A wide range of organizations across industries use the Net Promoter Score (NPS) as a tool to measure and track customer loyalty. A good alternative to longer and more exhaustive customer loyalty surveys, NPS is simple to use and provides a straightforward score that can be measured and tracked over time. This article breaks down the fundamentals of NPS, discusses the reasons why the procurement function should use it, and examines cross-industry NPS data in procurement. Used well, NPS can be a very effective tool for measuring internal procurement stakeholder loyalty and can help keep supplier relationships healthy as well.

What is Net Promoter Score (NPS)?

Developed in 2003 by Fred Reichheld at Bain and Company, NPS is a tool used to measure customer loyalty. The simplest version of an NPS survey asks customers to indicate, on a scale of 0-10, the extent to which they would recommend a company’s products or services.

Scores in response to this question will sort respondents into one of three broad categories:

- Detractors: Customers responding with a score between 0-6.

- Passives: Customers who assign a score of 7-8. These customers are generally satisfied but unenthusiastic.

- Promoters: Customers who assign scores of 9-10, which signal that the customer is loyal and enthusiastic in his or her support.

An organization’s NPS score can be calculated by subtracting the percentage of detractors from the percentage of promoters. The resulting score will be a number ranging from -100 (a worst-case scenario in which every customer is a detractor) to 100 (a best-case scenario in which every customer is a promoter). Broadly speaking, any score from 0-30 is considered a good NPS score.

Why Should Procurement Use NPS?

One of the biggest benefits of NPS is the tool’s simplicity. Unlike longer customer satisfaction surveys, an NPS survey typically only has one or two questions at most. The survey is easy to create and distribute, and it produces a single number that can be used to track trends over time. Another benefit of using NPS for procurement is that this measure will already be familiar to executives and leaders. Using NPS allows procurement to speak in the same language as key stakeholders as it measures, tracks, and reports its performance.

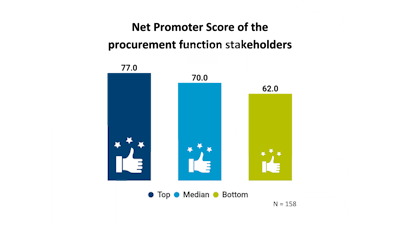

Data from APQC’s Open Standards Benchmarking® database in Procurement shows that top NPS performers have an NPS score of 77, while bottom performers rated 62. Scores for top, median, and bottom performers are all quite high and are in the range of what are typically considered to be ‘great’ (30-70) or ‘excellent’ (70-100) NPS scores within broader, cross-industry benchmarks. Industry NPS scores outside of procurement, for example, tend to range from 0-40.

Why are NPS scores so high for procurement? There are a few likely explanations.

- Good procurement departments tailor their services to internal customers’ needs. If procurement is serving the unique needs of a particular leader or business unit in a customized fashion, scores are likely to be higher.

- Procurement functions serve a captive audience and internal stakeholders may not be able to use a different provider.

- The organization is measuring NPS internally. When measured by the organization itself, NPS surveys tend to produce a higher score. Respondents tend to be more candid in their assessment (and thus deliver a lower score) if the survey is administered by a third party.

CONCLUSION: PRACTICES FOR NPS EFFECTIVENESS

If you are considering or already using NPS for procurement, the following practices will help ensure you get the most out of your NPS surveys:

- Distribute and collect NPS surveys through a third-party provider, if possible. Doing so encourages more candid feedback from stakeholders.

- Consider including a follow-up question asking respondents to explain the reasons for their score, especially for detractors.

- Incorporate structures and processes for feedback, learning, and improvement in response to NPS scores and data. For example, some organizations meet for short, interactive working sessions to review NPS data and determine opportunities for improvement.

- Expand the scope of procurement NPS surveys to external suppliers and benchmark your performance against other organizations. This will help you keep your finger on the pulse of your supplier relationships and find ways to make these relationships stronger.