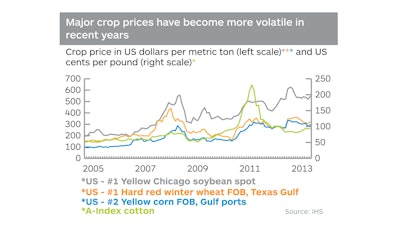

Global agriculture markets have experienced increased price volatility in recent years. While this volatility has many root causes—the global financial crisis, distorting trade and agricultural policies, and supply chain issues—weather variability and climate change are key influencers.

Many organizations struggle with price volatility and how to plan for its impacts on key crops and livestock in diverse regional markets. With this in mind, IHS’ Global Agriculture Team developed a 15-year scenario analysis quantifying the effects of weather and climate change on global agriculture markets by major product and region.

The scenario invokes increased global weather volatility in lieu of the conventional assumption of future average weather—the latter representing the baseline forecast—to examine the impact of increased weather variability on global crops and livestock.

The scenario’s assumptions are that: (1) historical weather events are indicative of the outcomes of future weather events; (2) crops that share a similar agronomic calendar are more likely to be impacted similarly by weather; (3) geographically proximate countries are more likely to be impacted similarly by weather; and (4) “climate change” is manifested as increased frequency of extreme weather events.

There were three key findings from the scenario:

- While weather volatility is a driving force behind crop price variability, for a majority of grains and oilseeds, the high price levels of recent years will not be revisited as a result of bad weather alone. Rather, a combination of supply and demand shocks would be required to set record highs, e.g., a biofuel mandate followed by a drought in corn-growing regions.

- Long-term stability of global oilseeds and grains production, even during more volatile weather, points to an improved ability of crop growers in major producing countries to absorb weather-driven yield shocks. World wheat production, for example, trended higher as weather variability increased, which supports the idea that, as regions or hemispheres experience varying weather conditions, producers in opposite hemispheres and non-neighboring regions allow for continued growth to satisfy global demand.

- The massive global expansion of oilseeds and grains planting beyond their traditional climatic zones has made their yields, hence their prices, more susceptible to changes in weather. This differs from crops, such as cotton, sugar and rice, that continue to be planted substantially within their traditionally favorable weather zones.

The major crops most impacted under the scenario (as compared to baseline) were sunflower and rapeseed; their mean percentage price change from baseline over the forecast period registered 41.2 and 32.2 percent, respectively. In part, this reflects the fact that these crops are grown in a relative handful of northern countries, so their proximity to each other means they are more likely to be impacted by the same weather events.

The major crops least impacted under the scenario were generally those like rice and cotton—9.8 and 6.9 percent mean change from baseline, respectively—with high yields that continue to be grown largely in their traditional climatic zones.

For more information on this topic, visit ihs.com/Q13CropClimate.

Ryland Maltsbarger is the principal economist of agriculture services at IHS Operational Excellence & Risk Management.