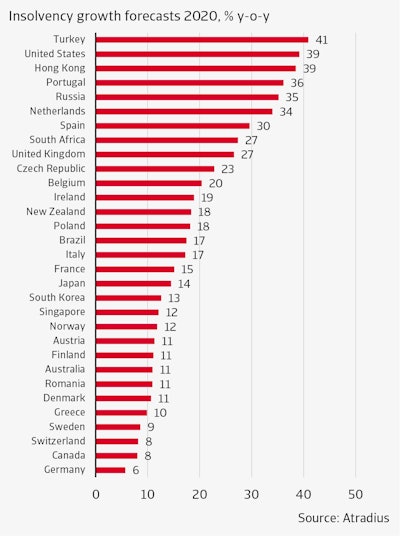

Atradius anticipates a 26% increase in global corporate insolvencies, largely in the second half of 2020. The increase is mainly driven by the impact the Covid-19 pandemic is having on global economies. Every major economy, except for China, is expected to enter recession this year. The depth and length of which will be determined by the ability of economies to manage health regulations and either exit lockdowns or thrive in social distancing.

Atradius Chief Economist John Lorié commented, "Government measures have reduced the anticipated increase in bankruptcy filings in a range of ways. They have either shifted the threshold for filing, reduced debtor's ability to force bankruptcy, or provided sufficient financial support to delay filings. However as the support programs begin to expire, the number of filings should climb rapidly."

Southern Europe economies are experiencing a bigger coronavirus impact than Northern Europe. Southern European economies such as Spain, Italy, France, Portugal and Greece typically rely more heavily on tourism. Germany, Denmark, Austria and the Netherlands are less dependent on tourism and have fared better in containing new infections, with their economies seeming to adapt better to social distancing restrictions. In Germany, the forecast of a particularly small rise in insolvencies reflects the low correlation between GDP and insolvencies as well as (along with Switzerland) less stringent lockdown measures. The UK is expected to experience the largest GDP contraction in Europe following a more stringent lockdown and Brexit uncertainty.

The US, Japan and Australia have more positive GDP outlooks than most European countries. However, the US, along with Hong Kong and Turkey, is expected to experience one of the largest insolvency increases. Japan's early lifting of restrictions put pressure on economic growth which may raise insolvency risks. And while Australia has been a model example for containment, its tourism industry may experience a latent impact causing a bigger increase in 2021 insolvencies.