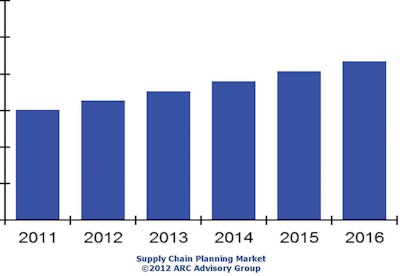

The supply chain planning market has been experiencing broad-based, above-trend growth, according to a new study from the ARC Advisory Group, Dedham, Mass. The worldwide supply chain planning (SCP) market is forecast to grow 44 percent over the next five years, representing a compound annual growth rate of 7.6 percent.

And with the global economic downturn now predominantly in the past, capital spending on information technology has rebounded vigorously. The SCP market has participated in this rebound, as suppliers have reported recent revenue growth rates well above the long-term trend.

However, going forward ARC expects certain segments to outperform others. This study answers such questions as: Who are the leading SCP suppliers in the various regions, industries and other revenue segments? What are the expected growth levels by end-user industry and when will this growth occur? What factors drive growth in the SCP market? What application categories are expected to experience the greatest growth and what factors will drive that growth?

“Suppliers reported growth across SCP applications, geographical regions and end-user industry segments,” said Clint Reiser, Enterprise Software Analyst and the principal author of ARC’s “Supply Chain Planning Worldwide Outlook. “This is being driven by a couple of prominent adoption trends and a release of pent-up demand from the preceding worldwide economic downturn.”

Integrated business planning fuels growth

Businesses have recently exhibited pronounced interest in integrated business planning, including S&OP planning. Organizations continue to integrate historically disparate processes to obtain a more comprehensive view of their overall operations. This ongoing maturity and increasing sophistication of corporate business processes is contributing to increased adoption of S&OP solutions as companies attempt to take their planning to the next level. The value proposition of S&OP solutions is also being enhanced by other high-growth supporting technologies, such as business analytics and high speed in-memory computing technology.

Demand management is a priority

Sales of demand management applications remain robust as companies continue to focus on aligning product availability with demand. Today’s solutions provide planners with standardized functionality to dynamically model numerous factors, such as seasonality, promotion up-lift and pricing effects. The feature and usability improvements enable companies to accurately predict demand at various product levels across a vast number of SKU locations. The increasing use of demand signal repositories by large consumer goods companies and food and beverage companies is also contributing to increased use of demand management solutions. Demand signal repositories increase the volume, recentness and overall value of point of sale (POS) data. The increased value offered by this data will increase the potential value companies can extract from its use within the demand planning process and will therefore increase adoption of demand planning solutions.

For the full report, visit www.arcweb.com.