Stamford, CT — August 1, 2008 — Manufacturing executives plan to use supply chain as a key mechanism to improve both top- and bottom-line performance, despite challenges of the current economic environment, according to results of a recent survey prepared by management consulting firm Archstone Consulting.

Nearly three-quarters of the 265 manufacturing executives surveyed in Archstone's Manufacturing Executive Agenda for 2008 felt that the current market pressures, including sharply rising commodity prices, a sluggish economy and foreign competition, may be triggering significant transformational changes within manufacturing organizations.

"Over 80 percent of manufacturers have responded to the current economic climate by devising aggressive agendas to boost sales and cut costs," said Todd Lavieri, president and CEO of Archstone Consulting.

Two of the four most common ways that executives plan to bolster performance in 2008 depended upon the capabilities of supply chain.

"An interesting pattern emerged, in that manufacturers across the board have high expectations for their supply chains to both boost revenues and reduce costs," said John Ferreira, industrial manufacturing practice leader at Archstone Consulting.

"In the past manufacturers simply used their supply chains as a means to control costs by improving efficiencies," Ferreira continued. "Now they are using their supply chains as a mechanism to boost revenue and improve customer satisfaction through capabilities like better management of highly customized products, quicker delivery times and more integrated services."

The four executive agenda items shared by manufacturers in all industries include:

Industry Trends

Archstone also identified several major industry trends in its Manufacturing Executives Agenda for 2008 surveys, including:

Archstone Consulting launched the Manufacturing Executive Agenda for 2008 survey in April to examine which macroeconomic constraints are having the most significant impact on manufacturing executives, what cost and revenue targets have been established, and what strategies or areas of focus executives are evaluating to achieve those targets. Over 265 respondents participated in this survey.

Nearly three-quarters of the 265 manufacturing executives surveyed in Archstone's Manufacturing Executive Agenda for 2008 felt that the current market pressures, including sharply rising commodity prices, a sluggish economy and foreign competition, may be triggering significant transformational changes within manufacturing organizations.

"Over 80 percent of manufacturers have responded to the current economic climate by devising aggressive agendas to boost sales and cut costs," said Todd Lavieri, president and CEO of Archstone Consulting.

Two of the four most common ways that executives plan to bolster performance in 2008 depended upon the capabilities of supply chain.

"An interesting pattern emerged, in that manufacturers across the board have high expectations for their supply chains to both boost revenues and reduce costs," said John Ferreira, industrial manufacturing practice leader at Archstone Consulting.

"In the past manufacturers simply used their supply chains as a means to control costs by improving efficiencies," Ferreira continued. "Now they are using their supply chains as a mechanism to boost revenue and improve customer satisfaction through capabilities like better management of highly customized products, quicker delivery times and more integrated services."

The four executive agenda items shared by manufacturers in all industries include:

- Increasing revenue growth by leveraging supply chain capabilities to add value to products and services.

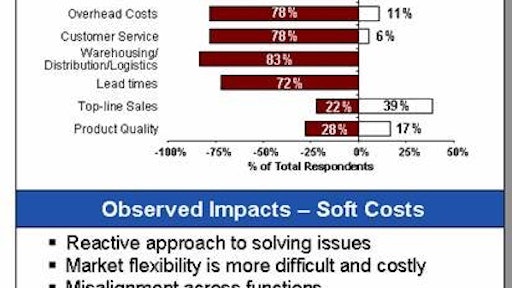

- Reducing costs with supply chain efficiency improvements.

- Improving product innovation.

- Controlling direct material costs.

Industry Trends

Archstone also identified several major industry trends in its Manufacturing Executives Agenda for 2008 surveys, including:

- Aerospace & Defense: Nearly 70 percent plan to simultaneously increase revenues and reduce costs by 3 percent or more.

- Consumer Packaged Goods: Nearly 90 percent anticipate cost reductions of 3 percent or greater. CPG executives cited managing direct material and commodity costs as the most important to achieving cost targets.

- Electrical & Electronic Equipment: Over 90 percent consider the sluggish economy to be a major constraint, and less than half expect revenue growth of 3 percent or more.

- Pharmaceuticals: Nearly 70 percent expect to reduce costs by 3 percent or higher, and 72 percent anticipate revenue growth of 3 percent or more.

Archstone Consulting launched the Manufacturing Executive Agenda for 2008 survey in April to examine which macroeconomic constraints are having the most significant impact on manufacturing executives, what cost and revenue targets have been established, and what strategies or areas of focus executives are evaluating to achieve those targets. Over 265 respondents participated in this survey.