Lexington, MA — December 10, 2009 — 'Tis the season for predictions about how the year ahead is shaping up, and IHS Chief Economist Nariman Behravesh is first up with his "Top 10 Economic Predictions for 2010."

His quick take on what the New Year holds in store: Global GDP will grow only 2.8 percent in 2010, much better than the 2.0 percent drop in 2009, but well below the 3.5-4.0 percent trend rate of growth for the world economy. Most emerging markets, particularly Asia, will outpace the developed economies next year, Behravesh believes, while the U.S. economic recovery will begin the year slowly, and Europe and Japan will rebound even more slowly.

Behravesh and experts at IHS Global Insight, which offers economic and financial analysis and forecasting, utilize proprietary economic models developed over more than 45 years to develop the annual list of Top 10 Economic Predictions. Here's a look at what they see coming up next year:

1. The U.S. Recovery Will Start Slowly. IHS Global Insight expects U.S. growth to be stuck in a 2.0-2.5 percent range for much of 2010. While housing and capital spending on equipment are expected to show respectable gains, with consumer spending rising just 1.8 percent, stronger gross domestic product (GDP) growth will be impossible. One of the biggest drags on spending by households will be the unemployment rate, which should move up to around 10.5 percent during the first quarter.

2. Europe and Japan Will Rebound More Slowly than the United States. Europe and Japan suffered through deeper recessions than the United States and are likely to see more modest recoveries. The Eurozone and the U.K. economies are expected to grow 0.9 percent and 0.8 percent, respectively, in 2010. Some West European economies — Iceland, Ireland and Spain — will continue to contract next year as the aftershocks of the housing bubbles and financial crises take their toll. Japan, on the other hand, will do better, with GDP growth of 1.4 percent.

3. Most Emerging Markets — Especially in Asia — Will Outpace the Developed Economies. Growth in all the emerging regions will recover in 2010 and, with the possible exception of "Emerging Europe," will outpace the United States, Europe and Japan. Non-Japan Asia will be at the forefront with GDP growth of 7.1 percent. Latin America, the Middle East and Africa will see gains in the 3-4 percent range. The laggard will be "Emerging Europe," which will expand only 1.7 percent.

4. Interest Rates in the G8 Economies Will Remain Very Low. While some central banks (notably in Australia, Israel and Norway) have already started to raise interest rates, the Federal Reserve, European Central Bank, Bank of England and the Bank of Japan are unlikely to raise rates before the third quarter of 2010. Nevertheless, some Asian central banks, notably the Reserve Bank of India and the People's Bank of China, may pull the trigger sooner — in the first or second quarters.

5. Fiscal Stimulus Will Begin to Ease. Aggressive fiscal stimulus by some countries (especially the United States and China) helped to cushion the blow of the financial meltdown a year ago. With that crisis now over, though, most countries have no plans for further stimulus and some are set to tighten (e.g., the January boost in the value-added tax in the United Kingdom). Even in the United States, where there is talk of a second stimulus package, there is no money for anything more than a symbolic attempt to relieve some of the pain from job losses.

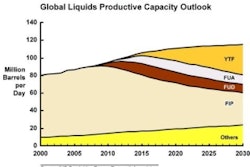

6. Commodity Prices Will Move Sideways. The extent of the recent rise in commodity prices cannot be justified, given the slow pace of the recovery. Some of the increase can only be attributed to investor activity. As such, IHS Global Insight and IHS CERA (which provides analysis on energy markets, geopolitics, industry trends and strategy) believe that oil and other commodity prices will likely soften in the coming months. Specifically, oil prices are expected to fall from current levels (in the $75-80/barrel range) to around $65 by next spring, before gradually moving above $70/barrel by the end of 2010 as the global recovery picks up steam.

7. Inflation Will (Mostly) Not Be a Problem. In most regions of the world, inflation will remain tame. Rising unemployment rates will put a big damper on wage increases and large amounts of excess capacity worldwide will limit the ability of businesses to raise prices. The only inflationary pressures will be in countries that are growing rapidly (mostly in Asia) and countries that peg (or closely tie) their currencies to the dollar (principally in the Middle East and Asia).

8. After Improving for a While, Global Imbalances Will Worsen Again. The deep U.S. recession was a key factor in the current-account deficit plunging from more than $700 billion in 2008 to near $450 billion in 2009. Nevertheless, IHS Global Insight expects this deficit to widen by about $90 billion in 2010. Some of this is because the U.S. economy will be growing faster than most other developed economies. However, continuing dependence on export-led growth in several large economies (e.g., Germany, China and the rest of Asia) is also a factor.

9. While the Dollar May Strengthen a Little, It Is on a Downward Glide Path. Given the slightly better prospects for the U.S. economy, relative to those of Europe and Japan, the dollar is likely oversold. This means that there could be a slight appreciation in the coming months. However, given that the progress on reducing global imbalances has been temporary, the downward pressure on the dollar will continue. This downward movement is likely to be the greatest against emerging-market currencies because of stronger growth prospects in those economies.

10. The Risk of a "Hard W" Is Still Uncomfortably High. There is about a one-in-five chance of a double-dip or "hard W" downturn. This could be triggered by any number of factors, including a premature tightening of fiscal and/or monetary policies, a major retrenchment of consumer spending in the face of rising unemployment, a sharp and sustained rise in oil prices (either because of a supply disruption or increased speculative activity), and the failure of a few large financial institutions. It would probably take some combination of these factors to drag global growth back into negative territory.

His quick take on what the New Year holds in store: Global GDP will grow only 2.8 percent in 2010, much better than the 2.0 percent drop in 2009, but well below the 3.5-4.0 percent trend rate of growth for the world economy. Most emerging markets, particularly Asia, will outpace the developed economies next year, Behravesh believes, while the U.S. economic recovery will begin the year slowly, and Europe and Japan will rebound even more slowly.

Behravesh and experts at IHS Global Insight, which offers economic and financial analysis and forecasting, utilize proprietary economic models developed over more than 45 years to develop the annual list of Top 10 Economic Predictions. Here's a look at what they see coming up next year:

1. The U.S. Recovery Will Start Slowly. IHS Global Insight expects U.S. growth to be stuck in a 2.0-2.5 percent range for much of 2010. While housing and capital spending on equipment are expected to show respectable gains, with consumer spending rising just 1.8 percent, stronger gross domestic product (GDP) growth will be impossible. One of the biggest drags on spending by households will be the unemployment rate, which should move up to around 10.5 percent during the first quarter.

2. Europe and Japan Will Rebound More Slowly than the United States. Europe and Japan suffered through deeper recessions than the United States and are likely to see more modest recoveries. The Eurozone and the U.K. economies are expected to grow 0.9 percent and 0.8 percent, respectively, in 2010. Some West European economies — Iceland, Ireland and Spain — will continue to contract next year as the aftershocks of the housing bubbles and financial crises take their toll. Japan, on the other hand, will do better, with GDP growth of 1.4 percent.

3. Most Emerging Markets — Especially in Asia — Will Outpace the Developed Economies. Growth in all the emerging regions will recover in 2010 and, with the possible exception of "Emerging Europe," will outpace the United States, Europe and Japan. Non-Japan Asia will be at the forefront with GDP growth of 7.1 percent. Latin America, the Middle East and Africa will see gains in the 3-4 percent range. The laggard will be "Emerging Europe," which will expand only 1.7 percent.

4. Interest Rates in the G8 Economies Will Remain Very Low. While some central banks (notably in Australia, Israel and Norway) have already started to raise interest rates, the Federal Reserve, European Central Bank, Bank of England and the Bank of Japan are unlikely to raise rates before the third quarter of 2010. Nevertheless, some Asian central banks, notably the Reserve Bank of India and the People's Bank of China, may pull the trigger sooner — in the first or second quarters.

5. Fiscal Stimulus Will Begin to Ease. Aggressive fiscal stimulus by some countries (especially the United States and China) helped to cushion the blow of the financial meltdown a year ago. With that crisis now over, though, most countries have no plans for further stimulus and some are set to tighten (e.g., the January boost in the value-added tax in the United Kingdom). Even in the United States, where there is talk of a second stimulus package, there is no money for anything more than a symbolic attempt to relieve some of the pain from job losses.

6. Commodity Prices Will Move Sideways. The extent of the recent rise in commodity prices cannot be justified, given the slow pace of the recovery. Some of the increase can only be attributed to investor activity. As such, IHS Global Insight and IHS CERA (which provides analysis on energy markets, geopolitics, industry trends and strategy) believe that oil and other commodity prices will likely soften in the coming months. Specifically, oil prices are expected to fall from current levels (in the $75-80/barrel range) to around $65 by next spring, before gradually moving above $70/barrel by the end of 2010 as the global recovery picks up steam.

7. Inflation Will (Mostly) Not Be a Problem. In most regions of the world, inflation will remain tame. Rising unemployment rates will put a big damper on wage increases and large amounts of excess capacity worldwide will limit the ability of businesses to raise prices. The only inflationary pressures will be in countries that are growing rapidly (mostly in Asia) and countries that peg (or closely tie) their currencies to the dollar (principally in the Middle East and Asia).

8. After Improving for a While, Global Imbalances Will Worsen Again. The deep U.S. recession was a key factor in the current-account deficit plunging from more than $700 billion in 2008 to near $450 billion in 2009. Nevertheless, IHS Global Insight expects this deficit to widen by about $90 billion in 2010. Some of this is because the U.S. economy will be growing faster than most other developed economies. However, continuing dependence on export-led growth in several large economies (e.g., Germany, China and the rest of Asia) is also a factor.

9. While the Dollar May Strengthen a Little, It Is on a Downward Glide Path. Given the slightly better prospects for the U.S. economy, relative to those of Europe and Japan, the dollar is likely oversold. This means that there could be a slight appreciation in the coming months. However, given that the progress on reducing global imbalances has been temporary, the downward pressure on the dollar will continue. This downward movement is likely to be the greatest against emerging-market currencies because of stronger growth prospects in those economies.

10. The Risk of a "Hard W" Is Still Uncomfortably High. There is about a one-in-five chance of a double-dip or "hard W" downturn. This could be triggered by any number of factors, including a premature tightening of fiscal and/or monetary policies, a major retrenchment of consumer spending in the face of rising unemployment, a sharp and sustained rise in oil prices (either because of a supply disruption or increased speculative activity), and the failure of a few large financial institutions. It would probably take some combination of these factors to drag global growth back into negative territory.