As we draw the curtains on 2019, the responses to our survey “Digital Transformation in Supply Chain Planning—On Pace or at Risk” are illuminating. Beyond the survey results, we also see anecdotal evidence from our customers that transforming the area of supply chain planning can improve service levels while delivering considerable efficiency and productivity gains and cutting costs and waste. We also hear about “soft” gains, like improved planner morale, better work/life balance and the opportunity to do more interesting work.

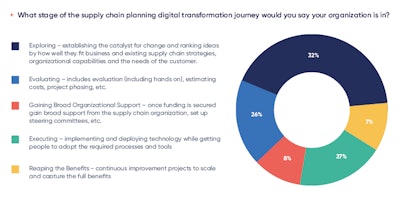

However, despite all the demonstrable upside, a whopping two-thirds of the companies we surveyed are yet to execute digital transformation and only 7 percent are currently reaping the benefits. It would be wrong to conclude from this that digital transformation is low on supply chain leaders’ agendas. Battling uncertainty on many fronts (see figure 1)—volatile demand, trade wars and tariffs and new business models—the 200 leaders we surveyed are understandably as eager to digitally transform as they are pragmatic in their approach.

Cautious About New Technology Innovations...

Supply chain leaders are not early to adopt disruptive and innovative technologies. That’s understandable. Failed deployments that impede the flow of food to tables, cars to driveways, and holiday presents to children can cause lasting reputational brand damage. Many technologies associated with supply chain transformation also require extensive (and often expensive) integration. Linking business IT systems to closed, legacy operational technologies can be particularly difficult.

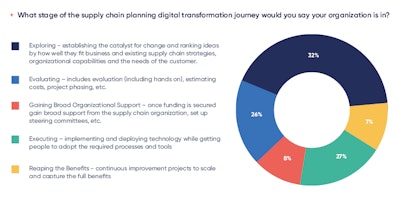

Our survey shows that supply chain leaders are most readily embracing Internet of Things (IoT) and Robotics technologies, with 21 percent and 18 percent of respondents, respectively, running active projects. While both technology categories include a range of discrete solutions at varying stages of maturity, many are now proven and have reached mainstream adoption.

In the realm of AI and related technologies, digital assistants/conversational commerce and machine learning we see cautious adoption levels, with 16 percent, 14 percent and 14 percent of respondents, respectively, running active projects. Of those who plan to apply machine learning, 40 percent see it as a technology that could improve forecast accuracy.

This chimes well with a report Tim Payne at Gartner published last year entitled “Current Use Cases for Machine Learning in Supply Chain Planning Solutions.” In the report, Payne explained that end users “want to get better, more accurate demand plans that do not involve absorbing masses of demand planner time to accomplish.” According to other recent surveys we looked at, three of the top five reasons why organizations haven’t adopted AI are related to their inability to articulate a roadmap.

Few respondents reported having projects underway involving Drones (12 percent) or Driverless Transportation (7 percent), despite the considerable hype surrounding these technologies. However, given their risks and relative immaturity, this is understandable. We believe these innovations will gather more steam after robust testing is complete and regulatory frameworks are defined (see figure 2).

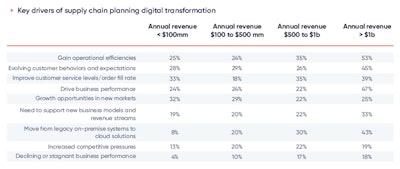

...And Having to Replace the Old

Interestingly, we also find a link between respondents’ attitudes to change and legacy technology concerns. Thirty percent cited “Fear of Change” as the top factor holding back digital transformation. In a similar vein, “Risk Aversion” came in third at 24 percent. However, “Data Quality/Lack of Data,” was the second highest response at 25 percent. Twenty-two percent cited “rigid technology and infrastructure” as an obstacle (see figure 3). Our experience from working with hundreds of multinational companies indicates that supply chain leaders are risk averse and reluctant to change because of having to confront large-scale legacy data and IT infrastructure issues as part of digital transformation.

We are concerned, however, that while top-down support is clearly strong, companies may be failing to communicate sufficiently with internal stakeholders. Going back to figure 1 on page 10, only 8 percent of respondents were actively “Gaining Broad Organizational Support.” This could signal that organizations are either not spending enough time on this phase or skipping it altogether.

The Skills Gap Poses Difficulties and Opportunities

Given the current low unemployment in the U.S., along with scarcity of technical talent, it’s no surprise that 23 percent of those we surveyed (see figure 3 on page 11) said they were obstructed in their transformation efforts by people/skills shortages. While 18 percent of respondents are addressing this by investigating ways to reduce the need for human capital (see figure 5), 48 percent are actively recruiting people with strong analytical skills.

All this bodes very well for skilled, upwardly-mobile supply chain graduates and professionals. Forty-one percent of respondents said their companies were offering internal growth/promotion as an incentive to retain staff. Thirty-eight percent of those surveyed said they were hiring people with established supply chain backgrounds and 31 percent were retraining existing staff into new roles.

All this suggests that companies’ moves toward automation do not appear to be happening at the expense of people. If anything, new technologies are deployed to handle repetitive number-crunching work and elevating the roles of supply chain staff. Our survey responses reflect exactly what we see in our customer base: companies redeploying planners into new, often customer-facing service roles, promoting them, or being able to offer better work/life balance.

To illustrate, ToolsGroup customer Shamir Optical’s global supply chain planning manager, Nila Azura, who started her career as a data entry administrator in production planning, applied her wealth of acquired business knowledge and deployed an automated planning system. This was a key factor that led to her promotion.

Size Matters

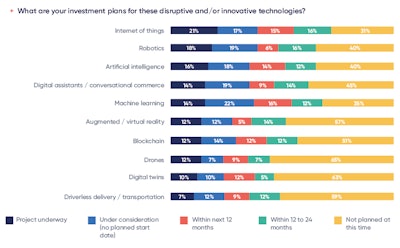

In our survey, we found some surprising differences in digital transformation maturity in relation to company size. Whereas in some business areas, smaller companies are more nimble and faster to embed new technologies, the opposite appears to be true in the realm of supply chain. Forty-one percent of large companies (above $1 billion in size) are currently executing digital transformation compared to only 14.9 percent of the smaller (below $500 million) companies.

However, there is some evidence to suggest that smaller companies simply don’t have the same urgency to transform as large ones. Only 8.3 percent of small companies, for example, said that a key driver was the move from legacy to cloud solutions, compared to 41 percent of large ones. That could well mean that many smaller companies already run (or started out with) cloud infrastructures and applications.

Large companies also reported a relatively urgent need to react to evolving customer behaviors and expectations (45 percent, compared to 26 percent in the $500 million to $1 billion group). The largest companies also had the greatest need to gain operational efficiencies and drive business performance (see figure 6). These are typical problems that large companies face as a consequence of their size.

“Real” Digital Transformation Is Complex and Integrated

As we reflect on the survey, one thing has become clear: the real capabilities and inherent benefits associated with this current wave of digital transformation in supply chain have kept pace with the hype and promise. Given the pragmatic nature of supply chain leaders, this is encouraging. We expect that as more companies succeed, others will follow.

Two points from the survey reinforce our belief that corporate adoption will continue to escalate. First, supply chain leaders are rightly treating digital transformation as a complex, integrated initiative involving people, process, technology, policy and metrics. This is one reason why we see some companies pushing back on purely technology-led solutions, like “digital twins,” which can replicate existing problems. Instead of rushing to introduce disruptive and innovative technologies, we see these same companies building the right infrastructure to properly implement and maintain these technologies in alignment with operational business goals. They are also working to hire skilled personnel to apply the technology profitably, and to incorporate change management principles to effectively embed these capabilities into corporate culture.

Second, efforts to realize the benefits of digital transformation are moving forward at pace. This survey clearly illustrates that the convergence of digital transformation technologies, AI, IoT and the like, have gained significant buy-in and investment from within the C-suite. The evidence shows that now is the time to execute on a strategy before opportunity and competitive advantage is lost. Digital transformation has not only changed the stakes, but the entire game. Companies are rapidly experiencing that “Kodak Moment,” where they will have to immediately determine their own digital transformation strategy or potentially cease to exist.