To many, supply chain finance still leans primarily on approved invoices and credit. And yet, over the past 15 years, there’s been a complete transformation in the way financial processes are handled within the supply chain. Fifteen years ago, letters of credit predominated the payment interactions between buyers, suppliers and financial institutions. Financing was arduous and expensive. Today, online, cloud-based platforms are revolutionizing both payment and financing.

Data is the driver. Today, we have unprecedented visibility into all the transactions and interactions that take place in the supply chain. The cloud, as a central information hub, not only can host these interactions and provide a real-time picture of them, but it can also keep long-term records.

This gives financial institutions what they always wanted—a better way to assess risk.

Big Data Financing

Credit rating was historically the key factor for financial providers to assess risk. In many cases, it’s the buyer’s credit rating that counts most, even when the supplier is the one receiving the financing. The problem with credit rating, though, is that it depends on a lot of factors, not just on how reliable a supplier is in delivering goods or how reliable a buyer is in paying on time.

But as far as risk assessment goes, proven transaction history is what lenders prefer to set their decisions and rates upon. But for the longest time, financial providers didn’t have a good way to assess risk independently of credit rating. Now, thanks to big data, they do.

For examples, Seabury TFX recently created a program that offers suppliers financing based solely on their performance data on a cloud platform from GT Nexus. The performance data exists because the cloud-based network has over a decade of detailed transaction history. A financial provider can set terms based completely on how a supplier or buyer performed historically, without resorting to credit rating. Instead, metrics like on-time payments, order performance, late shipments, cancelled orders and chargebacks determine risk.

This type of performance-based financing is tremendously advantageous to buyers and suppliers, too. Unlike credit-based lending, performance-based financing exists off balance sheet. This aids liquidity and working capital without affecting credit.

A Vision for Trade Financing

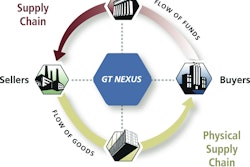

Big data is a component of a larger upheaval taking place in supply chain finance. It has to do with the ability to inject cash or take on assets at any point in the supply chain. Prior to buyers, suppliers and logistics providers operating together on a single network, the places where money could flow into the supply chain were limited. Suppliers often sought loans from local banks to access capital. Those loans were issued at high rates.

Financial institutions want to be able to take advantage of new business models. And suppliers and buyers want more opportunities to fund operations. Already, network platforms aided companies to develop solutions like early payment programs—in which suppliers have the option to get paid early from their buyers in exchange for a discount on the invoice. With big data being the driver for financial decision-making, the ability to inject cash at any point in the supply chain is becoming a reality. And that’s huge, because it leads to win-win-wins between buyer, supplier and financial provider.

This includes opportunities that connect the financial supply chain to the physical supply chain. The role that transportation and in-transit inventory can play financially is huge. Data-based financing can lay the groundwork for things like inventory financing—in which a financial institution takes on the ownership of inventory in transit in order to alleviate the balance sheet of the supplier. From the procure-to-pay process through transit and delivery, there are multiple opportunities where buyers and finance providers can use the visibility of network platforms to solidify supply chains through innovative financing.

The world is changing considerably since the days of letters of credit. Not only did automation make supply chain processes far simpler and easier, but the idea that cloud platforms can network partners together gave rise to innovative new business models that serve to benefit all parties involved. The performance-based financing model devised by GT Nexus and Seabury TFX serves as an example of how far the traditional idea of supply chain finance evolved. It’s no longer just about approved invoices. It’s about redefining the supply chain in a way that financing—based on clear, visible histories—can be used to alleviate the burdens of partners and benefit everyone involved.