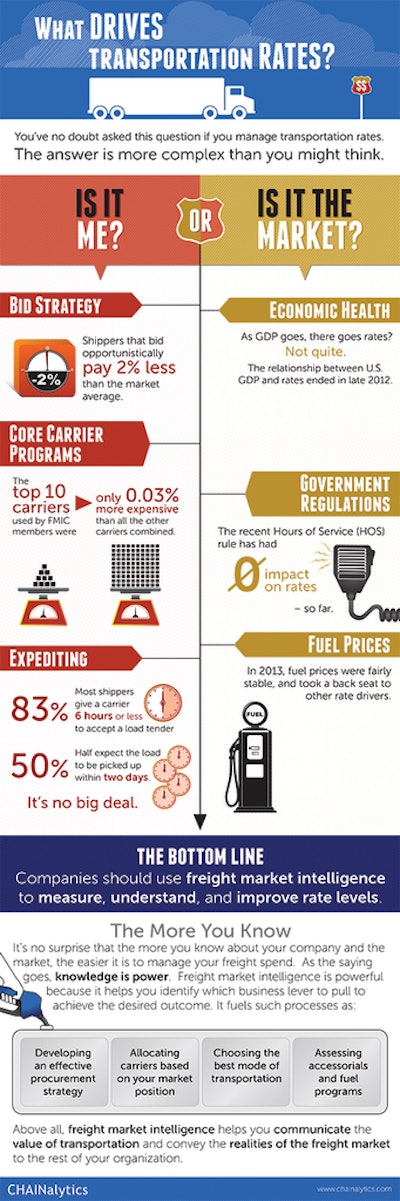

As we explore the North American truckload transportation market over the years, the notion of a good market rate as expressed by buyers in the market appears to be a highly subjective concept. In our interactions and experiences with buyers, it is clear that there are many factors that lead to the perception that rates are at reasonable market levels, or more importantly, understanding what is truly happening in the overall market.

Before embarking upon a journey to optimize truckload rates, it is vital to understand that market indices and historical experience with certain markets can be poor indicators of overall network cost. In a macro view of the market, the price paid for transportation exists at the equilibrium between shipper volume and carrier capacity. However, at a micro view, dynamic variables are constantly in flux because each shipper-carrier agreement is highly dependent upon a myriad of common needs, and both sides may have significantly different experiences in negotiating.

Major Indices Are Irrelevant for Specific Action

Transportation rates are highly reactive to current market conditions and rarely correlate with any external indices in the long term because transportation is a leading indicator of the economy. Analysts routinely attempt to draw correlations based on gross domestic product (GDP), producer price index (PPI), consumer price index (CPI) or any other index in which a short-term correlation may exist, but over the years, we see deviations without warning. More importantly, an index does not represent a shipper’s network because of the individual aspects of procurement strategies, service needs and a host of other factors that are independent of the market. Indices are generally lagging indicators that may be good for high-level presentations, but mask many opportunities within each shipper’s portfolio of lanes and carriers.

This is not to say that external forces do not drive transportation rates. Naturally, fuel prices affect rates, but the fluctuations have to be significant enough so that carriers must adjust line haul costs to compensate under compensating fuel programs. Fuel prices were stable enough over the past two years to remain very minor rate influencers. Global demand, domestic demand and weather conditions also affect transportation rates, often without warning. The unpredictable nature of these conditions, combined with shipper-specific strategies, make most indices irrelevant for change.

Know your Neighbor

Comparing actual paid transportation rates to last year’s performance masks opportunities. Instead, shippers should look to freight market intelligence to determine if their rates reflect the current supply/demand environment. Transportation rates exist on a continuum for any particular lane, and within dry van markets, we see regional variations of 30 to 60 cents a mile (often higher) for very specific freight corridors. Rate benchmarks are useful tools in identifying whether a shipper is paying more or less than similar shippers, and this is the starting point to understanding if a particular rate is calibrated to service appropriately.

Without knowing what other shippers are paying, it’s impossible to understand if individual transportation rates are too high—or just right. Periodically, companies express that their rates are competitive because carriers tell them they are getting great pricing—but would any business wittingly tell customers anything different? Suffice it to say that this approach can be problematic. The best information to have is to know where the middle of the market is so that service and cost strategies can be aligned accordingly.

What’s in the Balance?

There are two fundamentals concepts required to fully maximize the benefit of market intelligence within a portfolio of carriers. The first is the notion of intangibles. Intangibles are the elements that lead to a sense of company-company efficiency. Intangibles include components of service that are difficult to measure that lead to a sense of whether or not a carrier is a true partner. Intangibles are different than standard service key performance indicators (KPIs), such as accept ratios, claims ratios, etc.

They also include other important aspects such as the ability to be flexible, or jump through hoops or even save the day. These are elements that no transportation management system (TMS) can capture or measure, but are critical to customer satisfaction. The most important intangible is the ability to allow open conversation in striving for collaborative opportunities. This level of dialog can be part of lasting relationships, which yield significant benefits beyond securing the lowest market rate with a less engaging alternative.

The second fundamental is market position. Intangibles cannot be ignored when comparing a particular carrier to a market position whether in aggregate or by lane, but they serve to balance the equation and provide a backdrop for decision making. Intangibles combined with service KPIs are the most important company knowledge when comparing rates to the general market.

Taking Action

There are three main categories of intangibles and market position that lead to specific types of decisions regarding carriers and they are as follows.

Aggregate Benchmarks above Market Combined with Low Intangible and Service Values

This is the no-brainer situation in any benchmarking exercise. If you are not getting good market rates and the carrier is underperforming, then a change should be considered either immediately or on the next bid. It may start with a conversation, but often, if the value is not there and it is confirmed from a general view of the market, it’s time for change.

Aggregate Benchmarks above Market Combined with High Intangible and Service Values, or Aggregate Benchmarks below Market Combined with Low Intangible and Service Values

This is a more difficult situation because it relies on value judgments. Perhaps low rates and poor service/intangibles are acceptable given the nature of the receiver or flexibility in scheduling. Likewise, high service/intangibles and high rates may fit with an intense service strategy driven by the customer.

In this environment, market positions should be controlled or monitored to ensure that, from period to period, they are managed at some level to the market.

Aggregate Benchmarks below Market Combined with High Intangible and Service Values

This is the best situation because what it suggests is that a true partnership is working. Receiving great market position combined with great service/intangibles identifies a potential growth opportunity for the carrier, and a direction toward greater investment of time and energy to support a relationship.

Three Tactics for Affecting Transportation Rates

Relationships matter. Strong relationships with carriers provide leverage in negotiation to shippers and give carriers motivation to be flexible in accommodating special circumstances. In a purely laissez-faire environment, rates are set at the intersection of volume and capacity with the sale going to whoever is the first to pay that rate. In the real world, there are more elements at play than simply who has a load and who can carry it. To operate efficiently, both sides need better strategies than working with whoever has a shipment or capacity at any given moment.

Shippers should meet with carrier partners regularly to understand various aspects of all sides of the business. In doing so, they can help carriers by timing freight to help keep trucks moving during periods of excess capacity. When capacity tightens, carriers are more likely to provide service to shippers that helped them keep trucks on the road when volumes were low. Willingness to engage in trade-offs and keep carriers operating efficiently when they need it most helps ensure they can be counted on not to immediately turn to a different shipper the moment they become more attractive.

Bid strategically. The biggest mistake shippers can make is to stick with a negotiated rate for more than two years with the assumption it’s a good rate. In most situations, it is sound strategy to host bidding events annually. Carriers expect to bid for freight and to receive capacity commitments for contracted rates. The rates within their bids reflect unique network efficiencies that may offer benefits previously unknown. While carriers can always deny capacity for more attractive rates, or try to raise contracted rates when conditions become favorable to do so, they are unlikely to engage in this behavior when shippers commit capacity under contracted rates and do so with discipline.

Regardless of which bidding strategy is used, over allocating capacity to a few carriers can lead to difficulties. Economies of scale often fail in transportation because allocating too much freight to a single carrier gives that carrier greater leverage in dictating rate increases. Balanced allocation among several carriers forces competition into the marketplace and allows shippers to employ the invisible hand on a micro level.

Use benchmarks wisely considering intangibles. Benchmarks should not be used to compare shippers against each other—there are too many differences between service needs and intangibles within each company to make this a relevant exercise. Rather, benchmarks identify extreme outliers in your portfolio of carriers and lanes/geographies. The extreme values offer more reasonable targets for focus. Whether typically over market or under market, most shippers pay some rates that are egregiously on the fringe. Benchmarking provides visibility into these particular instances, and offers shippers opportunities to fine-tune their networks and ensure that rates are within the appropriate range. When used correctly, benchmarks provide a quick punch list of lanes and carriers to adjust in order to bring cost and service into proper balance.

Understanding transportation rates is a tricky business because so much relies on unpredictable variables and negotiated contracts boil down to little more than gentlemen’s agreements. Without access to what price points other shippers are paying, it is virtually impossible to know how competitive a rate is. Outlier transportation rates can result from a variety of situations, but hardly ever the overall market. When shippers ask “Is it me or is it the market?” the answer is almost invariably, it’s you.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?ar=16%3A9&auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=135&q=70&w=240)