Reading, United Kingdom—Mar. 14, 2014—A new report from Intermec by Honeywell shows that nearly 60 percent of suppliers surveyed in the fast-moving consumer goods (FMCG) industry admit that the amount of data they can now collect exceeds their capability to process and act upon it, therefore reducing their ability to compete in the marketplace.

This was just one of a number of significant challenges cited by 350 C-level executives and directors from across the globe, 63 percent of who believe their business is becoming more complicated, and is impacting their ability to meet consumer and retailer demands.

Pressure to deliver lower prices, increasing competition, retailer relations and government regulations were named by respondents as the most significant challenges that are troubling to their business.

In addition to overcoming these challenges is the need for suppliers to share more supply chain data with consumers. Globally, 57 percent of companies say their consumers are placing them under pressure to show better traceability.

However, this demand is not echoed by retailers, with just 35 percent of suppliers claiming they are put under pressure from their retailers to improve traceability.

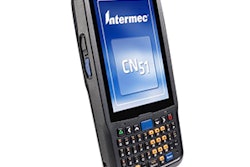

“The results of this survey clearly show that business today is increasingly complex and challenging, and there is no sign of that letting up,” said Brian Schulte, industry director for direct store delivery at Honeywell Scanning & Mobility. “It’s also clear that companies that are looking for ways to address their growing challenges and jump ahead of their competition are well-advised to look at re-engineering their processes, and consider upgrading the systems and technologies they use.

“With better processes and tools in the hands of their staff, consumer goods suppliers can benefit from efficiency and productivity gains, revenue increases, reduced costs, and improved in-store execution.”

The top areas of pressure faced by FMCG organizations were:

- Lower prices.

- Introducing more new products.

- Competition from private label/own brand products.

- Analyzing and leveraging customer data.

- More frequent visits.

With changing processes not among the top three pressure points for suppliers, it is perhaps no surprise that 51 percent of respondents indicated that they still use pen-and-paper processes in at least part of their direct store delivery (DSD) operations.

This leads to only 41 percent of companies responding that their route sales representatives have the tools they need to do their jobs effectively. And an almost identical amount (42 percent) believes that their DSD systems are fit for the future.

A first step highlighted by the respondents for addressing these issues is a re-engineering process to review the performance of current operations, technologies and systems, a step that just 32 percent of consumer goods organizations undertook in the past year. But of those companies that recently went through process re-engineering, 30 percent received, or expect to receive, annual savings over $500,000.