Today’s global supply chains work to an ever tighter set of interdependencies, where “just-in-time” and “lean manufacturing” have become standard practices. This evolution, coupled with an increasing trend among companies to source globally and with a rise in disruptive natural catastrophes (often in those areas where new supply capacity has been developed), has led to growth in business and contingent business interruption. Manufacturers are increasingly being caught out by the closure of critical suppliers, a trend which has both insurers and businesses concerned.

While insurance does not take into account loss of market share, declines in investor confidence or share price losses, it ensures short term liquidity for the insured to mitigate the financial impact. Transferring financial risks to an insurer is therefore a tool for managing supply chain interruptions.

How it works

Insurance is one tool for managing costly and common supply chain interruptions

Intrinsically linked, revenues, profits, reputation, market position and share price are seen as the pillars of corporate resilience: a blow to any of these props could cause serious issues for a company and its management team. Yet, all are at risk of crumbling if an organization cannot maintain its supply chain of raw materials or critical component parts in the wake of a natural catastrophe, an information technology breakdown or labor strife. In a global sourcing world, disruption in one part of the world is rarely contained to that area: the ripple effect of localized devastation, disorder or calamity has the power to significantly damage international business interests.

Paradoxically, while complex supply chains are designed to minimize production costs, their reach from a manufacturing plant in one part of the world to an off-shored or outsourced operation in another makes them a conduit for catastrophe-related disruption. The impact of a disturbance at the manufacturing end of the chain is almost immediate, but the knock-on impact follows rapidly down the supply chain to other companies—an effect that can take years for full recovery.

To mitigate potential damage and protect themselves against financial losses following a supply chain disruption, companies can seek insurance cover for business interruption (BI) and contingent business interruption (CBI), as part of their property insurance. Essentially, both BI and CBI insurance cover AGCS’s clients’ net profits in the event an insured peril damages or destroys a covered property and interrupts production. Both protections also cover some ongoing costs for the policyholder, such as wages, building lease or mortgage costs and other fixed costs. Business interruption insurance responds when the insured owns the property that is damaged or destroyed. Typically, clients can tap their full property insurance policy limits to cover their business interruption losses.

CBI insurance responds when the affected property is controlled by a supplier or customer that is important to the insured party (the “insured” or policyholder). In that loss scenario, the insured’s own property is undamaged. However, CBI insurance would be triggered if the insured is still forced to slow or halt production—and therefore loses profits—because the supplier with damaged operations cannot deliver critical raw materials or component parts, or the customer does not request the parts from the insured. Industrial insurers such as Allianz Global Corporate & Specialty SE typically offer policyholders sub-limited CBI coverage, or limits that are lower than the property insurance policy’s full limits. Both insurances also provide cover for external perils too, which could include natural catastrophes—such as hurricanes, earthquakes, flooding and landslides—and fire. An example of an internal peril would be a machinery breakdown.

While insurance is an important risk management tool for companies with complex supply chains, taking out insurance should not be seen as stand-alone solution. Insurance will address part of the risk, but practical risk management is also required from each company to prevent or at least reduce that risk. Business interruption and CBI insurance typically cover supply chain disruptions resulting from a physical loss or damage to insured property. Standard insurance cannot restore an eroded market position after a policyholder’s customers have turned to competitors that did not have to curtail production after the event, nor can it re-inflate sagging share values after investors have lost confidence in a company’s ability to manage its way through adversity. Insurance will however provide the financial liquidity in case of an insured supply chain interruption to mitigate or prevent the impact on the balance sheet.

Information is key

Robust data exchange, greater transparency and active risk management are essential to obtaining the required coverage.

The increasing attention property insurance policyholders are paying to supply chain risk management is encouraging to insurers. Given that business interruption and supply chain-related losses typically account for half, and sometimes up to 70 percent, of insured property catastrophe losses, insurers are beginning to put much greater weight on supply chain risk when underwriting large industrial risks.

The data on suppliers that insured have to generate to build greater resiliency into their supply chains is the same data that is critical to insurers in better managing their exposure to supply chain-related losses. However, identifying and sharing this information is still a quite new approach for both parties. In fact, the severity of supply chain disruption in 2011 on the back of natural catastrophes (earthquake and tsunami in Japan, floods in Thailand) put a significant portion of the world’s suppliers of hard drives out of business for months and thereby brought the biggest PC manufacturers around the globe to a prolonged and costly halt—has prompted industry and insurers alike to consider new ways of mitigating risk, including data sharing, collection of more data, better analysis of the same, and more effective action on strengthening supply chains.

There are two good reasons for policyholders to be transparent with supply chain data. First, it gives insurers a clearer view of whether a client understands who its critical suppliers are and what risks those suppliers face. With sound data, the insured can develop a business continuity plan that would allow the company to stay in operation even if a key production facility or supplier unexpectedly closes down. The second reason has a direct impact on the amount of insurance a client wants to take out. An insurance company covers multiple companies within the same industry and region. In order to ensure a solid capitalization, insurance companies need to assess their accumulation exposure. The more transparency the insurance company receives regarding supply chain exposure, the better the demand of a client can be met. Ultimately, the insured that gives insight on their supply chain risk will receive higher coverage limits and pay a risk adequate premium.

Natural catastrophes pose an even greater accumulation risk problem for large insurers. A disaster like flooding, an earthquake or a hurricane will likely damage or destroy the operations of numerous policyholders or a cluster of suppliers of critical component parts for a group of policyholders in the same industry. If that cluster of suppliers supports a large segment of an insurer’s clients, that accumulation of risk will mean a huge loss for the insurer. Therefore, choosing a well-capitalized insurance company also is key when transferring supply chain risks to an insurance policy.

The bigger picture

Even with supply chain data, calculating accumulation of risk is challenging for any insurance company. Supply chains have evolved over the past two generations to become extremely complex—and not just because they stretch around the world into regions increasingly prone to natural catastrophes. They are also at risk from other perils, such as information technology or telecommunication outages, transportation network disruptions and civil strife. In addition, supply chains include suppliers with their own risk management issues, as well as their own supply chains that are at risk of disruption. The supply chain can be compared to a Russian doll, where for any direct supplier exist multiple layers of suppliers.

In spite of limited data availability, insurance solutions can be provided if the underlying design of a company’s Supply Chain Management is understood by the insurer and makes up for any missing data. Allianz Global Corporate & Specialty has developed together with University of Applied Sciences and Arts Northwestern Switzerland an assessment method to understand the Supply Chain Management and the resulting exposure of an insured during a half-day meeting with the client. As each Supply Chain Management setup is tailored towards the requirement of the specific company, the assessment method will provide recommendations about the client’s supply chain exposure by performing a benchmark of the individual structure against general industry standards.

Leading the evolution

Gap in interruption insurance is being addressed by emerging non-damage policies

Business interruption and contingent business interruption insurance have helped companies maneuver through what otherwise would have been crushing supply chain disruptions. Without the coverage, an insured would have lost millions of dollars of profits with no certainty of ever recouping it. But as policyholders demand coverage that will respond to even more perils than those addressed by traditional business interruption and CBI insurance, new forms of cover are being developed.

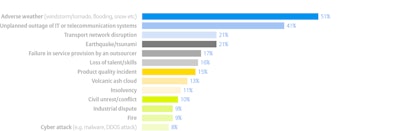

Since the inception of business interruption and CBI insurance, which is provided through property insurance policies, the coverage trigger for both has been property damage resulting from perils such as fire, earthquake, windstorm and flooding. Damage at the policyholder’s own property triggers business interruption coverage, and damage to property controlled by a policyholder’s supplier triggers CBI coverage. But many more perils that are not covered can also shut down a policyholder’s own operation or a supplier’s facility, causing a costly supply chain disruption. According to The Business Continuity Institute’s Supply Chain Resilience 2013 study[i], these so-called non-damage perils are an even bigger threat than natural catastrophes. For example, 35 percent of the manufacturing companies’ respondents cited unplanned outages of information technology or communications systems, 43 percent cited transportation network problems and 35 percent cited energy scarcity as significant threats.

Another survey of more than 60 large corporations released in February 2012 by forensic accountant and risk management consultant Dempsey Partners came to the same conclusions. Dempsey reported that 61 percent of the survey’s respondents had suffered supply chain disruptions within the past five years but that insurance covered lost income and extra expenses for less than half as no physical damage was involved[ii].

Different perspective

To bridge this gap, alternatives to traditional business interruption and CBI coverages now are emerging. AGCS, for example, has launched a policy to cover many traditionally uninsurable non-damage perils that have either disrupted supply chains in recent years, or that risk managers fear could cause major disruptions, such as closed air space and political risk. This policy extends business interruption and CBI coverage to core non-damage scenarios including utility service interruptions, labor strikes, insolvency of suppliers and transport operators or actions taken by civil and military authority—such as closing air space because of a volcanic ash cloud (as in the case of the eruption in Iceland in 2010) or cordoning off areas.

This is not an off-the-shelf product but closely tailored to a client’s specific needs and strongly depends on the company providing data. Thankfully, risk management is so sophisticated today among multinational groups that they are able to provide this data. This would have been unthinkable as recently as 10 years ago.

The evolution of data accuracy and transparency has helped insurers to more precisely ascertain risk levels on non-traditional covers. This development has been the catalyst for emerging coverage of risks previously perceived as “uninsurable,” and thus made it possible for insurers to offer new risk transfer solutions to their clients that simply were not available in the past.

[i] Business Continuity Institute (2013), ‘Supply Chain Resilience 2013’

[ii] Dempsey Partners (2012), ‘Supply Chain Risk Management Survey’