As if the ongoing impact of the pandemic weren’t enough, lurking behind the scenes is a threat ready to impact a top operational cost from the factory floor to the distribution center – rising energy prices. Supply chain leaders can be forgiven for not having paid close attention. Low electricity prices, the kind U.S. industry has enjoyed for the last two years, can easily make enterprise power buyers forget that energy commodities are by their very nature volatile.

Unfortunately, that volatility is beginning to rear its head. It’s time to get your supply chains ready.

A recent history of energy prices

A warmer than usual 2019-2020 winter season, followed by the demand-destruction of COVID-19, created a supply and demand imbalance – with energy producers and suppliers left sitting on excess inventory – that kept natural gas and electricity prices at or near historic lows.

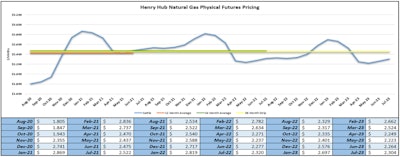

This trend reached its peak (or nadir, depending on where you sit) in July 2020, when natural gas prices settled at their all-time deregulated low (see chart 1 below). This created a buyer’s market that extends to this day, but that is changing precipitously as we speak.

This trend reached its peak (or nadir, depending on where you sit) in July 2020, when natural gas prices settled at their all-time deregulated low.Transparent Energy

This trend reached its peak (or nadir, depending on where you sit) in July 2020, when natural gas prices settled at their all-time deregulated low.Transparent Energy

Whiplash ahead?

As early as March of this year, Goldman Sachs warned of possible “whiplash” in natural gas prices by year’s end and into 2021, with natural gas prices rocketing higher. Raymond James echoed these sentiments in a June 2020 report, outlining a scenario where natural gas prices nearly doubled year over year.

Unfortunately for supply chain operators, these predictions are coming true. After hitting what looks like a bottom in July, natural gas prices are already rocketing up. In August, natural gas prices settled nearly $0.36 higher, a 20%-plus jump in just one month. And, natural gas forward/future prices forecast further high-percentage leaps into the first quarter of next year. (See Chart 2 below).

Natural gas forward/future prices forecast further high-percentage leaps into the first quarter of next year.Transparent Energy

Natural gas forward/future prices forecast further high-percentage leaps into the first quarter of next year.Transparent Energy

So, what’s to be done?

Charts are one thing, but you have a business to run and costs to manage, so let’s get practical.

First, with electricity prices tightly correlated to natural gas prices (remember, more and more electricity now is being generated by natural-gas-burning power plants), the current data points to a potentially shocking future: businesses that do nothing to manage their energy costs today will wake up to energy supply charges 30-50% higher this winter than what can be secured right now in today’s markets.

Here are six suggestions to help you make the most of that advantage:

1. Examine your current energy contract, and if it makes sense, get back into the market now to capitalize on today’s low rates. There is still time – just not much, so don’t delay.

2. “Go long.” If you can successfully get back into the market now and lock in a low rate, consider extending it beyond the industry average of 24-36 months. Many buyers today are entering 36-, 48- and even 60-month contracts to maximize their gains.

3. Don’t wait for your current energy contract to near completion before seeking a new one. When you wait, you become an order taker and have to accept what the market gives you. Businesses with even 24 months remaining on their current contract can benefit from entering a new agreement in today’s pricing environment now.

4. Always make suppliers compete for your business, even if your current supplier offers you a good rate. Experience has shown that a competitive process typically results in a much lower electricity rate than one offered independently by an incumbent supplier.

5. Make sure your competitive process attracts multiple suppliers. If your current process, whether run by you or your energy broker, isn’t attracting 10 or more suppliers to your procurement, it’s time for a change. Supplier liquidity – i.e., lots of qualified suppliers bidding on your business – is fundamental to getting the best price from the market.

6. Understand the solvency of suppliers. While record-low energy prices have helped energy buyers, they have hurt many in the supply industry. In addition, the supply market is in the midst of contraction and consolidation. Knowing who you are buying from is more important today than ever.

The data is pointing to higher energy prices and increased volatility ahead. Fast-acting supply chain pros still have time to capitalize on today’s relative market lows and lock in long-term gains.

Those who don’t may find the cost of waiting painfully high.