Santa Clara, Calif.—Aug. 20, 2013—Resilinc Corp., a provider of supply chain resiliency solutions, today announced that leading global supply chains have become dependent on the same small group of sub-tier suppliers—concentrating the risk and increasing the potential for crippling supply chain disruptions. Additionally, because this sub-tier supplier concentration is occurring deeper in their global supply chains, many large organizations are not aware of the risks involved. As a result, they are not adequately prepared to mitigate those risks to ensure global supply resiliency.

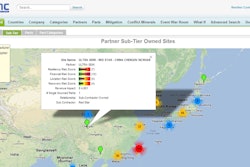

Resilinc’s findings are based on a subset of its global supply chain mapping data from hundreds of suppliers across thousands of supplier sites spread over 50 countries. A detailed analysis of the data was performed to identify specific industry trends to assist clients in improving supply chain resiliency planning and sourcing tactics. While the study focused on the high-tech and automotive industries, many of the sub-tier suppliers analyzed also support other global industries.

Resilinc specifically focused the analysis on sub-tiers since risks of disruption often can be hidden deep in the global supply chain of large client organizations. The analysis helps Resilinc’s clients respond to their executives’ questions and concerns regarding cross-industry supply chain risk trends and strategies that might be used to lower risk, especially from sub-tier suppliers. Resilinc clients also are concerned about the scalability and vulnerabilities of their multi-tier supplier chain when planning new product launches.

The analysis found that global supply chain risk does tend to be concentrated in certain sub-tier suppliers and localities, posing increased disruption risk potential to the companies exposed to those dependencies. More specifically, in the high-tech and automotive supply chain, a vast majority of suppliers are dependent on sites that are owned by just four suppliers: Taiwan Semiconductor (TSMC), Amkor Technology, ASE and United Microelectronics (UMC).

Resilinc found that a number of companies are highly dependent on these sub-tier suppliers but do not always have the visibility to quantify the degree of dependency and accurately

understand their exposure. Additionally, Resilinc found that more than 50 percent of all sites analyzed are located in just four countries: Taiwan, China, the USA and Japan. The study further found that a high degree of supplier factory aggregation in a relatively small sub-set of regions creates global supply chain hotspots, and many of these hotspots for high-tech and automotive suppliers are in areas known for susceptibility to natural disasters.

For example, the massive earthquake and resulting tsunami and nuclear crisis in Japan in 2011 “highlighted the world's dependence on electronic components made in the country,” as pointed out in The Wall Street Journal at that time.

“The results of our sub-tier supply chain analysis underline the critical need for deeper sub-tier dependency insights based on the comprehensive business intelligence Resilinc is able to provide,” said Bindiya Vakil, CEO of Resilinc. “Sourcing, procurement and supply chain executives need greater visibility into their suppliers’ global footprint and site locations, sub-contractor and sub-tier supplier dependencies, site activities, parts origin, alternate sites, recovery times, emergency contacts and business continuity planning (BCP) information.”

For more information, visit www.resilinc.com.