New York — May 12, 2010 — Mergers and acquisitions activity is set to pick up in the automotive sector and will drive significant changes in the industry, but M&A appears to be off to a slow start in the industrial manufacturer space, according to new reports from PricewaterhouseCoopers LLP (PwC).

Meanwhile, PwC suggests that M&A deal activity for global chemicals sector remains strong so far this year, while activity in the global metals sector has improved moderately to date in 2010.

Automotive Revs Up

Automotive M&A activity will continue to drive the fundamental changes necessary for the near-term restructuring and long-term sustainability of the industry, and the deal market will play a critical role as market participants pursue transactions with a focus on synergies, including cost savings and adding revenue to their business, according to the PwC report "Drive Value — Automotive M&A Insights 2009."

"The current deal environment is showing positive signs and presents a number of opportunities for both strategic and financial buyers who have access to financing," said Paul Elie, U.S. automotive transaction services leader at PwC.

"Companies with stronger operating models and cash positions will likely leverage M&A to develop a competitive advantage through the consolidation of scale and expertise," emphasized Paul McCarthy, U.S. automotive strategy leader at the consultancy.

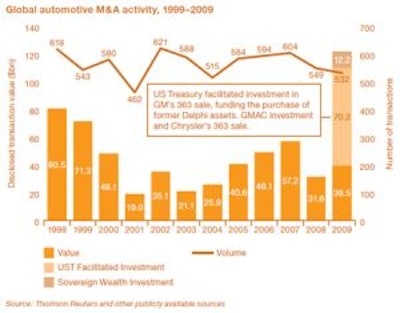

The publication highlights a variety of factors driving the deal market in 2009 and provides an outlook for 2010 and beyond. According to the report, automotive M&A deal value soared to $121.9 billion for 2009, up 286 percent from $31.6 billion in 2008.

The increase in deal value was influenced heavily by the U.S. Treasury investment in the vehicle manufacturing sector, which occurred in response to a near collapse of the automotive industry. Players across the automotive value chain reacted as they sought capital infusions, shed noncore assets, renegotiated debt obligations and pursued mergers of necessity.

Despite the record high deal value in 2009, the total deal volume fell to 532 transactions, representing a 3 percent decline from an already weak 2008 level and its lowest point since 2004.

"As we look forward, companies are likely to increase their focus on growth and the traditional drivers of M&A — driving economies of scale, acquiring technology and expanding their geographic and customer base," said Elie.

Automotive companies seeking long-term success will drive the deal market in 2010 by developing and executing strategies for sustainable growth and value creation, PwC added. The report is available at http://www.pwc.com/auto.

Industrial Weaker than Expected

M&A deal activity in the global industrial manufacturing (IM) industry was weaker than expected during the first quarter of 2010, as total deal value and volume declined on a year-over-year basis and sequentially, according to the PwC report "Assembling Value: First quarter 2010 Global Industrial Manufacturing Mergers and Acquisitions Analysis."

In the first quarter of 2010, there were only 11 announced deals with total transaction values greater than $50 million, representing a decline from the 16 deals announced in Q1 2009 and 31 deals in Q4 2009.

In terms of value, deals totaled $1.9 billion in the first quarter of 2010, compared with $2.0 billion and $9.6 billion in the first and fourth quarters of 2009, respectively. Despite the decline in deal volume and total value, average deal value in the first quarter of 2010 increased on a year-over-year basis to $200 million in Q1 2010 compared to $100 million in Q1 2009.

"While expectations for deal activity in Q1 were weak relative to the fourth quarter 2009 results, the belief was that year-over-year trends would improve. However, this was not the case," said Barry Misthal, U.S. industrial manufacturing leader with PwC. "Though the year is off to a slow start, we believe the deal environment will improve throughout 2010 as credit availability continues to loosen and risk aversion continues to moderate."

Smaller deals (valued at $50 million or less) and transactions with undisclosed values dominated overall activity, which is consistent with historical trends. The level of mid-market, large and mega-deal activity continued to be constrained, although the near-term outlook for a turnaround is favorable, according to the report.

Transactions involving both U.S. targets and buyers were the key drivers of deal activity during the first quarter of 2010, reversing a long-standing trend. Of the 11 transactions announced during Q1, seven (64 percent) involved a U.S. entity. This compares with an average of 39 percent over the last four years (2006-2009). Similarly, 79 percent of total deal value during the first quarter was attributable to U.S.-affiliated activity, compared with an average of 50 percent over the last four years.

The regional breakdown of M&A deals shows that targets located in North America were the primary drivers of deal activity, as 55 percent of transactions announced were in the region. Additionally, all six transactions announced in the North American region were in the U.S.

In relative terms, Asia and Oceania remained a strong region for deal activity. However, on an absolute basis, only two transactions were announced in the region compared with 35 in 2009. Similarly, the U.K. and Eurozone region contributed meaningfully on a relative basis, but, in absolute terms, only two transactions originated in the region.

Due Diligence in a Recovering Economy

The report takes a closer look at the role of M&A due diligence in a recovering economy and the impact it will have in the industrial manufacturing sector. As the global economy begins to recover, deal making might offer the leverage that IM companies need to push ahead of the competition. It will be the companies with strong balance sheets and robust cash reserves that are in the best position for strategic M&A opportunities.

According to the report, to make the right deal, IM companies must consider how two years of economic contraction have altered the balance of supply and demand within the value chain as well as how it has significantly changed and elevated the importance of due diligence. Healthcare, climate change, commodity prices, pension plan structures, changing tax laws, company culture and the role of human resources must be factored into today's due diligence process.

M&A activity inevitably generates a certain amount of immediacy, so it pays to be prepared, the report states. Companies that might be rusty in the area of due diligence because few (if any) deals were completed during the past two years may need to dust off their existing processes and make sure the right resources are in place so they are ready when opportunity knocks.

The report is available at http://www.pwc.com/us/en/industrial-products/publications/assembling-value.jhtml.

Global Chemicals Heating Up

Deal activity in the global chemicals industry was much stronger in the first quarter of 2010 than the first quarter of 2009, increasing by 33 deals or 15 percent, according to the PwC report "Chemical Compounds: First Quarter 2010 Global Chemicals Industry Mergers and Acquisitions Analysis."

When looking at deals with a disclosed value greater than or equal to $50 million, activity is up by 11 deals or 110 percent over the same time period. With the financial markets and global economy beginning to recover, these results are consistent with expectations.

Large deal activity is off to a strong start in Q1 2010, as five deals with a value greater than $1 billion were announced, substantially driving total deal value. These five deals accounted for $17.9 billion in deal value, representing 80 percent of total activity in the first quarter of 2010 already surpassing total large deal activity for all of 2009.

Excluding large deals, the average deal size in Q1 2010 remained relatively consistent with all of 2009 at $43 million (107 deals) in Q1 2010 compared with $42 million (401 deals) for all of 2009.

"Based on our current view of the market and the transactions in progress, we are optimistic that the level of M&A activity will remain strong in 2010," said Saverio Fato, global chemicals leader for PricewaterhouseCoopers. "Proactive companies in the chemicals sector that are willing to invest up-front time preparing for deals so that they can move quickly as opportunities become available will be able to effectively utilize M&A as a growth tool to reposition themselves."

The trend of fewer deal announcements by financial investors has continued into the first quarter of 2010, with only 11 percent of deals including a financial investor compared with 20 percent in 2007. As the economy and the debt markets continue to recover, it is possible that we will see a higher level of financial investor deal activity in the chemical sector, according to PwC.

In fact, we have already seen some financial investors come off of the sidelines and actively participate in the bidding process for several of the recent deals. One of the large deals in the first quarter of 2010 was made by a financial investor, in contrast to 2009 when no acquisitions were made by financial investors.

The five large deals were the primary drivers of the trend in terms of deal value in the first quarter of 2010. While there was strong activity in Asia and South America, deal value was relatively low due to a lack of large deals. In addition to a disproportionately high value in North American deals, driven by several of the large ones, the majority of deal activity was intra-country, with only 22 of the 112 announced deals with a disclosed value being cross-border deals ($5.8 billion of the total $22.5 billion deal value).

The report is available at http://www.pwc.com/us/en/industrial-products/publications/chemical-compounds.jhtml.

Global Metals Improves Moderately

Finally, activity in the global metals industry indicates that the volume and value of deals announced in the first quarter of 2010 improved moderately from the quarterly lows of 2009, according to report "Forging Ahead: First Quarter 2010 Global Metals Industry Mergers and Acquisitions Analysis."

In the first quarter of 2010, the 21 deals announced rank above the three-year quarterly low of 17 deals announced in both the first and second quarters of 2009, although it is down from the 34 deals announced in the fourth quarter of 2009.

Additionally, the $5.9 billion deal value announced in Q1 2010 remains above the three-year quarterly low of $4.6 billion in the third quarter of 2009. While deal totals have not yet fully recovered from the downturn, the environment is becoming more conducive to deal activity in the metals sector.

After a relative pause in mega deal activity in the metals sector during 2009, these deals began to reemerge in Q1 2010. Two mega deals were announced during the first quarter of 2010, exceeding the pace of 2009.

"This continuation of mega-deal activity provides evidence that some acquirers are ready to engage in deal making at the higher end of the value spectrum. Supporting this are higher commodity prices, improved access to capital and greater confidence in the strength in the recovery," said Robert W. McCutcheon, U.S. metals leader with PwC. "We believe that these factors have also contributed to the increased interest in controlling stakes, a trend that matches our prediction in the fourth quarter 2009. Looking forward into 2010, the sector's M&A flow will likely continue to grow."

Entities from emerging and developing economies appear to have increasingly become more aggressive as acquirers of metals targets. The large increase in the proportion of deals involving these acquirers has been driven by greater involvement from Chinese acquirers. In 2009, 38 percent of acquirers were Chinese entities. In the first quarter of 2010, this proportion grew to a majority (57 percent) of acquirers.

"Globally, the relative sense of urgency to engage in new deals is likely greatest for steel companies, which face a consolidated base of iron ore suppliers. This could lead to additional horizontal mergers among steel constituents or backward integration," said Jim Forbes, PricewaterhouseCoopers' global metals leader. "Although many strategic buyers have been slow to resume their M&A activities, we believe it is only a matter of time before these acquirers look more seriously at potential growth opportunities. A more stable global economy, generally supportive capital markets, and improved financial positions should encourage these entities to enter the deal market."

The regional distribution of deals by acquirer region is highlighted by the influence of Chinese deals, which drove Asia and Oceania acquirer totals in the quarter. In the first quarter of 2010, four of the five largest deals and 12 of the 21 total deals involved Chinese acquirers. This regional distribution of deal activity is unlikely to change significantly through the balance of 2010, as emerging-market entities in Asia & Oceania continue to fuel much of cross-border activity among metals companies.

The report is available at http://www.pwc.com/us/en/industrial-products/publications/forging-ahead.jhtml.

![Pros To Know 2026 [color]](https://img.sdcexec.com/mindful/acbm/workspaces/default/uploads/2025/08/prostoknow-2026-color.mduFvhpgMk.png?auto=format%2Ccompress&bg=fff&fill-color=fff&fit=fill&h=100&q=70&w=100)