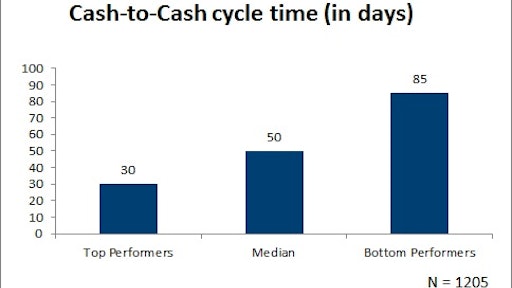

Cash-to-cash cycle time looks at the number of days of working capital an organization has tied up in managing its supply chain. The faster the cash-to-cash cycle, the fewer days an organization's cash is unavailable for use. American Productivity and Quality Center (APQC) research shows that top performers have a cash-to-cash cycle time of a month, whereas bottom performers have a cycle time of nearly three months.

Reducing cash-to-cash cycle time involves eliminating factors (such as inventory) that tie up operating capital. Organizations can optimize inventory to free up capital while maintaining enough stock to satisfy customer orders. This can be accomplished through a well-designed inventory optimization strategy that aligns roles and responsibilities in the supply chain, and identifies processes that can be streamlined.

Streamlining order-to-cash processes can also reduce cash-to-cash cycle time because faster invoice processing and receipt of customer payment decreases the amount of time that an organization’s capital is unavailable. Organizations can revisit their invoicing processes to see how they can be made faster. Organizations can also reduce needless activities and revise inefficient processes that increase the likelihood of billing errors.

The data above originated from APQC’s Open Standards Benchmarking in supply chain planning, which contains metrics related to supply chain planning performance as collected from participating organizations. These metrics can help your organization see where it stands in relation to its peers and identify potential areas for improvement.