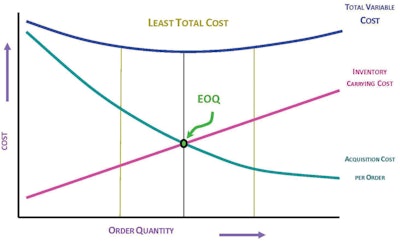

The concepts of Just-in-Time (JIT) and Lean have led many to question the continued relevance of Economic Order Quantity (EOQ), whose function is to identify the optimum order with the lowest cost parameter.

In response, yes, it is still valid as a basic analytic tool, however, many supply chain industry executives perceive it as “old school” or don’t even know about it. My experience has shown that many individuals and some companies cannot apply it—even if they wanted to—because they do not know their acquisition costs to place an order or their yearly inventory carrying cost rate.

EOQ is used today despite its highly restrictive assumptions that: demand is relatively constant and is known or predictable; the item is purchased in lots or batches and not continuously; the order and preparation costs (acquisition or purchase cost per order) and the inventory carrying costs are constant and known; and replacement of inventory occurs all at once. And knowing how to apply EOQ practically is just as important as being able to use the formula calculation itself.

Determine your metrics

EOQ involves determining the optimal quantity to purchase when orders are placed. For example, small orders result in low inventory levels and inventory carrying costs, frequent orders and higher ordering costs; while large orders result in higher inventory levels and inventory carrying costs and infrequent orders and lower ordering costs.

Alarmingly, many companies have never determined their cost of placing and processing a single purchase order (e.g., the time and extra cost to send in an order for an item, receive it, handle the supplier’s invoice and pay for it). This cost of placing and processing a single paper-based purchase order (PO) is often substantial—in the range of $35 to $200 per PO. The cost impact of placing and processing a single PO in many instances is further aggravated by the higher receipt handling processing and inbound freight charges that may incur for smaller and more frequently delivered orders. Worse yet is that some companies only use the holding cost as the extra cost of money invested in stock rather than an inventory carrying cost (ICC) rate. Normally, the holding cost portion is the actual out-of-pocket expense for money borrowed from a bank or interest which varies with the prime borrowing rate. For others, the holding cost may constitute the imputed “opportunity cost” on the use of equity capital earned by investing it in a high yielding security.

Ideally, the ICC should include the holding cost plus:

- Taxes paid on inventory

- Insurance on stock

- Stock quantity shrinkage losses due to handling, pilferage or theft

- Stock risk losses due to product obsolescence, deterioration or shelf life expiration

- Storage space occupancy

Advantageously, EOQ is very insensitive to parameter errors because those errors are muted by the presence of the square root function in the EOQ formula. Such insensitivity is advantageous whenever EOQs are computed with imprecise estimates, forecasts or costs. Can you remember the last time you worked with a valid forecast? By being insensitive to parameter errors, EOQs can be rounded off without a significant loss in economies; order sizes can be increased or decreased to the nearest pack, minimum, or unit of measure (UOM); and order intervals can be lengthened or shortened to the next interval. By way of example, EOQ suggests fractional values for things which come in discrete units, i.e. 2.7 truckloads or where suppliers are unwilling to split standard package sizes.

EOQ adoptability

EOQ (and its derivatives) is used particularly in companies that deal with large volumes of stock as well as purchase-to-stock distributors and make-to-stock manufacturers. These are businesses that have multiple orders, specific release dates for their products and have requirements plan for their components. For manufacturers, EOQ is particularly applicable if the product utilizing the raw materials has a simple process structure and is produced continuously over time at a fairly uniform rate. By way of example, a chemical process manufacturer requires only a few major ingredients to yield a finished product because economic production run sizes are known and the production rate is relatively constant over a long time period. Therefore, many materials can be ordered in bulk on a quarterly or annual basis in container load, railcar load or truckload quantities. Additionally, business candidates for EOQ applications are those that have a steady demand for stock such as maintenance, repair and operating inventory (MRO). Such suitable candidates can include manufacturers with a highly repetitive production process with long runs; while retailers and high technology providers are the least likely candidates.

EOQ for order management

When using EOQ, it’s easy to understand that your total cost will increase if you order too much or too little of a stock item. Very simply, raising your order quantity increases inventory dollar investment and reduces the number of times each year you send in a replenishment order. Conversely, reducing order quantities lowers your inventory dollar investment and increases the number of times each year you send in an order. Remember that EOQ assumes that the entire order for an item is received into inventory at a given time. Whenever the order is received in increments, the EOQ must be revised to account for the change in quantities. These revisions are necessary whenever consumption (or production) simultaneously decreases or increases the stock level. For example, in situations where an item is produced rather than purchased, a variant of EOQ called Economic Purchase Quantity (EPQ) is often used because the lot may not be made available instantaneously. In EPQ, acquisition or purchase processing cost per order is replaced by a set-up cost per order, which is the cost of the time required to prepare the production equipment or work station to do the job and to disassemble it after it is done.

Know when and how to apply the EOQ formula to your business processes using the six guidelines below:

- The EOQ formula applies to products offered at a single price; therefore, if different prices or discounts are offered by your supplier based on quantity purchased, do not use EOQ.

- It works best with normal predictable demand items. If seasonality is involved, EOQ gives you the order quantity independent of the increased or decreased seasonal demand. For items with seasonal demand, you will have to make an adjustment in your demand.

- The EOQ formula assumes the price of goods acquired will not change during the time the order is in stock. If the item being ordered is subject to price volatility or the price is expected to increase or decrease, you should know how to stock ahead before a known upcoming price increase occurs and adjust the EOQ accordingly.

- If you deal in products that require disposition or use by a specified date (a limited shelf life), the EOQ formula may produce an order quantity that will allow on-hand stock to exceed the shelf life, based on the rate of usage or sales.

- The EOQ formula is based on your ability to send in a single order for an item at any time, not multiple items in a batch or group. If you must send in a group of orders or a multiple line buy at once to qualify for some type of volume, trade, or total order discount (or because the supplier will accept only a minimum order size), then you must have the wherewithal to conduct a cost-benefit analysis to determine the basis of a line buy minimum; the amount of benefit that results; and then select those line items to buy which cause the least or minimal extra carrying costs.

- EOQ assumes that freight is included in the purchase price. If not, then it must be added to the purchase price of the item. Hence, under JIT or lean approaches where the on-hand inventory investment may be reduced, the down-side may be a dramatic increase in your inbound freight and receipt handling costs.

Preferred methods for EOQ

JIT will be the preferred method for inventory items with higher purchase price, holding costs or ordering cost. EOQ is great for production where it is consistent, easy to forecast, the demand is fixed and lead times are both known and fixed. Under the concepts of JIT and Lean, EOQ is assumed to produce undesirable results. So let’s check that premise by experientially comparing the inventory costs of purchasing under EOQ with a quantity discount versus those costs under JIT.

Experience shows us that at low levels of demand, JIT is the preferred method, whereas EOQ has the cost advantage for an item with a high demand. In a lean environment, inventories are reduced (not allowed to build up), thereby requiring less storage space and manpower to receive, count, store, pick and deliver it. For example, if you reduced your product costs your EOQ will go up. If the bank interest rates are low, your lot size will go up. In both of these situations, your inventory levels will go up which is contradictory to the expected benefit of a lean operation. On the other hand, with a lower interest rate you would be able to borrow at a good interest rate to add more storage space for the entire excess inventory. Additionally, you would have to ensure that your inventory carrying costs are reflective of all the costs of storing that excess inventory.

The sum of its usability

The experienced supply chain practitioner will check each application of EOQ to be sure that it is valid for the practical situation at hand. With a thorough understanding of EOQ, the technique can be used to yield some of the following benefits by its modification based on experience:

- Establish minimum quantities to reflect a supplier’s minimum purchase of quantities or batches of items made from one unit of raw material, e.g., steel bar or sheet

- Set a maximum ceiling stock figure for bulky, high density or difficult-to-handle stock items where storage space limitations exist

- Base adjustments on multiples of packaged lots (dozens, skids or unit packs), shipment loads (LTL, TL or FCL), or units of material issue (drums, bundles, pails, pallets and barrels)

Remember, EOQ balances supplier/vendor order size, order frequency, the timing of orders and storage and handling to minimize costs and improve efficiencies as orders flow through the supply chain system. Companies that have a steady demand for stock are the most suitable for the application of EOQ. Consequently, EOQ is not used (nor should it be used) in every type of company and industry. It is commonly used in an MRP manufacturing environment where the ordering of stock is constant and repetitive. EOQ also has its use for purchase-to-stock distributors and MRO storage facilities that have to plan for forecasted demand and/or have to generate multiple orders.