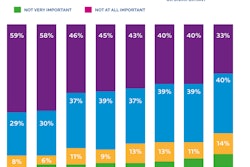

In the most recent Supply & Demand Chain Executive Readers’ Survey, one of the questions was “Which of the following supply chain areas is most important to you?” Demand management appeared on almost 60 percent of the responses.

As Lora Cecere, founder and CEO of Supply Chain Insights, has written, supply chain leaders are becoming increasingly concerned over demand volatility. “Global market expansion and specific regional needs heightens this concern. Further, the proliferation of products and the changing needs of customers make it more critical than ever to sense market demand and quickly translate the requirements into the supply chain response.”

Cecere says that Supply Chain Insights’ research shows that demand planning is the most misunderstood of any supply chain planning application. While companies are the most satisfied with warehouse and transportation management, they are the least satisfied with demand planning.

“Teams are also confused about the demand planning process,” she writes. “They are unclear on how to move forward. What drives process excellence is not clear. And well-intentioned consultants brought in to help achieve that clarity often give bad advice.”

Analytics, of course, are changing the game for demand planning, just as they are doing throughout the supply chain. There’s more information to sift through, but when done properly, it can be a great advantage.

In his Logistics Viewpoint blog, “Supply Chain Planning—Graduating from Demand Forecasting 101,” author Clint Reiser writes that demand management applications “offer a comprehensive set of functionality. They are used to organize, structure, manage and perform analysis on a large amount of data that is typically too unwieldy for spreadsheets. The analytical capabilities in today’s solutions include a wide array of demand forecasting and other statistical formulas to assist with predicting future sales and determining the causes of variation.”

There are powerful and widely used software solutions available with usability “placing the statistical complexities in the background of the user’s experience,” Reiser writes, adding that the usability enhancements are applicable to the overall product.

The solutions include a broad array of forecasting methods and algorithms, as well as data cleansing and management features. The planning software vendors are consistently improving their solutions by adding features and enhancing the usability of their systems. These usability enhancements streamline processes and minimize complexity by providing step-by-step guidance for the demand planners, allowing them to focus on the big picture. “I believe these usability enhancements improve the value of the solutions. But I also believe that it is important to periodically look under the hood of the demand planning vehicle being driven,” says Reiser.

He writes that a demand forecasting model with a high level of explanatory power may not retain that capability when used out of sample or on a different data set. The model must be logical.

Some software solutions “offer the ability to forecast sales for new product introductions by leveraging the sales history of products with similar attributes. Similar attributes may, in some cases, have predictive power, but it is important to choose the correct attributes. In these cases where product sales history is not available, proper logic is required to choose the common attributes that can offer predictive insights into new product sales,” according to Reiser.

Escaping the Plateau

Lora Cecere has written in Supply Chain Insights that too few supply chain teams successfully post improvements to their balance sheets through demand planning initiatives, indicating that, while improvements can be made, progress slowed over the last 10 years, resulting in a supply chain plateau. Growth is slowing, she writes, while inventories are climbing and costs escalating.

“Getting the basics right in the demand planning process is essential to moving supply chain results past the current plateau. However, too few companies know what to do or how to do it,” says Cecere. “The supply chain is a complex system that has grown even more complex over the decade. Most companies understand that it is complex, but they do not see it as a complex system. In a complex system, there are finite tradeoffs between areas. In the supply chain, these tradeoffs include growth, costs, cycles and complexity.”

Each supply chain has a potential based on the tradeoffs of these factors. As a result, companies cannot make improvements in operating margin without affecting inventories unless they improve the supply chain potential. One of the most effective ways to increase the potential of the supply chain is to improve the demand signal.

“As products proliferate, channels become more specialized and, as companies span global geographies, demand planning principles grow in importance,” Cecere stresses. “Organizational design, process design, and how the data is used in demand processes all play a major role in defining the differences between leaders and laggards. An important factor in making demand planning progress is the design of reporting relationships. Based on our work with more than 300 companies, we have concluded that a reporting relationship to a central group or a supply chain center of excellence gives companies an advantage in getting past the plateau.”

By contrast, she says, her research shows that companies with reporting relationships to the sales organization tend to post the worst results in demand planning. These organizations are plagued by high, and often uncontrolled, bias. Reporting relationships to marketing and manufacturing are similarly problematic. The bias in these relationships is not as high as it is with sales reporting, but it is higher than in organizations with reporting relationships to a neutral, cross-functional analytics group.

In short, Cecere concludes, the traditional supply chain is designed to respond, not to sense. “As market opportunities change, this design cannot flex and adapt; the companies are not well-suited for periods of high demand volatility. Creating an adaptable system that can sense and respond—and better manage volatility—requires a radical departure from traditional design approaches. The system needs to be designed from the outside-in. It needs to embrace the concepts of demand management.”