High diesel prices may endure for years. There are a host of market dynamics responsible for this possibility. Fuel demand returned more swiftly than supply following the pandemic, and energy market upheaval followed Russia’s invasion of Ukraine. Other dynamics—like the shift in consumer behavior and policy toward investment in clean, renewable energy and technology—have been decades in the making.

Shippers will need to pivot their approach to transportation energy costs if they hope to reduce the costly impact on their network over the next couple of years. High energy costs will likely persist while few headline-grabbing alternative energies are ready for commercial use.

In the interim, the movement of goods remains overwhelmingly dependent on low-sulfur transport fuels like diesel. In recent years, energy market dynamics have limited low-sulfur fuel supply growth while demand for these fuels used by heavy-duty transport has continued to grow.

According to the U.S. Energy Information Administration, 2022 U.S. operable refining capacity—the capacity refineries have available to produce transport fuels and other refined products—will slump to its lowest level since 2014. This represents a loss of more than 1 million barrels per day of refining capacity since 2020. Meanwhile, July and August saw U.S. exports of diesel and other low-sulfur fuels at their highest levels in five years.

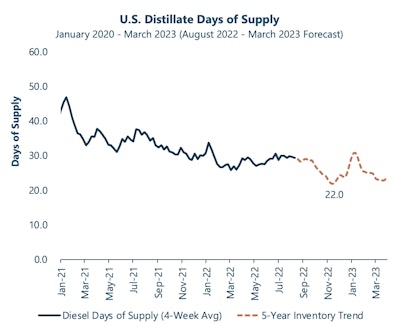

The potential of diesel prices pushing higher this autumn continues to increase. Diesel market fundamentals routinely cause diesel inventories to draw into the fourth quarter of each year. Modeling of the five-year trend in diesel days of supply shows days of supply. When considering the average seasonal experience of diesel inventories, it is projected to decrease 15-20% from today’s levels into November.

This projection suggests transportation energy costs will remain a prominent discussion topic in shippers’ and carriers’ year-end budget meetings and earnings calls if this seasonal trend becomes a reality. But there are opportunities for shippers to pursue strategic partnerships and initiatives to reduce these financial implications.

Breakthrough

Breakthrough

Restructure transportation network strategy

Shippers can restructure their fuel program and network to not absorb the entire burden of high energy prices persisting above the 2015-2020 market experience. In each pivot, partnerships and insights should be at the center of the conversation to build a sustainable strategy.

1. Use market-based fuel reimbursement programs. Fuel programs tied to indexes that hold prices constant for a week or more do not reflect the actual cost of fuel for trucking, rail, ocean or air freight. Additionally, legacy fuel surcharge programs limit operational insights that may be gained when daily, lane-level transportation energy costs are understood. Data-driven fuel programs provide granularity to enhance network efficiency, understand costs, keep carrier partners whole and strategically source network improvements.

2. Source SmartWay Carriers. The U.S. Environmental Protection Agency (EPA) developed SmartWay in 2004 to recognize companies for their efforts to become more sustainable. SmartWay carriers are known to be more efficient, improve supply chain sustainability and move goods at a reduced cost. The best gallon of diesel fuel in a transportation network is one that is avoided. Since 2004, SmartWay claims it has helped its partners save 336 million barrels of oil and 143MMT of CO2, factors that can drive significantly reduced costs and opportunities for shippers.

3. Explore alternative modes of transportation. Leveraging intermodal carriers is wise if it meets service standards, is cost-effective and is efficient for your network. Rail is a competitive mode of transportation because off-highway diesel fuel is exempt from on-highway excise taxes; it boasts superior fuel efficiency over truckload, lowers GHG emissions and can offer linehaul savings. A thorough analysis of cost, service and capacity is necessary before pursuing an intermodal partnership.

4. Consider alternative energy in the long-term strategy. Consumer demand and strict government regulations are adding pressure for carriers to switch to alternative energy and for shippers to support carriers who have made the change. While infrastructure needs to be built for the alternative energies on the market, natural gas can already be used and is commercially competitive. Compressed natural gas (CNG) is a viable option in the short term with stations in most states and nearly 900 public stations available nationwide. CNG also experiences less price volatility than diesel fuel, making it cost-effective. Exploring your options will provide you with a solid foundation to build your strategy.

5. Connect with carriers. Small fleets are likely the most challenged by high diesel prices. Communicating with your transportation network to understand the impact of high energy costs and resolve any challenges will strengthen the carrier relationship. If a carrier is struggling, one suggestion is to shorten payment terms. This allows them to continue to operate within their credit limit and support maintenance costs.

Planning for the future of the energy market

The repercussions of recent events will persist in the years ahead with plenty of market disruption and volatility along the way. With the knowledge that conventional fuel dynamics may keep energy prices higher than the 2015-2020 experience, shippers will need to pivot to reduce disruption to their network.

Shippers can gain a competitive advantage through market-based fuel reimbursement, sourcing SmartWay carriers and exploring alternative modes of transportation in the short term. Alternative energy, while a viable option, will require more research and development to confirm it is commercially and logistically viable for a network. These market dynamics additionally call for pursuing sustainable partnerships with carriers and working to ensure valuable relationships remain supported. One or a combination of these initiatives will help shippers build and maintain their competitive edge.