. “She will have a massive amount of pressure from the left to veto it, and a huge amount of pressure from businesses, the public and the media to pass it. It will be a tough call.”

If nothing happens, businesses will continue to be negatively impacted by a lack of immigration reform. With a shortage of skilled workers available to them, businesses need a wider talent pool to draw from and to be able to attract talent from anywhere in the world. H-1B legislation would exempt foreign nationals who graduate from American universities with a master’s degree or Ph.D. in a science, technology, engineering and math (STEM) field to apply for a green card and remain in the United States. Currently, these students are forced to leave the country after graduation, and thus, the United States loses the talent it trained to competitive businesses in other countries.

FCPA Compliance Crackdown

By Lara L. Sowinski

Nearly 40 years ago, the U.S. federal government enacted the Foreign Corrupt Practices Act (FCPA), which made it unlawful for certain persons and entities to bribe foreign government officials to obtain or retain business. The U.S. Department of Justice (DOJ) is diligent about enforcing the FCPA. Over the past year and a half alone, enforcement actions were taken against a slew of companies, including Qualcomm, Las Vegas Sands casino and resort, Bristol-Myers Squibb, Hitachi, and Goodyear Tire & Rubber Company.

In November 2015, the DOJ levied its largest ever FCPA fine—a whopping $772,290,000—against Alstom S.A., a French power and transportation company, which was charged with a widespread corruption scheme involving at least $75 million in secret bribes paid to government officials throughout the world, including Indonesia, Saudi Arabia, Egypt, the Bahamas and Taiwan. Two of Alstom’s U.S. subsidiaries, Alstom Power Inc. and Alstom Grid Inc., formerly Alstom T&D Inc., were also part of the case.

During an anti-corruption conference in New York this spring, Leslie Caldwell, the DOJ’s assistant attorney general for the criminal division, remarked that the DOJ is investigating “a lot” of FCPA cases. She also downplayed the idea that fewer enforcement actions were taken in 2015 compared to 2014.

“A lot of cases are being investigated,” countered Caldwell, adding that the DOJ is increasing the number of attorneys investigating FCPA cases to 29 from 19. She also said the DOJ remains committed to boosting transparency in the process to help companies determine what they might be liable for in terms of fines depending on the level of cooperation they provide.

Caldwell read aloud a sampling of settlement agreements that were made public and suggested companies could “read the tea leaves” to discern what the outcome might be for those that provided full cooperation, partial cooperation or no cooperation.

She also acknowledged that the DOJ is looking at better ways to investigate FCPA cases, noting that, “corruption is so pervasive that it really needs to be addressed in a more strategic and thoughtful way. It’s not just waiting for a company to self-report, but being out there, being proactive and looking for things.”

In April, the DOJ made good on its pledge for more transparency when it issued a press release and accompanying memorandum for what it called a one-year FCPA pilot program, which outlined the benefits for companies that self-report FCPA violations.

Three components of the DOJ’s “enhanced FCPA enforcement strategy” include:

- Increasing law enforcement resources for FCPA prosecutions by hiring 10 new prosecutors for the fraud section’s FCPA unit.

- Strengthening coordination with foreign counterparts in order to share leads, documents and witnesses.

- Establishing a pilot program to motivate companies to voluntarily self-disclose FCPA-related misconduct, cooperate and remediate.

According to the National Law Review website, “The pilot program’s directives and specific requirements, even if not individually new or surprising, are presented for the first time as specific ‘boxes to check’ in evaluating whether it makes sense for a company to self-disclose and cooperate.”

For example, “The memorandum first provides that, if a company is to receive credit for a voluntary disclosure, the disclosure must:

- Be made in a timely fashion (prior to an immediate threat of a government investigation).

- Be made within a reasonable amount of time after discovery.

- Include all relevant and known facts, including all relevant facts about individuals involved in an FCPA violation.”

Furthermore, “Eligibility for the cooperation benefits of the pilot program means a company must disclose relevant facts proactively (rather than reactively); preserve, collect and disclose relevant documents (including those located overseas) and provide translations; provide timely updates; ‘de-conflict’ the internal investigation with the government investigation ‘where requested;’ provide facts relevant to third-party misconduct; make company officers available for interviews as practicable (including those overseas); and disclose non-privileged findings made during any internal investigation.”

Small companies will not be held to the same standard as larger ones, however, when it comes to their ability to perform their own investigations, stated the DOJ, which said it will take into account a company’s ability to cooperate from a financial perspective.

“The remediation ‘checklist’ includes implementation of an effective compliance program (one that, inter alia, is effective, independent and tailored to risk, and includes auditing functions), appropriate discipline of employees, including compensation considerations and ‘any additional steps’ that the company takes to demonstrate its commitment to compliance and identify future risks,” added the National Law Review.

If all these requirements are met by a company, “It will be eligible for a 50 percent reduction off of the bottom end of the applicable guidelines range and will generally not be subject to the appointment of a monitor. If it meets the cooperation and remediation requirements, but did not appropriately self-disclose, it will be eligible for, at most, a 25 percent reduction.”