New York — August 4, 2010 — The global market for engineering research and development (ER&D) services sourcing has defied the economic downturn, with demand from such sectors as computing systems, medical devices, energy and infrastructure fueling growth in the market, a new study has found.

Meanwhile, providers in emerging economies, led by India, are poised to gain share as multinational corporations seek to invest in innovation and drive future growth, according to the study, "Global ER&D: Accelerating Innovation with Indian Engineering," conducted by management consulting firm Booz & Company with the National Association of Software and Services Companies (NASSCOM) in India.

The report sheds light on multinational corporations' perspectives on ER&D services sourcing, growth trends in the Indian service provider landscape, and competitive positioning of emerging markets as sourcing destinations.

Overall spending on ER&D increased 12 percent from $980 billion in 2008 to $1.1 trillion in 2009 and is expected to expand to $1.4 trillion by 2020. India, a pioneer and leader in the global sourcing industry, remains a dominant player in the global ER&D services market, with revenue growth of more than 40 percent over the past three years, to $8.3 billion in 2009, and expectations of reaching $40 billion to $45 billion by 2020.

The joint report also examines and prioritizes 11 key verticals for growth in the global ER&D market. While automotive, consumer electronics and telecom — all traditionally high spenders on ER&D — continue to lead ER&D spend, emerging sectors include computing systems, medical devices, energy and infrastructure.

Also according to the study, growth in global ER&D spend is being driven by four emerging trends:

- Continued R&D investment considered imperative by multinational conglomerates when it comes to pursuing innovation and penetrating new, emerging markets.

- Increasing use of electronics, the search for alternate fuel sources and greater fuel efficiency, and the convergence of technologies that enable a single device to perform multiple functions.

- Growing sophistication and maturity of the ER&D services industry.

- Changing view of India as a strategic partner focused on innovation rather than simply sustenance and maintenance of existing products.

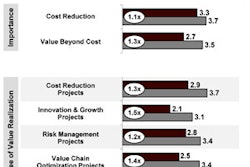

"Many corporations are seeing the recent economic downturn as not a threat but an opportunity to earmark ER&D budgets for innovation to drive growth in times of economic recovery," said Vikas Seghal, a partner at Booz. "Companies are no longer offshoring simply for cost benefits, but are seeking flexible resource capacity, reduced time to market and localized products for emerging markets. Our study aims to help multinationals understand these trends as ER&D becomes a major driver of innovation and expansion."

India Poised to Become "Engineering Powerhouse"

According to the study, the ER&D services industry is now global with the emergence of several new, low-cost destinations. The United States, which accounts for approximately 40 percent of ER&D spend — the most in the world — continues to be a leader in terms of establishing global engineering networks; however, it faces a shortage of low-priced talent. India has established itself as the premier location for offshore ER&D services and has played a strategic role in globalizing the ER&D value chain, according to Booz.

The report suggests that India is emerging as an innovation partner to mature markets, especially the U.S. India's supply base is currently involved in supporting leading innovations across multiple industries, including automotive (hybrid technology), aerospace (avionics and structures), telecom (next generation routers) and medical devices (low cost medical devices). Further, its supply base is partnering with U.S. companies to lessen the impact of economic downturns through innovative business models.

Going forward, the report asserts that India's ER&D providers have the potential to capture a 40 percent share of global offshore revenues in 11 key verticals by 2020, due to several unique advantages: a strong and diverse service provider pool with a current and growing employee base of 150,000 out of about 1 million trained engineers country-wide; capabilities across verticals; communication capabilities; structural cost advantages; and a range of business models to suit the diverse requirements of global corporations. "India is the only country in the world to offer a large third-party engineering vendor base," noted Sunil Sachan, a principal with Booz.

Other locations that are building up their ER&D capabilities include China — which has a large presence of captives driven by its manufacturing capabilities — followed by Central and Eastern Europe, ASEAN, Brazil, South Africa and North Africa, among others.

Som Mittal, President of NASSCOM, said that, due to the growing sophistication of the ER&D services industry, customers have begun to view service providers as strategic partners. "India is now an epicenter for global ER&D services, with a compelling value proposition based on its growing depth and breadth of services, flexible business models, large engineering base and global footprint with greater proximity to customers," Mittal said. "Increasing investment in ER&D has the potential to transform India into an engineering powerhouse over the next decade with the potential to create more than 5 million jobs."

Asia Emerges as Key Player

The Booz & Company/NASSCOM study also details anticipated changes in the ER&D landscape in 2020, compared to the current day. Key global drivers of change include a shift in centers of economic activity, that is, the emergence of Asia, demographic challenges in mature economies, greater technology convergence and major shifts in industry structures. Simultaneously, growth in the Indian domestic market, infrastructure investments by the Indian government, and offset policies are expected to drive growth in the domestic Indian ER&D services outsourcing industry.

The growth of the global ER&D sourcing market is expected to come from contributions from all major verticals as well as geographies. According to the findings:

- North America remains the largest market for Indian ER&D services, although its share of contribution to total revenues is expected to decline from 62 percent in 2009 to 45 percent in 2020.

- The European market is opening up and is expected to contribute another 30 percent, while new opportunities from the Japanese market and the rest of the world will contribute 25 percent.

- In 2020, automotive, telecom and consumer electronics are expected to remain the highest revenue generating verticals.

- The Indian domestic market is expected to contribute almost 10-15 percent of the ER&D services market in 2020 driven by several sources of revenue: supporting growth of domestic market/companies; meeting offset requirements in the aerospace sector; planned investment in infrastructure; and energy & utilities infrastructure by both the Indian government and corporations.

Study Methodology

Evolution of the ER&D services market was determined using a three-part framework:

- On the demand side, change in drivers of offshoring from 2006-2009 and its resulting impact on the likelihood of companies to outsource/offshore ER&D services and market revenues was assessed at an industry level.

- Maturity and growth in capabilities of the ER&D sourcing supply base (captives and service providers), especially in India was evaluated along multiple parameters including value proposition, presence and depth across verticals, and scale of operations. In addition, specific challenges faced by the Indian supply base were identified based on interviews with customers across geographies.

- Last, the research evaluated competitive positioning in the fast-growing services market in low cost countries like India, China, Eastern Europe, and the ASEAN region. Along with labor and other cost economics, the country-evaluation framework also looked at the capacity and capability of the supply base, communication skills and working culture. Benchmarking of the countries was dynamic; the study looked at present as well as potential/emerging competitors. In addition, India was assessed along major policy levers that governments can use to increase a country's attractiveness as an offshoring destination.

An executive summary of the report is available for download here and the full report is available for purchase on the NASSCOM website (www.nasscom.in).