What do Diageo and Tesco in the UK, Woolworth in Australia and Carrefour in France have in common? Beverage giant Diageo recently decreed that it would require 90 days to pay its suppliers. Accusations of “shakedowns and “bullying” related to similar attempts to improve cash flow at the expense of their suppliers were also leveled at Tesco, Woolworth, and Carrefour.

Facing public pushback, Diageo agreed to climb down to 60-day payments. Tesco had to accept changes to its supplier management practices. The Woolworth and Carrefour cases are ongoing.

Large buyers have long wielded the big stick over (usually smaller) suppliers. This buyer-takes-all era of payables management, if not at an end, seems to be in remission. However, the acute pressure on every supply chain actor to optimize working capital, which led to the imbalance, remains.

Apex stakeholders have led many a supply chain innovation for optimizing the flow of product. Product flow innovations have included analytic frameworks such as demand-driven supply chains (DDSN), practices such as vendor managed inventory (VMI), and strategies such as incentive-matching contracts of dizzying sophistication. Optimizing the flow of money across the supply chain has been more challenging. Trade payables make up 20% of corporate liabilities. Thus the prevalence of inequitable “solutions” like the ones described above.

The post-Recession slowdown in lending and recent retrenchment of multinational banks are pushing cash-constrained suppliers closer to factors and other similarly expensive financiers. SME suppliers often require capital injection from their better-established apex buyers. All of that increases the cost of goods for apex buyers, reinforcing a propensity to pressure suppliers. A perfect vicious circle!

Though we’re experiencing a time of flat demand, the pressure on costs hasn’t gone away. Indeed, it’s become more acute. Yet it is no longer practical to simply pressure Tier 1 suppliers and expect them to pass on the big squeeze. Cost reductions have to come from across the supply chain, from each according to his ability, so to speak. In that effort supplier finance can go from being the heavy to being an enabler of a new - intrinsically collaborative - form of supply chain management.

Collaboration

In mainstream supply chain management, collaboration typically refers to activities geared to improving efficiency through the sharing of demand patterns and synchronizing other business activities. However, if the motivations of interacting firms aren’t aligned, collaboration can actually exacerbate disruption. Unless care is taken to align and monitor incentives, collaborative activity - in design, planning, marketing, or inventory management - may yield small or negative benefits.

Western, largely American, initiatives such as VMI, Collaborative Forecasting, Planning and Replenishment (CPFR), and Continuous Replenishment, have scored impressive benefits for apex buyers such as Walmart and lead suppliers such as Proctor and Gamble. Note that such collaborations are almost always monogamous: between one buyer and one supplier.

Asian collaboration models such as the Japanese keiretsu are multi-lateral. Leveraging its network of time-tested relationships with strategic suppliers, some buttressed by cross-holding, OEMs would manage costs based on histories of trust and mutual obligation. Though it is still based on ambiguous contracts, over time the keiretsu model has evolved to include explicitly spelled-out collaboration on product and process design, customer intelligence-gathering, and defect remediation. Keiretsu-like formations have also been observed in Europe, e.g., in the supply chains of truck giant Scania and furniture vendor IKEA.

A slightly different collaboration model has emerged in China. OEMs such as Xiaomi have focused on developing a supplier ecosystem, often through the injection of capital into small and medium suppliers. The suppliers are incentivized via profit-sharing to provide goods at cost to the OEM, reducing the overall price of the finished product. Note that collaboration here is built on a financial rail, not custom or history.

The success of Asian manufacturing - Japan following WWII and China more recently - owes significantly to multilateral collaboration, often mediated by financial cross-involvement.

Profit potential is a universal measure of a firm’s self-interest. Profit, especially for small-medium firms, is directly correlated with the availability and price of financing. Can this observation enable collaboration based on financing rather than on product flows? Can such collaboration extend beyond the buyer-seller dyad?

Supply Chain Finance

Recent studies show that roughly 75% of working capital is tied up in supply chain itself. It is not common in traditional supply chains, such as apparel or durables, to have cash-to-cash cycles of six months or more. Working capital inefficiencies combines with cross-border risks related to exchange and interest rate movements to increase the cost of goods and reduce service levels.

Supply chain finance (SCF) refers to the use of short-term credit to balance working capital across a buyer-seller pair, and thus minimize aggregate supply chain cost, i.e., the usual supply chain costs plus the cost of money. SCF lets buyers keep their long payment terms and simultaneously ensures that suppliers are paid quickly.

SCF works on interest rate arbitrage between a credit-worthy buyer and a less well-established seller. The financier purchases the seller’s accounts receivable at a discount, securing cash against the buyer’s credit. The discount assessed on the seller’s invoice amount, minus the risk premium, constitute the financier’s profit. Typical SCF spreads range from around 20 to 500 basis points.

Compared to the literally medieval Letter of Credit, SCF encompasses new trade finance instruments and thus is a field still gaining definition. Depending on whom you ask, SCF includes or is synonymous with reverse financing, payables financing, and dynamic discounting. The money may flow from the apex buyer’s treasury, a bank with an active transaction banking practice, or a trade finance Fintech such as Prime Revenue. (When the buyer’s cash is used to finance suppliers, the practice is called Dynamic Discounting. However, it is functionally the same as SCF.)

SCF on the Blockchain

In its current incarnation, SCF leverages the buyer’s credit-worthiness to improve the supplier’s cash flow. But what if the buyer’s rating is strong enough to finance the supplier’s supplier (i.e., a Tier 2 supplier) and possibly beyond? Can SCF equalize the cost pressure over the buyer’s entire upstream supply chain?

Extended buyer-backed financing would require the financier to finance the buyer’s Tier 2 suppliers, Tier 3 suppliers, and so on. Such multilateral collaboration is infeasible with existing SCM processes for two reasons: lack of visibility, and lack of trust.

While a financier partnered with the buyer is in a good position to assess SCF risk associated with the buyer’s (Tier 1) supplier, the capability doesn’t extend to the supplier’s suppliers. The financier isn’t privy to financial or contractual details in the second echelon. Nor are larger financiers necessarily capable of assessing the solvency and performance of Tier 2 firms, who are often small and medium enterprises felt to be riskier.

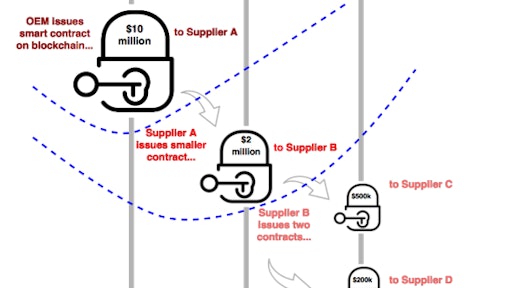

In the simplified synthetic example shown below, an established OEM with an Aaa rating, issues a large order to Company A. Ten million dollars of working capital is offered to Baa-rated supplier A, by an OEM-partnered bank.

The financing is laid out as a smart contract on the blockchain, with unambiguous triggering conditions (e.g., verified shipment or receipt of goods), payment methods, time-bound discount rates, etc. For instance, Supplier A may wait to receive full payment 60 days following receipt of goods (Net60). But it may elect to receive up to $10 million at a discount of one basis point for each day it advances payment.

To this point, specifying the buyer’s payment obligation as a smart contract on the blockchain doesn’t offer much incremental benefit other than possibly a higher degree of automation over a standard SCF system. Things are more interesting when the contract is “chained” to pass on a certain fraction of the financing to Tier 2 suppliers of Company A. The illustration shows such a chaining: Company A splits off a $2 million chunk of the OEM’s payment obligation to its supplier - Company B.

Here, the benefits of blockchain technology are easier to see: Because the bank can see both the original contract (between OEM and A) as well as the order placed with Company B by Company A (details of that order may be appended to the associated $2 million payment obligation on the blockchain), it can verify both authenticity and provenance. Further, if the contract tracks manufacturing or transportation events, the bank can also know the state of fulfillment at any given time. In other words, even if the bank is not as familiar with Supplier B, it can extend the company a receivables discount against the faith and credit of the originating OEM.

The illustration also shows that Supplier B may, in turn, split off smaller chunks of the OEM’s payment obligation to suppliers C and D. As before, the bank can finance C and D with greater assurance because it can guarantee the authenticity of the split (or chained) contract.

Note that unlike highly customized SCF systems, the design of blockchain is decentralized and collaborative. So adding new participants (such as the Tier 2 and 3 suppliers in the illustration) is relatively light: it may be as easy as scanning a QR code with a cell phone and authenticating participation with a digital signature (with an associated public key).

The example described above is, as previously mentioned, simplified and synthetic. However, the machinery to implement it exists today. Blockchain-based SCF platforms with varying degrees of sophistication in terms of workflow, customizability, and linkages with standard IT systems for supply chain management are available.

What should be quite clear is that the visibility and auditability that are hallmarks of blockchain technology allow, for the first time, financial collaboration across supply chain echelons, not just bilaterally. According to recent estimates, of the annual global trade expenditure of $18 trillion, SCF can address $255-280 billion with existing SCF instruments (study by ACCA/Aite Group in 2014).

The potential of blockchain technology in SCF is only beginning to be explored. For instance, the “deep tier finance” solution described above is only supported by emerging Fintech challengers; incumbent SCF platforms cannot enable that level of cross-network collaboration. Where it will take SCM is anybody’s guess.

Blockchain

Blockchain is a type of electronic ledger created to ensure that once a party transfers a digital asset, he cannot transfer (perhaps, sell) it to anyone else. Unlike other ledgers, blockchain is owned by its participants, and decisions about what it records are subject to participant consensus.

Recording accuracy is ensured by duplication: every participant has a copy of the ledger. Discrepancy-resolution mechanisms ensure that all copies reflect an identical history. Though permissions can be managed with a fair degree of control, by default any permitted participant can view all transactions. Thus together with immutability, notarization and assured provenance, transparency is a core blockchain attribute.

Finally, blockchain isn’t simply a secure collective database. In addition to transactions, it also records and executes simple programs. In the context of supply chain management, such programs can be self-executing “smart contracts” that manage the flow of money.

Blockchain smart contracts may also influence, or be influenced by, product movements. For instance, a positive QA test indication can release a part for assembly. However, today that role is played by ERP systems. Blockchain technology doesn’t necessarily add value in such traditional operations management tasks.