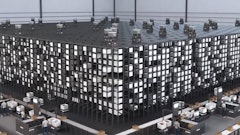

The industrial lift truck market has been buzzing, with high investment in electrification, automation, and the implementation of telematics systems. In fact, shipments of autonomous industrial lift trucks are projected to double from 2024 to 2025 in North America and Europe, according to ABI Research.

“Pallet picking operations have lagged when it comes to automation, with most warehouse automation coming in the form of smaller form autonomous mobile robots (AMRs) and automated storage and retrieval systems (ASRS) for case and item picking. This is mostly because of the additional complexity and safety concerns associated with heavy pallet handling requirements. But more organizations are now exploring how they can optimize their industrial lift truck fleets through better management by adding telematics systems and exploring autonomous models for certain tasks,” says Ryan Wiggin, senior analyst at ABI Research.

Key takeaways:

- Most original equipment manufacturers (OEMs) are bringing their own automated industrial trucks to market.

- Growing adoption is expected to cannibalize shipments of standard industrial lift trucks in the medium term, with the effect most pronounced in North America and Europe.

- The need to track and analyze movements, ensure worker safety, and orchestrate mixed fleets will see shipments of telematics systems to this part of the market rise considerably.

“A declining workforce in industrial settings is forcing companies to consider adopting automated industrial trucks to conduct repetitive put-away and shunting activities, such as trailer unloading/loading and moving pallets from one part of a warehouse to another. Fleets will become an increasing blend of automation and manual operation alongside growing investment in telematics systems to support safety and management. Significant opportunities exist for all three sides of the market (OEMs, aftermarket telematics, and robotics providers) with several partnerships and new players expected in the coming years,” says Wiggin.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=100&q=70&w=100)

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)