“You’ve got to work with what you got”—the catch phrase is no stranger to anyone and in the realm of global supply chain finance (SCF), it’s a philosophy that numerous organizations in the supply chain came to terms with in the wake of such crises as the Eurozone’s demise and the U.S. recession of 2008.

Supply chain investments of any kind were few and far between as tight budgets took hold of companies who struggled to get through the economic conditions over the past several years. And for suppliers and manufacturers, such market conditions resulted in a domino effect felt end-to-end with a decreased demand for items as consumers kept a tighter rein on their spend; manufacturers experienced, in some cases, the slowdown in production; and as the need for logistics services to transport those goods became less frequent. It’s not to say that such processes came to a complete halt. But a disruption was felt nonetheless, as cash flow that many end-users, manufacturers and service providers expected was affected; and more stringent requirements for approved supply chain credit lines were put in place to mitigate approved loans.

In such scenarios where you have a financial or economic crises occur, “you have a situation where the supply chain should continue to operate—people are still going to buy products and services and goods are still going to move through the supply chain—but you have a disruption of the flow of the money that follows the goods and services,” confirmed PJ Bain, Chief Executive Officer, PrimeRevenue Inc. “It’s not as efficient as it should be because the supply of the cash is not there. And it still takes cash to run a business—to run a supply chain.”

As such, it comes as no surprise that the global supply chain experienced a rise in SCF platforms and capabilities offered to connect buyers, suppliers and their financial partners. In the case of Kyriba Corp., it launched its supply chain finance technology platform integrated with its treasury management system in early 2012. Additionally, universal purchasing and invoice processing system provider Verian launched V11.1 of its purchase to pay software suite in Q4 of 2012.

Perhaps even more important to address here is the increased adoption rate of such services companies use to mitigate their financial health. Freight and logistics company Panalpina implemented a financial shared services model with the help of Accenture—as part of a seven-year agreement signed in 2010—to consolidate and standardize finance processes across its global operations. More recently, Tuff Automation Inc., a U.S.-based manufacturer of industrial machinery, implemented PrimeRevenue’s OpenSCi SCF solution to speed payments and optimize working capital.

The bottom line is clear—in addition to government finance regulations, buyers and suppliers are looking at SCF platforms as an additional means to help control their financial transactions—and SCF technology and tools providers must understand their challenges to meet their strategies.

Cashflow ramifications

“Buyers and suppliers—in those affected areas where money is disrupted—seek additional tools,” said Bain. “They look for ways to mitigate risk associated with the banks because much of the crisis that occurred within those regions really kind of starts with the stability of the banks, a lot of times. So if the flow of money is disrupted at the banks, it’s going to trickle down and affect the flow of money in the supply chain. What we’ve seen is a very high demand of people that are looking for alternative solutions and ways to mitigate the risk of being associated with a particular bank. If you have a single bank that is funding all of your working capital through a traditional operating line of credit and that bank doesn’t have access to money, all of a sudden you’re in a very bad spot.”

With a number of providers who offer supply chain finance in an integrated cloud environment, invoices can be uploaded virtually to allow the supplier to see its status—whether it has been approved and if any credits have been applied—before opting to sell that invoice at a discount; or set up business rules to manage their working capital.

Additionally, a number of new regulations continue to be set forth to improve cashflow and control working capital management for the buyer and supplier. In the fall of 2012, United Kingdom Prime Minister David Cameron announced a new initiative designed to enable and protect increased levels of SCF—despite already raised payment concerns. A number of companies already agreed to provide cheaper SCF to their small business suppliers as a means of supporting their supply chain.

For Tipalti, which works to protect the payers in the supply chain, the need for supply chain finance management is crucial.

“All of our customers are very concerned and attuned to what is happening on the global supply chain side,” said Eran Karoly, Vice President of Sales and Marketing for Tipalti. “If a company has a supply chain that is only in the U.S., solving payment problems are much easier. But if the supply chain spans the globe, then as the payer in the supply chain, you need to adhere to the issues, rules and regulations happening on the other side of the ocean. The real challenge is with the medium and the small-sized businesses or the start-up businesses that don’t have the resources, the expertise and the know-how to deal with the changing regulations that they still need to adhere to.”

Yet, while it is important to understand the regulations governing finance in a particular region, Karoly advised not to become too focused on such aspects; and instead align with a partner who is well-versed in such areas—allowing your business to focus on its growth and market strategies.

“Companies should try and focus on their core business and not try to become an expert on local rules and regulations in each country in which they have a supplier,” Karoly added. “Because the list just keeps growing and the regulations in each and every country are constantly changing and you’re going to need significant resources in chasing this problem. Use a service, a solution or a company that specializes in the global aspects to provide you with that expertise and help. And that, of course, is a valid recommendation to companies especially which are either starting up or small or medium-sized and don’t have the resources available to them to manage this in-house,” he explained.

The Financial Services Act—to commence on April 1, 2013—implements the following reforms of the current regulatory system, according to the UK’s HM Treasury:

- “Establishes a macro-prudential authority, the Financial Policy Committee (FPC) within the Bank of England, to monitor and respond to systemic risks;

- Clarifies responsibilities between the Treasury and the Bank of England in the event of a financial crisis by giving the Chancellor of the Exchequer powers to direct the Bank of England where public funds are at risk and there is a serious threat to financial stability;

- Transfers responsibility for significant prudential regulation to a focused new regulator, the Prudential Regulation Authority (PRA) established as a subsidiary of the Bank of England;

- Creates a focused new conduct of business regulator—the Financial Conduct Authority (FCA)—which will supervise all firms to ensure that business across financial services and markets is conducted in a way that advances the interests of all users and participants.”

“We see governments getting involved in the form of financial support, either through direct lending or credit backing of a bank that does the direct lending,” said Eric Riddle, Vice President and General Manager, Europe, PrimeRevenue Inc. “We see this in Canada with the EDC. We see this in the U.S. in the form of Ex-Im—the Export-Import Bank of the United States. We see governments responding to what they see in terms of these restrictions on working capital access. Corporates are really starting to look at supply chain finance as a viable access point to working capital that can be used for multiple reasons.”

Awareness campaigning

“We have companies that are enhancing their balance sheet cash to support acquisition strategy,” continued Riddle. “And there is a supplier component where they really are the ones that feel the pain. Downstream in the supply chain, the smaller mid-sized enterprises are the ones that really struggle for capital. Their cost of capital has gotten to a point where it makes the supply chain finance model very attractive, since typically the discount program or the cost of the capital that comes to the small or mid-sized enterprise in the form of SCF, comes at a far lower rate than the cost of borrowing themselves from traditional debt vehicles. The awareness created a focus on supply chain finance. It’s a ‘must be considered tool’ to help manage the overall working capital picture by corporate treasurers,” he explained.

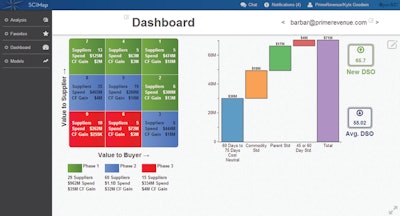

But it’s not just the corporate treasurers that are involved. Fixed income managers, hedge funds and other entities outside of banks are also adopters of supply chain finance assets off such SCF platforms. And for a service provider like PrimeRevenue, this is key as the company works to provide the network and technology capabilities to connect the buyer, supplier and funding institution.

The tools and the strategies for the optimization of cash flow and credit lines do exist. And the momentum of its adoption by financial institutions combined with key players in the supply chain will only continue to increase as questions regarding liquidity, availability and flexibility are addressed in the global economy’s recovery.