For global manufacturers, the past year has been challenging to say the least. Key industries, and everyday life ground to a halt while equipment and vehicles sat dormant. Sales plummeted, impacting manufacturers and supply chains everywhere. But, with vaccinations becoming more widely available and regulations loosening, we’re starting to get back to business as usual. The supply chain will accelerate as both materials and skilled technicians become more readily available. With a surge of demand on the horizon, original equipment manufacturers (OEMs) need to plan ahead to ensure they can meet customer needs.

Recovering from the bullwhip effect

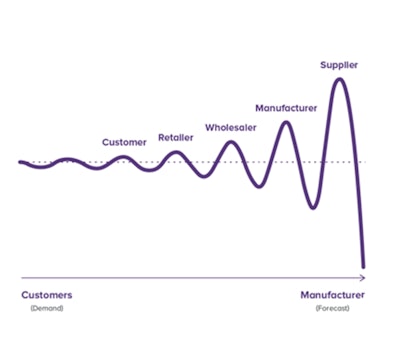

When sales drop drastically, the natural and often automatic response is to adjust forecasts, and consequently, order levels. A cash crunch resulting from a drop in sales can increase the pressure to reduce stock levels even further. Lower consumption and reorder points makes the change look even bigger for each upstream tier of the supply chain. This propagation and amplification throughout the supply chain is often referred to as the bullwhip effect. The same thing was seen following the 2008 financial crisis.

For example, if retail demand drops 25%, manufacturer orders may drop even more while retailers use up existing inventory. That could translate to a 50% demand drop for manufacturers, who in turn cut their orders to tier one suppliers, who stop ordering from tier two suppliers, and so on down the chain.

Syncron

Syncron

Now that the tide is turning and the global economy is once again in motion, demand is rising in almost every region. As retailers and manufacturers respond, they’ll place orders for quantities far beyond the rising level of consumption as they’ll also need to rebuild buffer stock. And this effect will again ripple throughout the supply chain.

More demand, less capacity

To compound matters further, many suppliers have already reduced capacity in response to the economic downturn. Others may have gone out of business or be unable to supply parts and products for regulatory reasons. As a result, the supply chain’s overall capacity to meet increasing demand will be lower. So how can manufacturers cope?

If you’re running a pure full system, capping your work in progress or the number of units in the supply chain will prevent you from ending up with a huge backlog of open orders waiting to be filled by the supplier. It’s also important to note that increasing forecasting based on false signals rather than true demand will result in excess inventory. This will lead to another period of pulling order levels back to below what’s being consumed and the cycle starts again.

While forecasting based on demand at each level may seem like a good way to plan ahead, this approach actually doesn’t do manufacturers or suppliers any favors in the long run. Immediate rightsizing is justified during times of uncertainty and when consumer demand is down. The problem is the tendency to overreact.

Visibility drives efficiency

To avoid fluctuating between over- and under-ordering, you need visibility into your actual consumption. This is especially key when demand patterns change. It’s also critical to include point of sales or consumption data in forecasting and planning. The closer you can get to planning your supply chain from end to end, the more likely you’ll be able to mitigate problems. This requires a better understanding of your end markets and sharing insights with your suppliers. After all, you both want to meet end-customer demand as efficiently as possible.

The nuts and bolts of supply chain management

On the operational side of the equation, an efficient network with IT support for redistributing stock both horizontally and vertically is key to serving customers and overcoming supply chain issues. If your business model includes independent retailers or dealers, you should enable and incentivize trans-dealer shipments, even when competing directly with each other. This will help to improve end-customer experiences and recover faster from urgent backorders toward your own distribution centers, while simultaneously balancing out excess stock in the network.

Implementing proven strategies and methods can help your organization ride the post-pandemic wave and minimize the bullwhip effect’s impact on your ability to serve customers. Consider the following areas to focus on:

Strategic supplier management. Segmenting your parts and suppliers based on business criticality and how prone they are to disruption allows you to differentiate your sourcing strategy for different suppliers.

Lead time management. Many suppliers will have longer lead times as result of layoffs, reduced capacity and regulatory reasons. Get ahead of this now by manually adjusting lead times in your system and planning. When things return to normal, use dynamic lead time adjustment to stay ahead of the curve.

Stock allocation. If your critical parts stock is low and suppliers are closed, or have limited availability in certain locations, stock allocation can help you ration that inventory. Prioritize order lines and allocate smaller quantities based on urgency.

Outlier management. Keep an eye out for skyrocketing or plummeting demand and take these levels out of your forecasting data to ensure you don’t over-correct, targeting unreasonable stock levels.

Pull/consumption-based inventory optimization. If using a re-order point system, pay close attention to items with a lot of backorders and reservations. Focus instead on end-customer consumption or “pull.” The same applies to the opposite situation, when demand plummets—make sure your system, or planner, doesn’t overcompensate.

Point of sales forecasting. Get a clearer picture of true demand by basing forecasting and replenishment models on actual consumption rather than on batch-size grouped demand. This also prevents skewing due to lead time or larger batch sizes. If you have the data and systems in place to do so, look at consumption data at every level of the supply chain.

Forecast aggregation. Another option is to aggregate downstream forecasting, taking planner adjustments into consideration with downstream adjustments propagated upstream. Just be aware that the human tendency to over-react can disguise actual consumption levels.

Multi-echelon inventory optimization (MEIO). For the best possible inventory optimization, you need a fully integrated approach that spans many levels and takes internal dependencies into account. While this strategy has the potential to deliver 30% supply chain stock savings by moving inventory closer to the customer, it can also create the bullwhip effect within your supply chain at the time of implementation. If you haven’t already implemented MEIO, it may be better to wait until the demand-supply balance has returned to more normal levels, so you don’t risk sending an additional shockwave through your system.

As the world and key industries adjust to the new normal, manufacturers should be ready for a busy year ahead. Stay calm, focus on actual consumption levels, and keep open lines of communication with your suppliers. That’s the key to meeting immediate customer demand and building long-term resilience.