Confronted with greater demands than ever to make major investments in global facilities and in new technologies to achieve much higher corporate average fuel mileage goals, OEMs should be redoubling their efforts to develop more collaborative supplier relations in order to leverage their combined resources, according to Planning Perspectives Inc.

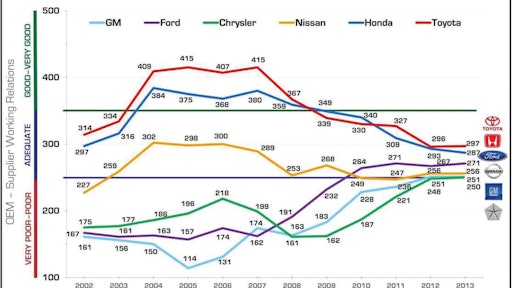

But according to the firm’s 2013 North American Automotive-Tier 1 Supplier Working Relations Index study, results showed no meaningful change since last year, except Honda, whose supplier relations continue to slowly drop. The annual study focuses primarily on General Motors, Ford, Chrysler, Toyota, Nissan and Honda because these six automakers comprise 77 percent of light vehicle sales in the U.S. The European 3 – VW, BMW and Mercedes-Benz – are reported separately.

“Given the challenges facing the automakers, to say this year’s results are disappointing would be an understatement,” said John W. Henke, Jr., Ph.D., President and Chief Executive Officer of Planning Perspectives Inc., Birmingham, Mich.

While still in first and second place respectively in this year’s overall Working Relations Index (WRI) rankings, Toyota’s score is virtually the same as last year with a gain of only one point, while Honda lost six points and continued its downward slide to its worst score since the study began. Ford remains comfortably in third place, followed by Nissan, neither of whom showed sustained improvement for four years. General Motors remained unchanged and in fifth place followed by Chrysler, who managed to pick up two points but remained in sixth place.

“It’s apparent that while the automakers’ top purchasing executives generally understand and support positive working relations, this support has not been translated into a consistent action plan for improvement,” said Henke. “The lack of improvement among these automakers’ purchasing areas over the past several years suggests that none of them has implemented a well-defined, focused plan to improve their supplier working relations. Or, if they have such a plan, it is not being implemented at the level of day-to-day contact with suppliers. Either way, this is not good for the OEMs or the suppliers.”

Historically, Toyota and Honda set the standard for the study. From 2004 to 2007 they performed well above the rest of the industry with overall WRI scores in the 350 to 415 point range.

Back then, the top-rated automaker, Toyota, scored 415 and the worst, GM, scored 114, with 301 points separating them. Since the recession in 2008, the two Japanese pace-setters have fallen dramatically to the 280 to 300 range, while the Detroit 3 improved to the 250 to 270 range. Today only 47 points separates Toyota at the top, from Chrysler at the bottom.

According to Henke, there are several reasons for Toyota’s and Honda’s fall and the current stagnation of the other OEMs:

- With the rapid growth of Toyota and Honda in the U.S., both companies had to dramatically grow their purchasing staffs in recent years and it became impossible to maintain the much-heralded Japanese culture with the continuing influx of new employees.

- For both Honda and Toyota, the growth in personnel in the past two years has been associated with a considerable drop in Help provided suppliers to reduce costs and improve quality; and in Communication with suppliers relative to 2004 to 2007. The profit opportunity for suppliers has also dropped in 2012 to 2013 for suppliers at both companies.

- For Toyota, suppliers indicate that the buyers have been less active in building trusting supplier relations each of the last several years.

- Honda and Ford are leveraging the expertise of their suppliers more than the other OEMs in that they involve suppliers earlier and more effectively through-out their product development process than do the other OEMs. However, Ford, Chrysler, GM and Nissan have the least disciplined engineering function in that they have had significantly more excessive/late engineering changes than Toyota for the last several years.

- Chrysler and GM for the past two years, and Ford and Nissan for the past four years showed little change in virtually all WRI–related measures suggesting unfocused efforts to improve supplier relations.

- There is still considerable performance variation among all OEMs’ Purchasing Areas. For instance, this year Ford’s Electrical & Electronics group scored 324, while its Body-in-White group only scored 249—a 75-point spread (see Table 1 below). It’s noteworthy that last year Ford’s Electrical & Electronics group was its worst performer at 239; this year it is best at 324, again suggesting unfocused efforts to improve supplier relations.

Further, many suppliers provided anecdotal comments in the study in which they said that the Detroit 3 are slipping back into some of their pre-recession bad habits.

“They seem to have forgotten the help we gave them during the 2008-2009 recession because they’re back to their old tricks,” referenced one supplier in the study.

The annual study tracks supplier perceptions of working relations with their automaker customers in which they rank the OEMs across the six major purchasing areas broken down into 14 commodity areas. The six purchasing areas are powertrain; chassis; exterior; interior; electrical & electronics; and body-in-white.

The results of the study are used to calculate the WRI based on five key areas that contribute to collaborative supplier relations: OEM Help, OEM Hindrance, OEM-Supplier Relationship, OEM Communication and Supplier Profit Opportunity. These areas, in turn, are further broken down into 17 working relations variables. This year, 583 supplier personnel from 441 suppliers participated, representing 61 percent of the six automakers’ annual buy.

Supplier relations improve with consistency

The most important factor in improving supplier relations is consistency in managing the

Every-day purchasing-engineering-quality interfacing activities in a collaborative manner, added

Henke.

“Maintaining good supplier working relations is a never ending process; it’s dynamic, not static and requires continuous attention,” he said. “Purchasing management must make sure their Buyers understand poor supplier relations is costing the automaker money and is unacceptable.”

Poor supplier relations impacts the bottom line

The costs to automakers of poor working relations are substantial, and will only increase going forward, Henke confirmed.

“We are in one of the most capital intensive periods the automotive industry has ever known,” he said. “New fuel economy standards, powertrains and fuels; global environmental requirements; global expansion; and increasing global competition are all placing enormous financial and human resource demands on automakers and their suppliers.”

“These pressures are further exacerbated by the large number of new product launches each OEM has in the pipeline for the next several years,” said Henke. “No automaker has the resources to go it alone, particularly when it is realized that each spends about 60 to 70 percent of its revenue on suppliers. If an automaker doesn’t work in a more collaborative manner with its suppliers, they’ll never realize the full competitive and financial benefits of good supplier relations, and at worst they’ll fail.”

Over the years, the study showed that automakers with Good-Very Good working relations realize considerable benefits. Their suppliers:

- Are more willing to invest in new technology to meet future OEM needs, and are more willing to share new technology with the OEM (see Table 2)

- Are more willing to support the automaker beyond contractual terms

- Communicate more openly and honestly with the OEM

- Give greater price concessions to OEMs.

Whereas, automakers with poor relations:

- Receive smaller price concessions and must work harder to get them

- Support the OEM with less experienced supplier personnel

- Typically are not among the first to get their suppliers’ best ideas and new technology

The European big three

In 2010, Planning Perspectives began studying the Big Three German automakers with manufacturing operations in North America: Volkswagen, Mercedes-Benz and BMW. Since 2010, BWM, after dropping for two years, improved this past year to lead all OEMs, including the Detroit 3 and the Japanese 3, with a WRI of 324.

Mercedes and Volkswagen continue to slide in the rankings with Mercedes now trailing Toyota with a WRI of 289 and VW trailing all OEMs with a WRI of 231. The WRI rankings for the two Volkswagen operations—VW-Puebla and VW-Chattanooga—are 241 and 216, a 25-point difference.

The increase at BMW resulted from a mix of changes, i.e., increases and decreases in rankings, across the WRI components. The BMW WRI increase came about because of improvements in the Hindrance and Communication components, which offset reductions in the Help, Relationship, and Profit Opportunity components.

The WRI decreases for Mercedes and VW have occurred because of reductions in the Help, Communication, Relationship, and Profit Opportunity components, which were greater than an increase in the Hindrance component.

If the Japanese 3, the Detroit 3 and European 3 were combined on a consolidated WRI graph as below, BMW would rank highest of the nine automakers and VW the lowest.

This report is provided by Planning Perspectives Inc.

Stay tuned for Supply & Demand Chain Executive’s exclusive automotive industry coverage, which will go live on www.sdcexec.com May 31st.