With supply chains (and the global economy more broadly) upended by COVID-19 in the first quarter of 2020, carefully managing inventory turnover, including understanding the benefits and risks, is vital. It has also become more difficult than ever. Sudden spikes in demand for some products are driving a bullwhip effect that distorts demand data as impacts move along the supply chain, while precipitous declines in demand for other products (like gasoline) are driving slower production or even bringing it to a standstill. How quickly should organizations be turning their inventory?

To bring clarity to the chaos, this article provides cross-industry benchmarks for finished goods inventory turns, the most popular measure for tracking finished inventory. Finished goods inventory turns is a measure that every supply chain leader ought to track now and even after the crisis has abated to ensure that their organization isn’t holding too much stagnant inventory on-hand or is unable to provide enough inventory to fulfill customer orders.

What is finished goods inventory turns?

Put simply, finished goods inventory turns is a measure of the rate at which an organization’s inventory goes out the door to customers. “Finished goods” refers to products that are completely manufactured, packaged, stored, and ready for distribution.

The importance of this measure becomes clear when examining the pitfalls of having too much or too little inventory. Lower inventory turnover can be a sign of money tied up in excess inventory—not an ideal situation in a time of crisis when cash is king and organizations are scrambling for greater liquidity. At the same time, when inventory turnover is too high, organizations increase their risk of lost sales opportunities due to stockouts or shortages and customer complaints. And while increased inventory turnover can be a product of good inventory management and sales, the COVID-19 crisis certainly demonstrates that it can also be the product of demand spikes from panic buying (for example, in the case of toilet paper).

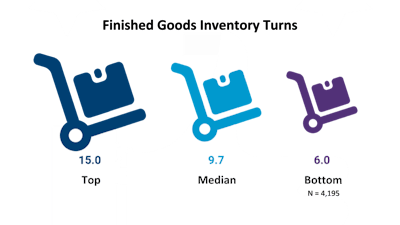

Data from APQC’s Open Standards Benchmarking® in supply chain planning shows that top performing organizations have more than twice the rate of inventory turns as bottom performers (15 versus 6 turns per year, respectively). Figure 1 represents cross-industry data for this measure. It’s important for supply chain leaders to familiarize themselves with performance in their own industry for a more complete picture of their organization’s relative performance.

At a bare minimum, to move finished goods inventory efficiently an organization should:

- standardize inventory control and reconciliation practices to verify the accuracy of finished goods inventory,

- integrate order management and manufacturing systems to provide visibility into finished goods inventory transactions and balances, and

- implement a warehouse management system (WMS) or other appropriate system to provide reporting to support key performance indicators.

If your organization’s performance isn’t where it needs to be for this measure, now is the time to check that your processes around inventory are healthy and that the technology that supports each process is working the way it’s supposed to. APQC has found that having a WMS in place is a strong enabler of better performance as a result of having greater visibility into inventory and how it moves.

Top performers not only leverage a WMS, but also know how to leverage more advanced features of their WMS to perform tasks like:

- dynamic location assignment of finished goods inventory in pick locations or in storage,

- lot/serial number control by location, and

- activity-based costing/management and full review of finished goods inventory.

An organization’s ability to forecast demand also plays a role in inventory turnover—The more accurate the forecast, the easier to determine an appropriate amount of inventory and safety stock to have on hand. Unfortunately, COVID-19 is currently wreaking havoc on demand in many areas and making forecasting a more difficult endeavor than it already is in ordinary times. Organizations should be keeping a closer eye than usual on demand now and in the months after COVID-19 subsides. Many items currently in high demand will eventually level off. Demand for items like hand sanitizer, meanwhile, may remain in greater demand than before even after the current crisis is over.

Looking forward

As demand spikes for some products and drops off a cliff for others, supply chain leaders should be tracking finished goods inventory turns to ensure their organizations have the right amount of inventory. Some good questions to be asking right now include:

- What level of inventory do you carry?

- Do you measure the inventory turnover metric?

- Is the majority of your inventory raw materials and sub-assemblies or finished goods?

- Do you have too much or not enough inventory to fulfill open orders?

- Do you own all the inventory in your facilities or do suppliers own and manage some of it?

- What’s your lead time for higher value inventory items?

- Do you share demand plans with your suppliers at regular intervals, or just send requests for quotes and purchase orders?

- How is your organization collaborating with key customers to better understand their predicted demand?

In times of downturn when liquidity is a high organizational priority, there are good reasons to keep overall inventory levels lower. That said, having too little inventory can be just as damaging as having too much. Supply chains need to strive to find a sweet spot for inventory in an undoubtedly chaotic moment—tracking finished goods inventory turns can help.