Global markets continue to reflect a broad range of responses to the COVID-19 pandemic. The gradual easing of lockdown measures in many of the larger import markets is proving price-supportive to several key commodities groups tracked by Mintec. This has particularly been the case where those commodities are used extensively in out-of-home consumption; for example in restaurants, bars, hotels and other food service vendors. In the last COVID-19 report, Mintec reported how the prices of specific whitefish, meat, oilseed and dairy products were responding positively, as lockdown measures were eased in key consuming markets.

However, some countries have since re-implemented social distancing in regions where virulent cases have begun to escalate. The majority of these new cases are so far restricted to localised outbreaks in specific towns, cities, or even factories. Notwithstanding, the effects of the ‘second wave’ lockdowns are already being felt among key commodities tracked by Mintec and the threat of further price impacts among other commodities groups is pertinent.

In this report, Mintec looks at a number of products experiencing significant price movements, based on ‘second wave’ COVID-19 outbreaks. The analysts look at the key COVID-19-specific factors underpinning the price movements and speculate on short-term price potential. The report also looks at products not directly impacted at present but susceptible to ‘second-wave’ price volatility.

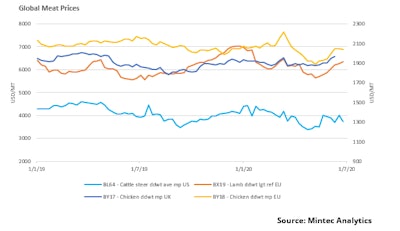

Global meat industry at risk due to COVID-19 outbreak in processing plants

The increasing instances of COVID-19 outbreaks in meat processing plants around the world could potentially contribute to higher prices by disrupting the global supply chain. Meat packing factories are becoming increasingly linked with new infections in the Americas and Europe. Growing consensus suggests that cold temperatures and the ventilation systems required to help preserve meat, also provide conducive conditions for the virus to multiply. As more countries relax social restrictions, leading to higher meat demand from foodservice sector, these bottlenecks at meat processing levels present higher price potential.

In the US, more than 20,000 meat-packing plant workers have fallen ill, during Q2 2020, leading to plant closures and/or low plant throughput. European slaughterhouses have faced similar issues, and cross-contamination between slaughterhouse workers is cited as being the reason behind the largest single outbreak in Germany. The UK’s largest poultry processing plant – the 2 Sisters factory in Anglesey, North Wales – was idled in mid-June, as more-than 150 staff contracted the virus. The 2 Sisters plant accounts for a third of the UK's chicken supply to retailers and foodservice players.

Mintec noted an uptick in average wholesale meat prices in several countries and meat categories, since early May 2020, as lockdown measures eased, stimulating demand from restaurants, hotels and bars. Mintec's UK chicken prices strengthened by 4% y-o-y in the first fortnight of June, and EU chicken, lamb and pork prices mirrored the UK price trend. Similar price movements have been recorded in the US and the potential for escalating COVID-19 cases at processing plants could accelerate the upward trend, should the markets tighten sufficiently.

US orange juice prices supported by higher demand

Global orange juice demand has remained firm during the global pandemic, and the orange juice futures price at the New York Intercontinental Exchange (ICE) has been generally well supported through 2020. This is likely due to consumer preference for food with reported health benefits during a global pandemic. The recent uptick in COVID-19 cases across the US and the risk of localised lockdown restrictions, is expected to keep orange juice demand firm for the remainder of 2020. The possibility of a second wave of coronavirus could accelerate consumer demand and potentially lead to higher prices.

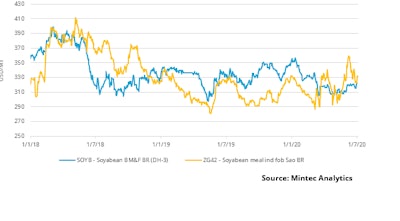

Brazilian soyabean and soyabean meal demand remains vulnerable to second wave of lockdowns

Brazilian soyabean and soyabean meal prices remain vulnerable to the possibility of a second wave of COVID-19 lockdowns. Recent outbreaks in meat processing plants in Germany, the US and UK have raised fears that the pandemic could re-escalate, necessitating further lockdowns. Global soyabean meal demand has remained relatively subdued in 2020, due to the adverse impacts of African Swine Fever (ASF) on pork consumption. However, a re-escalation of the pandemic may support higher prices if supply is significantly disrupted.

Reports from the Brazilian National Association of Cereals Exporters (ANEC) on 25th June suggest that Brazilian exporters to China will require guarantees for cargoes to be tested against COVID-19. China is the world’s top soybean buyer, and Rabobank estimates Chinese imports will reach 94 million tonnes in the 2019/20 crop year, representing a 10% y-o-y increase. Thus, the risk of further lockdowns would paint a bearish picture for Brazilian soyabean and soyabean meal prices, given already-low levels of demand and the possibility of extra trade guarantees.

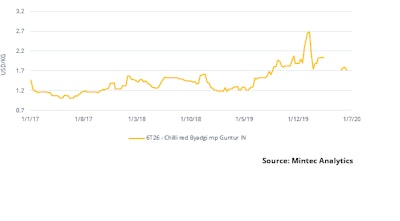

New social-distancing measures may impact Indian chilli demand

A re-escalation of COVID-19 cases in the Assam region of north-east India has resulted in the local government re-introducing lockdowns in Kamrup Metropolitan district, with the West Bengal and Jharkhand governments extending lockdown regulations until 31st July. Lockdowns have also been implemented in other parts of the country, including several districts of India’s southernmost state, Tamil Nadu.

In the chilli market, where majority of the spice is consumed domestically, prices have fallen substantially since the beginning of the year. The price of Byadgi chilli at the Guntur market has declined by almost 30% since mid-January, to USD 1.90/kg. The lack of domestic demand has contributed to rapidly rising cold storage inventories since Q2 2020. Given that domestic demand is already subdued, the re-imposition of social-distancing measures presents strong downside price potential.

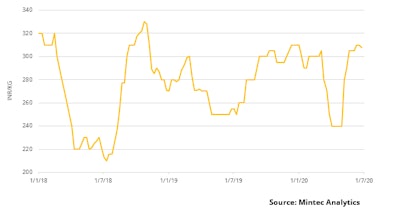

Indian prawn prices soften for the first time in 12 weeks, as Chinese demand wobbles

Global prawn prices softened in the final week of June, as Chinese import demand weakened, in light of new COVID-19 cases in Beijing. China is the world’s largest prawn import market and the recent outbreak in Beijing is being attributed to imported seafood, leading to the reimplementation of stringent import controls.

The average Indian ex-farm prawn prices of 60-piece whiteleg prawns fell by 1% week-on-week (w-o-w) on 24th June, which is the first w-o-w price drop recorded in two months. Since hitting the floor at INR 240/KG in early April, the ex-farm price increased by 30% to mid-June, as Chinese demand began to improve following the easing of lockdown measures. However, the recent dip is expected to be relatively short-lived, as overall fundamentals are strong. Most pertinently, Indian production is widely anticipated to fall by approximately 20% y-o-y in 2020 (equivalent to approximately 100,000 tonnes), due to a lack of feedstock imports in Q1 2020. At the same time prawn consumption should accelerate as more countries relax COVID-19 restrictions, particular out-of-home demand from restaurants, pubs and other foodservice vendors.

US butter prices dip amid a surge in COVID-19 cases

In the eight-week period to 10 June 2020, Mintec US butter prices increased by 63% to USD 4,219/MT. Mintec butter prices fell by 6% between 10th June and 24th June to USD 3,951/MT, following an eight-week price run-up to that point. The fall in price may be attributed to a surge in COVID-19 cases in June 2020, which has forced closures of foodservices across the US. On 25th June, 40,000 new COVID-19 cases were reported in the US, which is the record for a single day. The subsequent drop in butter price is probably linked to the sudden closure of foodservices, which accounted for 45% of butter consumption before the pandemic.

The United States department of Agriculture (USDA) introduced government assistance via the Coronavirus Food Assistance Program (CFAP) in May 2020. This is a relief package, where the USDA has purchased USD 68 million worth of dairy products to mitigate the impact of the pandemic on dairy farmers. While this initiative will remain price supportive to contain excess supply, it may be short-lived if a second lockdown is enforced, as funding runs out in September 2020.

With several states across the US announcing new restrictions, in response to recent spikes COVID-19 cases, this has resulted in the closures of foodservices and hospitality sector for a second time. The possibility of future localized lockdown restrictions being imposed, could push Mintec US butter prices lower over the next few months.

Conclusion

The potential for ‘second wave’ outbreaks of COVID-19 to destabilise commodities prices is highlighted in this report. In particular, products with robust foodservice demand – those products eaten extensively outside of the home – appear to exhibit stronger price elasticities of supply by comparison. Seafood, meat and dairy products depend on restaurants, hotels and other public eateries for a large portion of consumption, and Mintec prices of these products would be expected to weaken, in correlation with any new restrictions placed on social movement.

On the other hand, average orange juice prices will likely strengthen as lockdown measures are re-implemented. This is mainly due to increasing levels of health consciousness during the global pandemic and consumer preference for products that are deemed to increase immunity.

Mintec will continue to monitor the impact of the pandemic on the food groups covered in this report, while also keeping an eye on developments regarding price-sensitive substitutes and/or related products.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)