Interact Analysis starts 2021 with a new report on automated micro-fulfillment centres (MFCs). In this first report of the new year, the focus is on one positive that has come out of the COVID-19 crisis – the growth in the number of retail-based MFCs, and the openings this offers for manufacturers of automation equipment.

Concerns over future lockdowns and customers’ heightened expectations regarding fast delivery are driving retailers to re-evaluate their fulfilment strategies. Many of them, particularly in the groceries sector, are installing MFCs in existing premises. They are closer to the customer than massive distribution centres, and they can be installed in weeks and months, rather than years. Ocado’s Zoom facility in Acton, for example, offers same-day delivery to a 5km radius in London, and the drive for efficiency and speed is propelling the automation of these facilities.

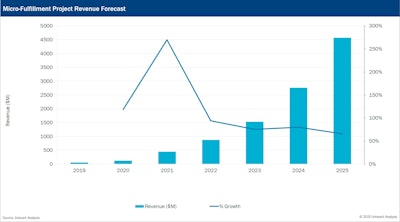

The automated MFC market is forecast to grow to just above $5.5bn in 2025. Up from $136m in 2020 - a CAGR of 104% (including both project and recurring revenues). Interact Analysis forecasts that by 2025 just over 2,100 micro-fulfillment centres will have been installed, 69% of them being built in 2024 and 2025. They also forecast that in 2025 the grocery sector will account for 45% of micro-fulfillment automation revenues. Retailers will make use of their existing real estate assets before constructing purpose-built micro-fulfillment centres. For this reason, grocers will favour retail-based MFCs, where the MFC is co-located with the retail store, due to their large real estate networks. General merchandise retailers, on the other hand, which tend to have fewer and smaller real estate assets, will favour dark stores and distribution centre-based MFCs.

A study by Mercatus recently found that online grocery could account for 21.5% of the total US grocery market by 2025. With each micro-fulfillment centre generating approximately $30 million in revenue, our forecast suggests that micro-fulfillment centres will fulfil approximately 8% of total US online grocery sales in 2025 with the remaining 92% being fulfilled in-store or from centralized fulfillment centres.

The top 3 suppliers of automated micro-fulfillment centre equipment in 2020 were Dematic, Takeoff Technologies, and Exotec, who accounted for 71% of the sector. The number of micro-fulfillment centre projects they completed in 2020 was 29, a relatively small number but it is forecast to increase dramatically over the next 4 years, with new companies offering innovative solutions and lots of competition.

“The number of new automated micro-fulfillment centre projects is growing at a phenomenal rate. This represents a major market opportunity for automated equipment suppliers not only in the installation phase, but in the potential for recurring revenues through additional services such as maintenance contracts, software, and fulfilment-as-a-service models. There really is a lot of potential here. Automated equipment vendors should sit up and take notice," Rueben Scriven, Senior Analyst at Interact Analysis says.