Koverly introduced a buy-now, pay-later (BNPL) solution to give a 30-day extension on foreign exchange (FX) payments at no cost to the buyer or seller. Through the new KoverlyPay service, businesses also have the flexibility to further extend payments over four, eight or 12 fixed weekly installments.

“Inventory is the lifeblood for importing businesses and it is directly impacted by cash flow,” says Igor Ostrovsky, CEO of Koverly. “Our KoverlyPay offering for FX transactions is designed to give businesses enough extra working capital to unlock at least one additional inventory turn per year. For a typical importing business this can boost annual profitability by 50-100%. This is a game changer for global trade.”

Koverly

Koverly

Key takeways:

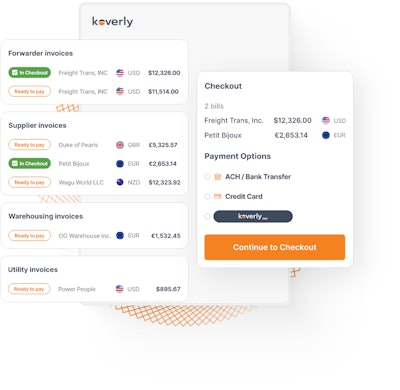

- Koverly provides U.S. businesses with fast customized underwriting of up to $500,000, determined within 24 hours. The underwriting process does not affect the applicant’s credit score, and once approved, KoverlyPay payment deferral options are seamlessly integrated into the user’s Koverly checkout flow.

- When a business chooses KoverlyPay at checkout, Koverly ensures the funds are transferred to the recipient within 1-3 business days after checkout and provides the business with transparent, fixed repayment options.

- Other features include reduced foreign exchange rates (up to 50% less), no wire transfer fees (up to $40 savings per transaction), defer FX payments by 30 days at no cost, and further extend bill payments for up to 12 weeks.